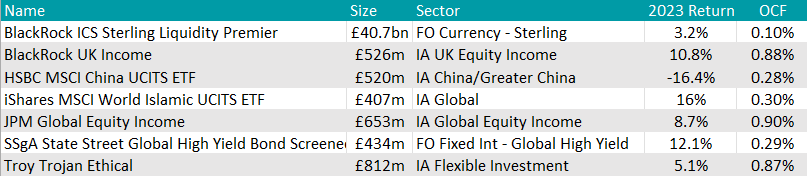

Income, UK-based and money market funds were among the strategies that convinced AJ Bell investment director Ryan Hughes and the wider team of analysts they were worthy of inclusion to the firm’s best-buy list in 2023.

Most funds added to the company’s Favourite Funds list in 2023 belong to these categories, on top of which a few defensive portfolio and index trackers were also singled out.

Below, Trustnet reviews the additions to the AJ Bell Favourite Funds list that were made throughout 2023.

Back in January last year, Hughes seemed keen on the UK market and included BlackRock UK Income to the list.

It convinced him and his team for its “experienced” management team, headed up by Adam Avigodri and David Goldman, who started at BlackRock as analysts in the 2000s. They employ a bottom-up approach to stock selection and follow a non-constrained approach to income investing.

“The managers use a pragmatic style-neutral approach, targeting a balance of income returns ahead of the benchmark without sacrificing long-term capital growth,” Hughes said.

“The fund’s income approach permits non-yielding companies to be held, resulting in a well-balanced yet high-conviction portfolio with a bias towards large-cap companies.”

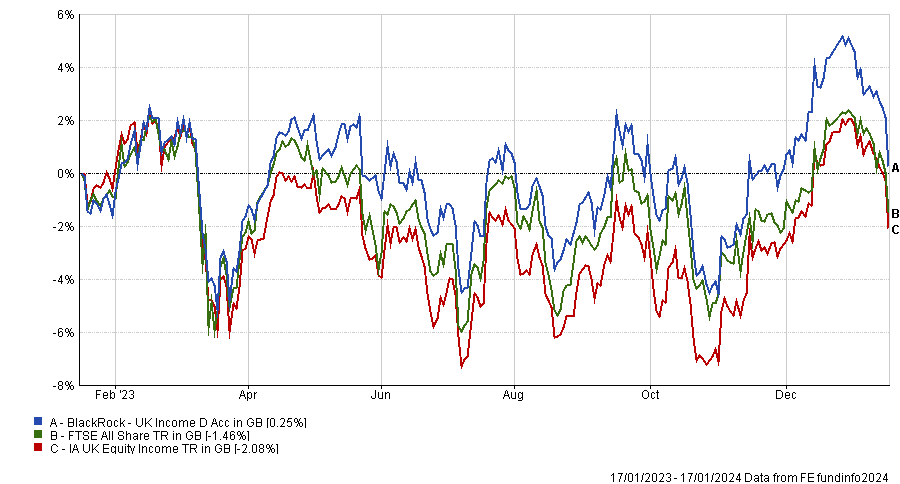

Since added to the list, the fund returned 0.3%, as shown in the chart below.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

In May, as higher interest rates drew people to cash strategies, the Favourites Funds list welcomed BlackRock ICS Sterling Liquidity Premier and the income strategy JP Morgan Global Equity Income.

The BlackRock portfolio is “one of the leading money market funds” and focuses on maximising income yield as well as ensuring capital preservation. It stood out for its “competitive” 0.1% ongoing charges figure (OCF).

“Due to the nature of the investible universe [short-term money market instruments across the globe, constrained to a maximum weighted average maturity of 60 days], investors benefit from the significant size of Blackrock and this strategy as it grants more opportunities,” AJ Bell analysts said. “However, returns can be muted given the fund invests in less risky area of the yield curve.”

Moving on to the JP Morgan strategy, the advantages of choosing it, according to Hughes, are the “tried-and-tested approach, a clear investment philosophy and the pragmatic balance” between income yield and capital growth.

The “experienced” fund management team includes Helge Skibeli, Sam Witherow and Michael Rossi, who take the highest conviction ideas of the “extensive” pool of analysts, selecting both high-yielding and high-growth companies, independent of sector and region.

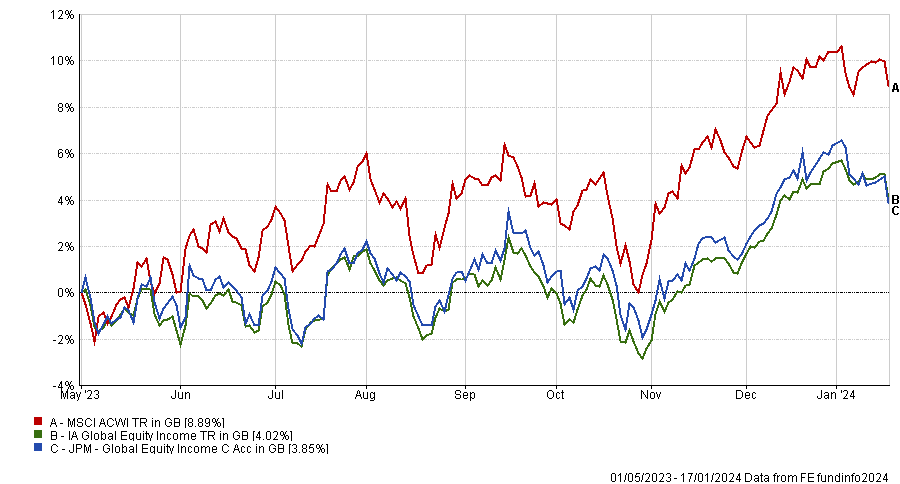

Performance of fund vs sector and index since May 2023

Source: FE Analytics

The long-only Troy Trojan Ethical made it into the list in July, joining its sibling Troy Trojan. Capital preservation is key to these strategies, which invest in multiple asset classes around the world, including fixed income, equities, precious metals and cash, without allocation constraints.

“The boutique nature of the management company creates an environment of pragmatism and patience enabling it to withstand outside noise,” said AJ Bell analysts. “The portfolio offers good downside protection but can still capture sufficient positive returns over time.”

Since its addition, it has made 3.6%, as the below chart shows.

Performance of fund vs sector and index over 6 months

Source: FE Analytics

Three index trackers found their way into the list in the summer – HSBC MSCI China UCITS ETF, iShares MSCI World Islamic ETF and State Street Global High Yield Bond Screened Index Fund.

For both mainland China and Hong Kong exposure, AJ Bell went with the HSBC tracker, as it was founded in Hong Kong, giving it “a strong reputation when investing in this region”, and the vehicle has one of the lowest OCFs in the market (0.28%).

For Shariah-compliant investors, the pick was iShares MSCI World Islamic ETF, which selects companies from the MSCI World index that meet Shariah requirements.

Finally, fixed-income investors were pointed towards State Street Global High Yield Bond Screened Index fund.

Hughes liked the asset class as it occupies “an interesting space in financial markets, having the fixed income and credit status of bonds, but being driven by and reactive to the economic signals and developments that impact stocks”.

“The fund is hedged back to sterling, which reduces the impact of currency fluctuations, which can be large on a fund with a global investing scope,” he concluded.

Source: FE Analytics