Bond investors may face disappointment this year, as cuts in interest rates could fail to materialise as expected, according to Trevor Greetham, head of multi asset at Royal London Asset Management.

Many anticipate weak global growth and falling inflation this year, with central banks able to start cutting rates after one of the most aggressive hiking cycles in history. Yet, this might not pan out, he argued.

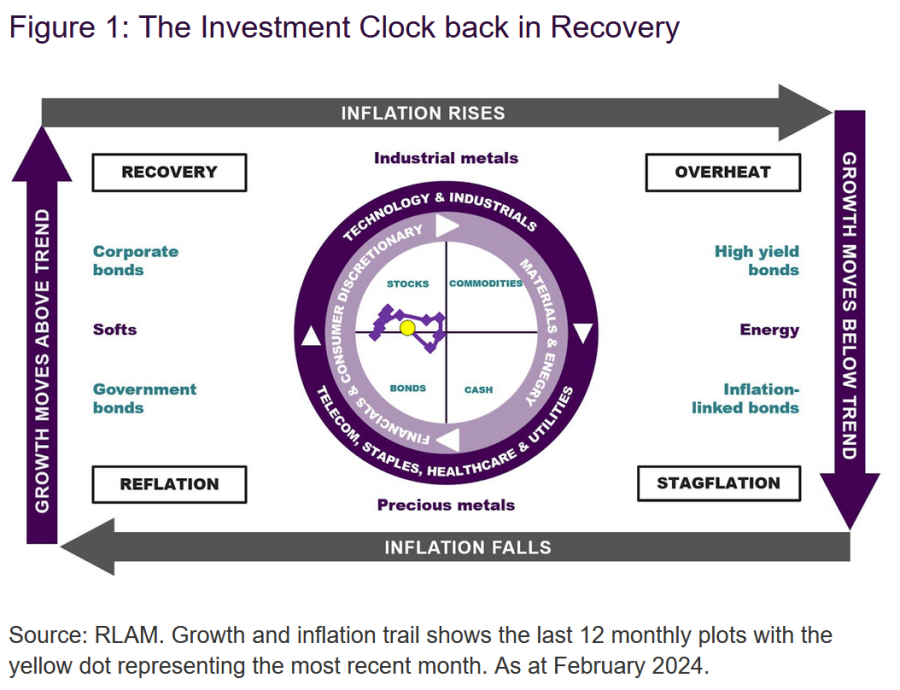

Experts still predict a recession towards the end of the year, as rate hikes (which cool growth and lower inflation) tend to have a lagged effect. But the economy might dodge a recession and move directly into a recovery phase, as global growth indicators are on the rise, while inflation is also falling.

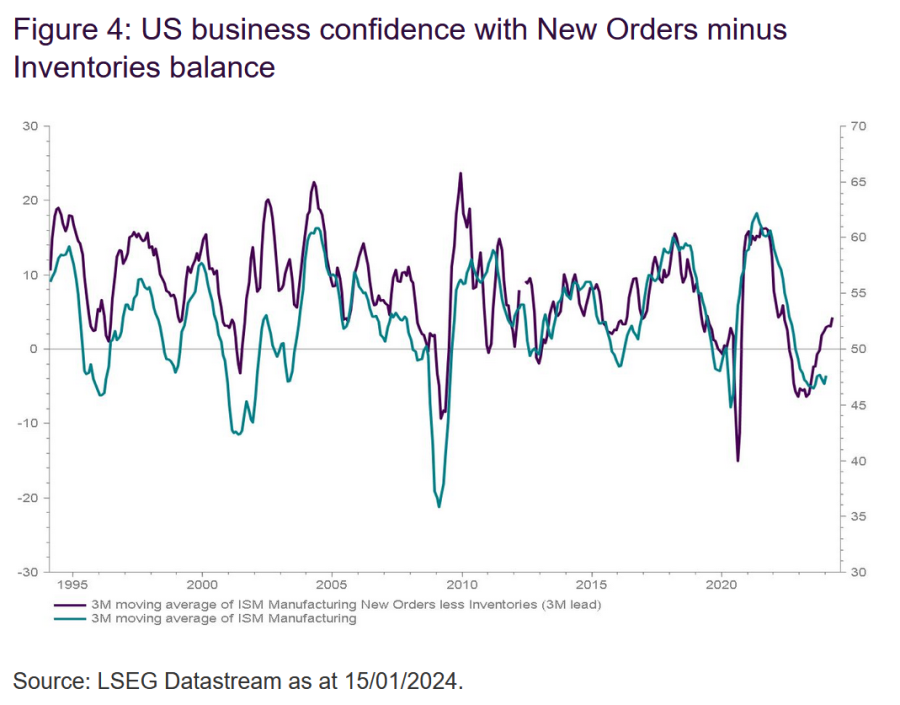

To prove this point, Greetham pointed to stronger business confidence data and robust non-farm payrolls reports in the US.

He said: “While improvements are tentative, the strength of industrial new orders relative to inventories in the US and elsewhere suggests a more sustained period of improvement.”

The bad news is that an acceleration in growth against the backdrop of tight labour markets and high core inflation rates will make central banks’ job particularly challenging.

Therefore, they might not be able to cut rates to the extent bond markets seem to be anticipating and investors might not get the returns they have been expecting as a result.

Greetham said: “We think interest rates will still come lower in 2024, but not to the degree currently factored into bond markets and this could limit returns.”

In this scenario, equities would be the likely winners, as they usually do well in recovery phases when growth is strong and inflation falling.

Greetham said: “We’ve been positive on equities since the fourth quarter of 2022 and this development adds to our conviction.”

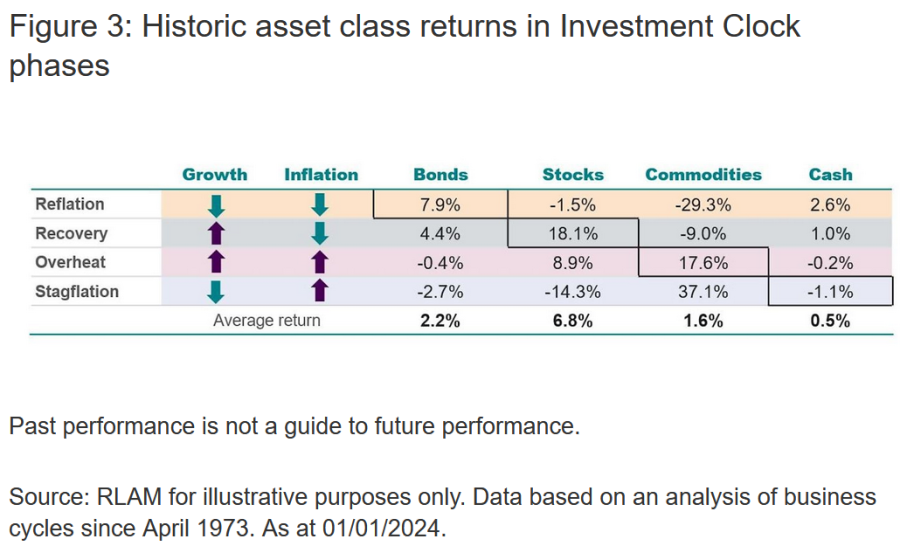

According to Royal London Asset Management’s models, equities have returned 18.1% in recovery phases since April 1973, while bonds have made 4.4%.

In a recovery scenario, commodities would be the worst-performing asset class, as they have historically lost 9% in those periods. Commodities also tend to do very well in stagflation, when growth is falling and inflation rising, but also outperform in ‘overheat’ phases, when growth is strong and inflation is rising. The only risk to the asset class is in the recession bucket, when growth is slowing.

However, not everybody would agree with Greetham. Charlotte Yonge, assistant fund manager of Personal Assets Trust, considers a recession the most likely outcome of this rate hiking cycle.

She warned that its impact has not fully played out yet, as there tends to be lag between the final rate hike and the beginning of a recession.

Yonge is also cautious with labour market figures, as they are lagging indicators. She believes data on small businesses may provide a more realistic picture of the situation, as they tend to feel the impact first.