One fund in the IA Global has consistently outperformed its peers on a diverse spread of risk and return measures but investors can no longer buy in, analysis by Trustnet shows.

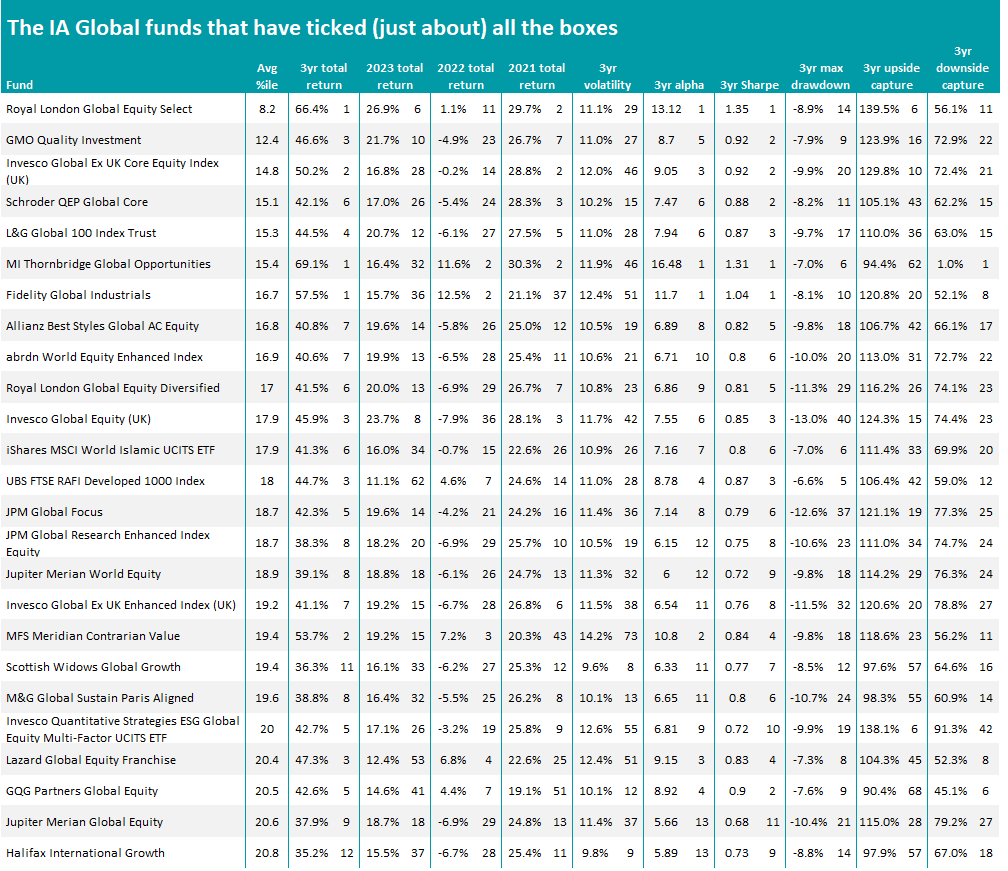

In this annual series, we score funds on 10 key metrics: cumulative three-year returns to the end of 2023 as well as the individual returns of 2021, 2022 and 2023 (to ensure performance isn’t down to one standout year), three-year annualised volatility, alpha generation, Sharpe ratio, maximum drawdown, and upside and downside capture relative to the sector average.

Each fund’s average percentile ranking for the 10 metrics is then used to discover which were most consistently at the very top for the sector across the board. Essentially, the lower a fund’s average percentile score, the stronger it has been over the past three years.

Performance of fund vs sector and index over 3yrs to end of 2023

Source: FE Analytics

We restart this series with the IA Global sector and Royal London Global Equity Select is in first place with an average percentile score of 8.2 – more than four points ahead of the second best fund. This is down to its very strong three-year return (the sector’s fourth highest), alpha, Sharpe ratio and upside capture.

Headed up by RLAM head of equities Peter Rutter, FE fundinfo Alpha Manager James Clarke and Will Kenney, the fund aims to invest in companies at the optimal part of their life cycle. This results in a concentrated portfolio (currently 43 holdings) diversified across geography, sector, investment style and stage in their life cycle, avoiding excessive risk or style bets.

However, the strong performance of the fund in recent years has caught the eye of many investors and Royal London Asset Management hard-closed it in September 2023 – meaning new and existing investors can no longer buy shares in it.

Royal London Global Equity Select currently has assets under management of £752m but a larger sibling can also be found among the best funds of the sector: Royal London Global Equity Diversified, which is ranked in 10th place in this research and managed by the same team.

The table below shows the top 25 funds in the IA Global sector according to their average percentile score.

Source: FE Analytics

There’s a mixed bag at the top of the peer group, with few broad themes consistently appearing in the table.

A few index trackers have some of the IA Global sector’s highest average percentile scores, such as L&G Global 100 Index Trust, iShares MSCI World Islamic UCITS ETF and UBS FTSE RAFI Developed 1000 Index.

Several ‘enhanced index’ funds also topped the sector, including Invesco Global Ex UK Core Equity Index, abrdn World Equity Enhanced Index, JPM Global Research Enhanced Index Equity and Invesco Global Ex UK Enhanced Index.

These are funds that broadly mirror their underlying benchmark but incorporate a degree of active management by adjusting the weights of holdings to generate additional return.

Some of the IA Global sector’s best-known funds are found much further down the rankings, however.

Fundsmith Equity, a household name running some £25bn, placed 264th out of 470 peers with an average percentile score of 53.9. The fund has underperformed in recent years, making 18.3% for the three years to the end of 2023.

Earlier this month, manager Terry Smith touched on the fund’s underperformance in 2023, saying: “Outperforming the market or even making a positive return is not something you should expect from our fund in every year or reporting period, and outperforming the market was more than usually challenging in 2023.”

He put this challenging 2023 down to the fact that a narrow band of stocks (the so-called Magnificent Seven of Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) were the year’s standout performers. Fundsmith Equity does not own all the Magnificent Seven and “would probably not be willing to take the risk of doing so”.

Some of the IA Global sector’s other best-know funds came out even worse in this research. Lindsell Train Global Equity ranked 308th out of 470 funds, Rathbone Global Opportunities 340th and Pictet Global Megatrend Selection 370th.

Source: FE Analytics

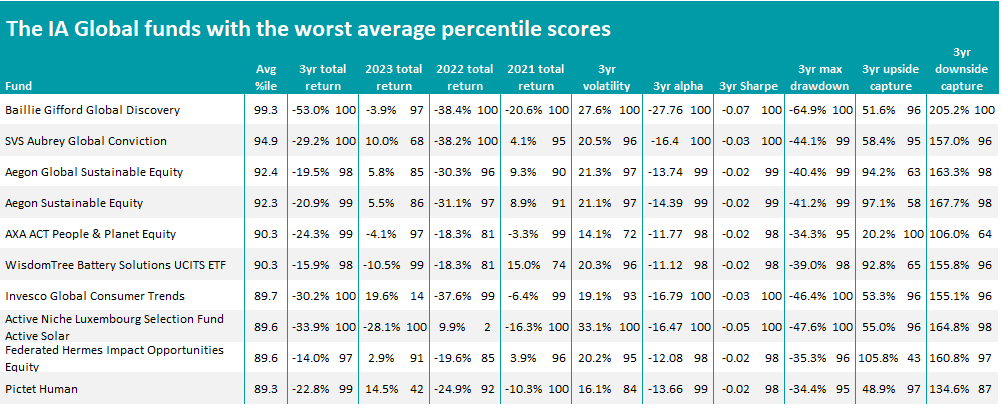

However, the worst result came from Baillie Gifford Global Discovery with an average percentile score of 99.3. It is a small-cap fund, so has scored poorly for upside and downside capture given that this area of the market underperformed large-caps; its 53% loss over the past three calendar years is the worst result in the sector.

Many of the other IA Global funds at the bottom of the rankings in this research are those with an environmental, social and governance (ESG) approach, as can be seen in the table above.

To see the previous articles in this series, please click here.