When the world sees the glass as half empty, contrarian managers see it as half full.

When other people focus on unabating inflation and high interest rates, Matthew Tillett, FE fundinfo Alpha Manager of the £344m Premier Miton UK Value Opportunities fund, calls the end of the cost-of-living crisis.

When wealth management company St. James’s Place (SJP) had to be sold “pretty painfully” at a 40% loss, the manager was able to offset the losses with retailer Next, which was badly mispriced after Covid and has since re-rated.

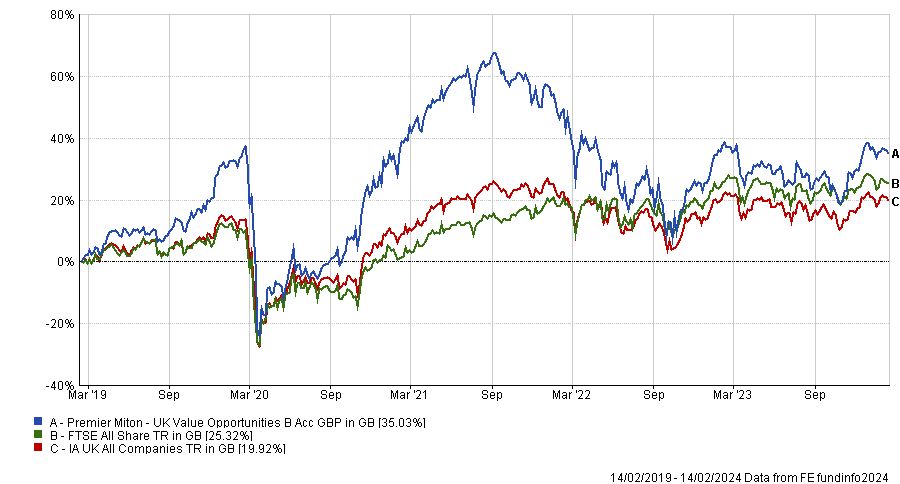

His contrarian approach has paid off, as the chart shows.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

Below, Tillett talks about selling SJP and the risks of investing in the Alternative Investment Market (AIM) and in the mid-cap space. He also reveals where he finds opportunities beyond retailers to benefit from a consumer that he sees as stronger than most people think.

Can you describe your investment process?

We are value-driven contrarian investors aiming to identify situations where the long-term fundamentals of a business differ materially from what's implied by market valuations and expectations, and to exploit these mispricings.

We look for these opportunities across the whole market-cap spectrum and almost all sectors, then put our best ideas together into a diversified portfolio that delivers across different market environments.

What segment of the market is most opportunity-rich at the moment?

Right now, we're at the highest allocation to mid-caps we've ever been [49.7% is invested in FTSE 250 stocks], which is a reflection of the major sell-off of 2022, when good-quality franchises in domestically-focused consumer cyclicals and interest-rate-sensitive areas of the market were trading at very attractive valuations because of worries around the economy.

We felt that these difficulties were already priced in and there’s still a lot of opportunity there today, as many mid-cap companies are still exposed to Covid recovery trends and undergoing structural changes in their industries.

Are Covid mispricings still affecting markets?

Absolutely, across a lot of industries. Many cyclical and defensive names are not necessarily where they would be in a normal cycle because of because of Covid effects.

Ever since Covid, industries’ cycles have moved out of sync with each other because of that exogenous shock and its aftermath, with a lot of downs and the uneven recovery in different parts of the world and the market just finds it so difficult to deal with this.

The market is quite good at dealing with one-off events that last for a few weeks or a month, but when it goes on for longer than that, people start to extrapolate.

Everyone's obsessed about macro – whether the US going to have a recession, whether inflation has peaked or interest rates will go up – but actually, what matters is what's going on at the industry level.

What were the best and worst calls of the past year?

Companies such as clothing retailer Next have done really well for us. It had upgrades over the course of the year – not because the consumer has been amazing but because the forecast was very depressed going into the year and they traded a bit better than that.

As a result, the stock has returned 75% over the last 18 months or so, which is not bad for a FTSE 100 consumer cyclical. That's a classic example of what we look for – a big disconnect between the fundamentals and market expectations.

In terms of the worst, wealth management business St James’s Place has proved itself very effective over decades, but recent regulatory intervention has forced it to completely upend its pricing architecture. We sold the position pretty soon after such a big change in its investment case but it was still painful. We sold at a 40% loss over a year.

You hold 17.2% in AIM, is that risky?

Not really. The main criticisms of AIM are the lower standards and reporting requirements and obviously, that there are some dodgy companies on AIM. That is true, but we do a lot of due diligence.

Jet2, which is one of our largest holdings, is an AIM-listed stock but it's the largest tour operator in the UK and a £6bn revenue business that is very well managed and conservatively financed, with pretty good reporting.

What do you do outside of fund management?

I play competitive chess, which is hands down the best board game ever invented.

It has some similarities with investing for the tactics, strategy and the incremental improvement and learning, but it's also quite different because it's a perfect-information game, where all the information is in front of you on the board hide. Investing is obviously an imperfect-information game.