UK equities haven’t been particularly popular with investors in recent years, as their returns have significantly lagged those offered by their international competitors, in particular US mega-cap growth stocks.

The UK hasn’t helped itself either, as the country has been plagued with political instability and gloomy forecasts for the domestic economy.

As a result, UK equities are now trading on a forward price-to-earnings multiple of approximately 10.7x versus 16.5x for their global peers. Moreover, UK equities are also trading below their historic average, which means there may be room for a positive re-rating.

Jason Hollands, managing director at Bestinvest, said: “Those prepared to go against the herd now and buy, could see a significant uplift over time if UK stocks re-rate towards more normal levels.

“That could come from overseas predators on the hunt for a bargain, but also from companies themselves as a notable trend has been a significant uptick in companies using cash on their balance sheets to buy back their shares. Around half of UK companies are estimated to have announced buyback programmes over the past year.”

Below, three experts explain how investors can build a comprehensive allocation to the UK market by pairing complementary funds.

Simon Evan-Cook, manager of the VT Downing Fox funds range

Evan-Cook is enthusiastic about the prospects for UK equities, thanks to their attractive valuations, the opportunity set and strong corporate governance.

To benefit from a UK equity revival, he suggested pairing VT Cape Wrath Focus with VT Castlebay UK Equity.

Performance of funds over 10yrs vs sector and benchmark

Source: FE Analytics

Evan-Cook said: “To my mind the epitome of the perfect pairing is Marmite and toast. I wouldn’t normally use this to represent a fund pairing though, as both parties would object to being the love-it-or-hate-it Marmite. But in the case of Adam Rackley and his VT Cape Wrath Focus fund, I suspect he’ll take it as the compliment it is.

“This fund is Marmitesque because it’s small-cap, UK-focused and run on a contrarian value basis. These are things that, apparently, cause many professional fund buyers to be a bit sick in their mouth. Rackley is unapologetic for this. He knows, as do we, that if you want to make the highest long-term returns, there’s no richer hunting ground than small-cap value.”

Yet, Evan-Cook warned that investors in this fund are in for a bumpy ride, which is why it should be held alongside a few other UK equity funds that can compensate when it’s out of favour.

This is where VT Castlebay UK Equity, managed by David Ridland, intervenes. The fund focuses on quality companies higher up in the market-cap scale.

Evan-Cook said: “Pairings like these are bread and butter (plus spreads) for us within our Downing Fox funds. We want our investors to benefit from holding great active funds, but we also want them to have an emotionally easier journey than holding just one by itself.”

Over five years, the two funds have a 0.69 correlation with each other, according to FE Analytics.

Jason Hollands, managing director at Bestinvest

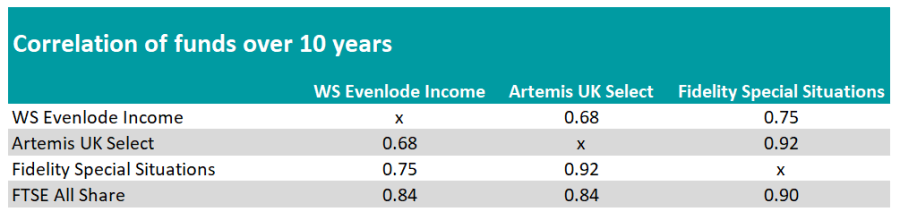

For his ideal allocation to UK equities, Hollands picked WS Evenlode Income, Artemis UK Select and Fidelity Special Situations.

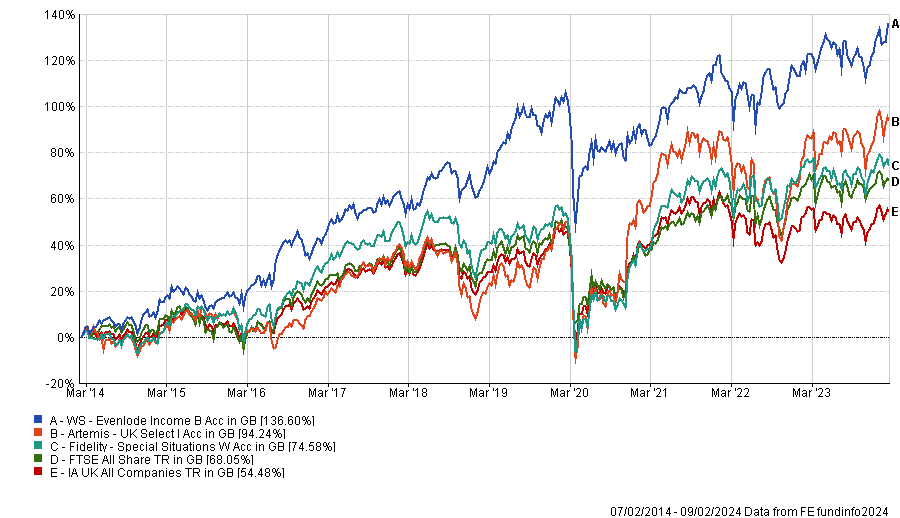

Performance of funds over 10yrs vs sector and benchmark

Source: FE Analytics

WS Evenlode Income has a quality-growth bias and a strong international flavour, as most of its investee companies generate their earnings overseas, despite being based in the UK.

Hollands said: “The fund is managed with a team-based, collegiate approach from a barn conversion in Oxfordshire and targets companies with low capital intensity and high returns on capital that generate strong free cash flow, which can compound returns over time.

“The approach has a quality bias, with companies bought on a buy-and-hold, long-term basis. The investment process of avoiding companies involved in activities that require constant investment in plant and machinery means it has no exposure to capital intensive sectors like energy, but instead it has high relative weightings to industrials, consumer staples and technology.”

The Artemis UK Select fund offers a different sector exposure, with energy giants such as BP and Shell as well as banking stalwarts Barclays, Natwest and HSBC among its top holdings.

The fund’s managers, Ambrose Faulks and FE fundinfo Alpha Manager Ed Legget, roam across the whole UK market-cap spectrum to identify the best ideas, although they tends to focus more on large- and mid-cap stocks rather than smaller companies.

Hollands said: “The managers seek out companies they believe have good earnings growth prospects but where they believe the current valuations are too conservative and therefore have the potential to be rerated. While the fund isn’t a dogmatic ‘value’ fund that is solely focused on cheap shares, it does have a modest value style bias.”

Another particularity of the fund is its flexibility to take selective short positions in stocks the managers believe have got too expensive and/or where the share price could decline. It currently has three short positions.

Finally, the role of Fidelity Special Situations is to provide exposure to UK small and mid-cap companies. Although they have been out of favour in recent years, Hollands highlighted that ‘smid’-caps have historically provided “significant opportunities” for generating high returns over the long-term.

“Managers Alex Wright and Jonathan Winton are contrarian investors who seek out unloved companies with the potential for positive change. This can mean companies that have seen a change of management, which are undergoing a turnaround, have been hit by worries about regulatory disruption or where the competitive environment is improving,” Hollands explained.

“Backing these companies early enables the managers to benefit from re-rating as the wider markets eventually recognise the improving situation.”

Nick Wood, head of fund research at Quilter Cheviot

Nick Wood, head of fund research at Quilter Cheviot, recommended building an allocation to UK equities with Schroder Recovery and Liontrust UK Growth.

Performance of funds over 10yrs vs sector and benchmark

Source: FE Analytics

Schroder Recovery is a value fund, which currently has a meaningful bias down the cap scale relative to the index.

Wood said: “Schroder Recovery is one of the few pure value managers in the UK, with a track record of managing in the same way counted in decades.

“The team has been adept at managing through periods in which their style is somewhat out of favour, with the last 10 years primarily favouring growth investors, yet the fund proving able to match the market over that period.”

Liontrust UK Growth is the polar opposite of Schroder Recovery, as it follows a quality-growth style and has little exposure to the small and mid-cap space. Over 10 years, both funds have a correlation of 0.76 according to FE Analytics.

Wood added: “The team looks for companies with sustainable structural advantages and has a bias towards higher quality growth companies. There is a bias towards industrials, consumer and energy stocks, although the manager tends to avoid miners and banks.”