It takes guts to back a truly active manager who has the courage of their convictions.

Investors choose contrarian fund managers precisely because they do not follow the herd but, by their very nature, they will lag other funds at certain stages of the investment cycle – requiring investors to screw their courage to the sticking place (in the words of Lady Macbeth) and stay the course. The rewards for doing so can be immense.

In keeping with this, Square Mile Investment Consulting & Research has selected five funds run by managers who apply a robust process and investment philosophy to unearth opportunities where their competitors might fear to tread.

Redwheel Global Emerging Markets

The Square Mile A-rated Redwheel Global Emerging Markets fund is an unconstrained strategy that aims to deliver long-term capital accumulation by capturing the growth potential of emerging and frontier equity markets.

These markets are volatile by nature, but investors can draw comfort from the Redwheel team’s extensive experience, said Amaya Assan, head of fund origination at Square Mile. Lead manager John Malloy is a “seasoned investor” supported by a well-resourced team of analysts.

Malloy “applies a well-constructed process to stock selection,” combining top-down and bottom-up fundamental research, Assan continued.

“He adopts a flexible and index agnostic approach to construct a portfolio of 50 to 60 holdings across the market-cap spectrum, with potential risk managed through close liquidity analysis. The manager is not afraid to hunt in markets often overlooked by his peers, taking advantage of attractive growth opportunities wherever he and his team find them,” she concluded.

Performance of fund vs sector and benchmark since inception

Source: FE Analytics

Schroder Global Cities Real Estate

Hugo Machin and Tom Walker, managers of the Schroder Global Cities Real Estate fund, seek to generate a combination of capital growth and income above inflation from a portfolio of real estate investment trusts (REITs).

They select REITs that hold high-quality assets with the greatest potential for price appreciation over time, said Scott Heaney, an investment research analyst at Square Mile.

“They first seek to identify attractive real estate assets and then determine the best owners of these assets, embedding environmental, social and governance (ESG) considerations throughout,” he explained.

“An impressive quantitative model underlies their approach which draws on an extensive database of city and company scoring, although the team may challenge its output.

“While the fund should protect against inflation through the inflation-linked rents collected within portfolio assets, they are held in equity vehicles, which can be volatile and unhinged from the underlying inflation linkage of their assets in the near to medium term.”

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The fund has a Responsible A-rating from Square Mile.

Jupiter Merlin Growth Portfolio

The AA-rated Jupiter Merlin Growth Portfolio adopts a high conviction approach to identify strategies without reference to a benchmark, said Alex Farlow, associate director of multi-asset research at Square Mile. Nonetheless, the experienced team holds capital preservation to be just as important as capital growth.

The fund is top quartile over one, three and five years and has beaten its peer group by a wide margin, as the chart below shows.

Performance of fund vs sector over 10yrs

Source: FE Analytics

The portfolio is managed by FE fundinfo Alpha Manager John Chatfeild-Roberts and co-managers Amanda Sillars, George Fox and David Lewis.

Farlow said: “They take an unconstrained approach to asset allocation and are willing to have very meaningful exposure to positions in funds run by managers they trust. The final portfolio of between 10 and 20 funds may therefore differ substantially from its peer group but it has nonetheless delivered on its objective of growing investor capital over the long term.”

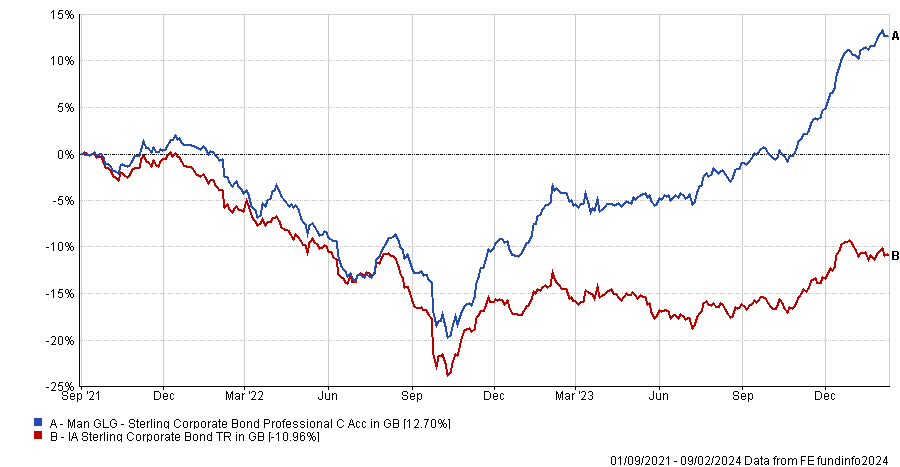

Man GLG Sterling Corporate Bond

For contrarian investors seeking to add a bond fund into the mix, Eduardo Sánchez, associate research director of fixed income, alternatives and multi-asset at Square Mile, singled out the Man GLG Sterling Corporate Bond fund.

It would suit investors who are “comfortable with enduring periods of elevated volatility”, Sánchez said.

The fund was launched in September 2021 and has already amassed £794m in assets under management. It provides a combination of income and growth and its performance is top quartile over one year.

Performance of fund vs sector since inception

Source: FE Analytics

FE fundinfo Alpha Manager Jonathan Golan is “passionate about credit selection and his edge lies in a bottom-up focus on smaller issuers and an ability to extract alpha from undervalued credits which are overlooked by larger scale investors”, Sánchez continued.

“Credit selection among these smaller issuers provides a greater opportunity of being well rewarded but this area of the market is more volatile, which can lead to larger drawdowns. Nonetheless, over a three to five-year investment horizon, this fund has a strong potential to meet investor expectations.”

The fund holds a Square Mile Positive Prospect rating, which is awarded to funds that analysts believe have the potential to be highly compelling propositions. However, there are some elements relating to the strategy where they need more time to be satisfied that the fund merits a full rating (i.e. length of tenure of the fund manager, assets under management). As a result, they award the fund a qualified rating to highlight its appeal, but also to recognise Square Mile’s reservations.

WS Lindsell Train North American Equity

The WS Lindsell Train North American Equity fund is an unconstrained strategy with a high active share and a bias towards quality businesses. It also has a Positive Prospect rating from Square Mile.

Ajay Vaid, senior investment research analyst at Square Mile, said: “Lead manager James Bullock, who is supported by Madeline Wright, is primarily focused on delivering performance in absolute terms from a high-conviction portfolio of companies with durable and sustainable return profiles.

“The team adheres to the same investment philosophy that underlies other strategies within the Lindsell Train suite, which maintains that truly exceptional businesses are both rare and persistently undervalued by the market, presenting an anomaly which can be exploited.”

Performance of fund vs sector and benchmark since inception

Source: FE Analytics

The fund invests in a concentrated portfolio of 20 to 30 companies that the managers believe offer the best value and which they are confident in holding for the very long term.

Its top 10 holdings include analytics software company FICO, ratings agency S&P Global, google parent Alphabet, credit card providers American Express and Visa, and entertainment giant Walt Disney.