Scottish Mortgage seems to be back on investors’ radars, as they project central banks to start cutting rates at some point this year – boosting the growth-heavy portfolio.

For instance, it appeared on recommendation lists for 2024 from Winterflood and Numis and was the investment trust interactive investor users bought the most in January 2024.

The Baillie Gifford’s flagship investment trust has struggled since central banks started their hiking cycle, but falling interest rates might prove to be the tailwind it needs, as we explained yesterday.

Performance of trust over 5yrs vs sector and benchmark

Source: FE Analytics

But the volatile trust is by no means a one-size-fits-all proposition and some will want to pair it with others to dampen the risk in a portfolio. Others may well wish to offload it altogether, looking for something steadier. Below, experts give options for both.

How to pair it?

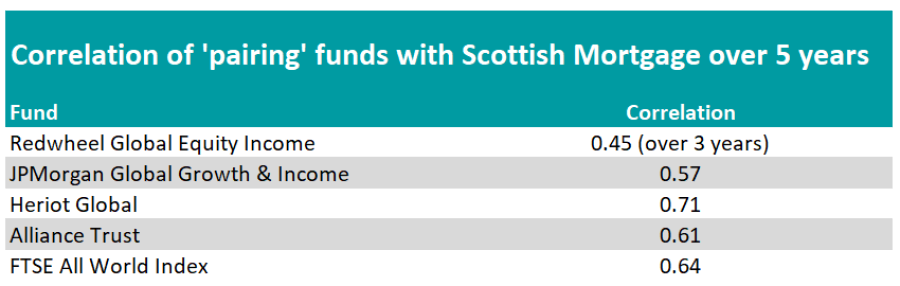

Due to Scottish Mortgage’s strong style bias, Nick Wood, head of fund research at Quilter Cheviot stressed that it is important to pair it with complementary funds offering different types of exposure, such as the value style.

An example he provided is Redwheel Global Equity Income, which launched in November 2020 and is managed by Nick Clay, who looks for quality companies paying an attractive dividend at a reasonable price.

Wood said: “The fund features quality companies at cheap valuations with steady dividend compounding, making for an attractive proposition both in the current volatile period and longer term.

“More broadly, the portfolio tends to offer downside protection in falling markets but may lag in strong up markets, almost the reverse of Scottish Mortgage and thus providing good diversification.”

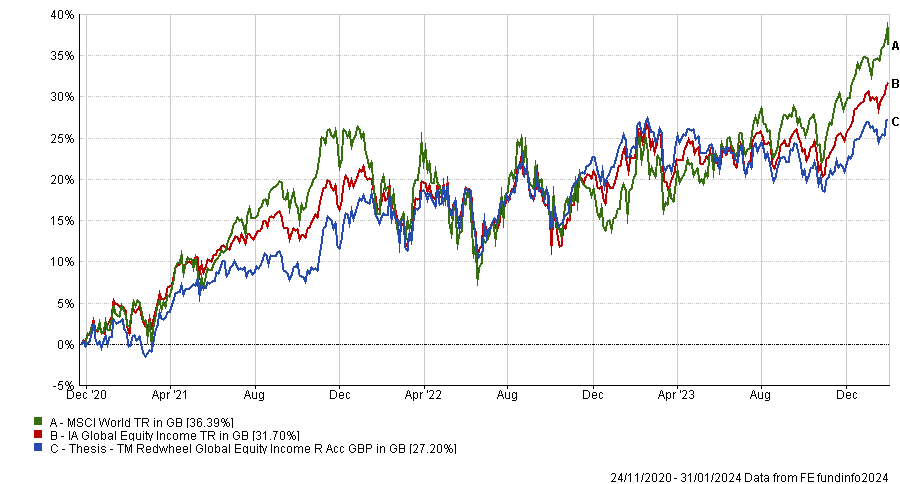

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

Income was a popular theme among the experts, with Emma Bird, head of investment trust research at Winterflood, also choosing a global equity income fund: JPMorgan Global Growth & Income – a trust for which Winterflood is the house broker.

She said: “On a net asset value (NAV) total return basis, this fund has outperformed the MSCI AC World Index in each calendar year from 2019 to 2023, representing the period under the current management team. This degree of consistency is commendable, in our view, particularly over a period that saw a range of market and macroeconomic conditions.

“We believe that the disciplined application of the managers’ style-agnostic, research-driven investment approach has been a key driver of the consistency of performance, and would expect this to continue. As such, we view JPMorgan Global Growth & Income as offering complementary, less volatile exposure to global equities.”

She stressed that it is “highly unlikely” that JPMorgan Global Growth & Income will deliver the level of outperformance enjoyed by Scottish Mortgage in 2020, but it should not underperform to the extent Scottish Mortgage did in 2022 either.

Sheridan Admans, head of fund selection at TILLIT, was on a similar wavelength, pointing to Heriot Global as a “compelling choice”.

He said: “With a philosophy grounded in dividend growth, Heriot provides global growth underpinned by solid cashflows and a focus on companies with the ability and willingness to pay dividends.

“This pairing creates a balanced portfolio, with Scottish Mortgage capturing high-growth opportunities and Heriot offering stability through dividends, especially in less favourable market conditions.”

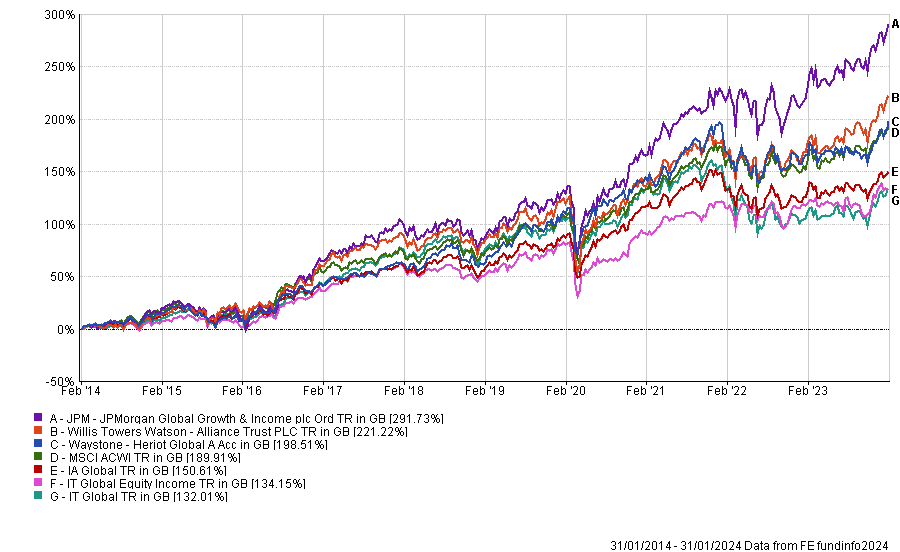

Performance of funds over 10yrs vs sectors and benchmark

Source: FE Analytics

Away from dividends, Matthew Read, senior analyst at QuotedData picked Alliance Trust for investors looking to balance out the Baillie Gifford’s flagship investment trust.

He said: “This is a large – £3.1bn total assets – investment trust that is also focused on global equities but is managed in a very different way. Alliance Trust’s manager, Willis Towers Watson, selects around 10 managers to run concentrated portfolios of their ‘best ideas’.

“The US is the largest market in the global equities universe and so will always be a significant allocation within any generalist global equities portfolio but the combined effect of Alliance Trust’s managers is a marked underweight to the US, which is in contrast to Scottish Mortgage which has a large US allocation. Alliance Trust is also significantly different to its benchmark, with an active share of 74%.”

Source: FE Analytics

How to replace Scottish Mortgage?

With its combination of higher growth equity and private equity, Scottish Mortgage makes for a unique investment proposition.

However, the portfolio may be too aggressive for some investors, who might prefer a more tempered and diversified way to gain access to global growth equities. In that case, Scottish Mortgage’s cousin Monks could be a more suitable option, according to Wood and Bird.

Wood said: “Rather than simply focusing on rapid growth names alone, the team is also willing to buy into ‘growth stalwarts’, which might include companies that are more established and have lower but dependable year on year growth, as well as more cyclical names.”

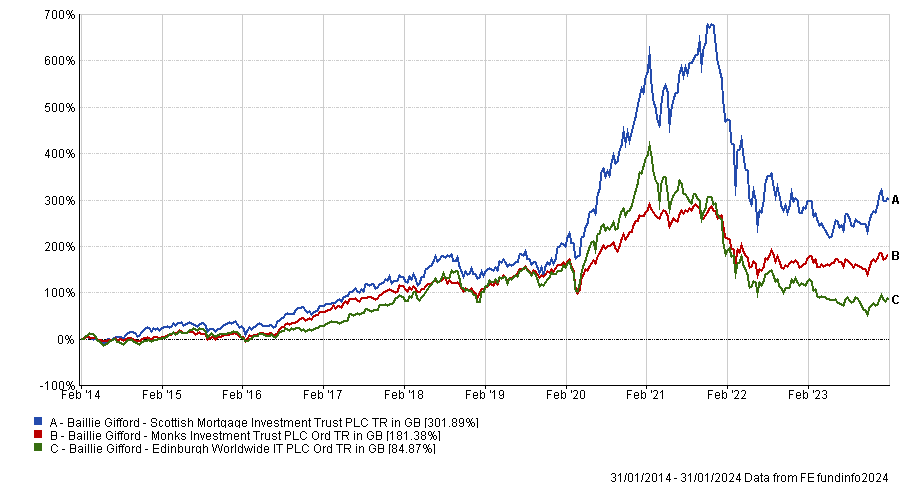

Performance of trusts over 10yrs

Source: FE Analytics

Conversely, some investors might feel Scottish Mortgage is not aggressive enough and may want a portfolio that goes a step further. For this cohort of investors, Read pointed to another trust from the Baillie Gifford stable: Edinburgh Worldwide, which is sometimes described as Scottish Mortgage’s ‘little brother’.

Read said: “Although it is a fraction of the size of the colossus that is Scottish Mortgage, Edinburgh Worldwide bears some similarity in style, albeit it has a smaller-cap focus (it has a similar approach to its private company investments).

“Today, Edinburgh Worldwide can be purchased on a 14.7% discount to NAV, making it a bit cheaper to Scottish Mortgage, which is trading at an 11.1% discount.”

Finally, Admans opted for Blue Whale Growth for investors seeking exposure to high-quality global businesses via a concentrated portfolio.

Performance of funds since launch of Blue Whale Growth

Source: FE Analytics

He said: “Blue Whale Growth distinguishes itself as a highly concentrated fund strategically investing in high-quality businesses globally, emphasising a long-term time horizon. The fund's investment style is growth-oriented, focusing predominantly on large-caps and mega-caps.”