Small-caps outperforming, corporate earnings faltering and investment trusts enjoying a resurgence are all among Columbia Threadneedle Investments' most likely predictions for 2024.

Meanwhile, the Bank of England could be the first to cut interest rates, the Bank of Japan will probably move away from yield curve control and Europe should experience a recession, albeit a mild one. Those scenarios are 80-90% likely.

Investment manager Anthony Willis has less conviction in the US Federal Reserve keeping rates higher for longer, to which he accorded a 40% probability.

Below Trustnet looks at the main themes for the year with a 50% or higher probability of occurring.

Columbia Threadneedle’s most likely scenarios

- German recession = European recession: 90% probability

A eurozone recession is a pretty safe bet and may already be happening, given that growth was negative in the third quarter of last year and the data for the fourth quarter is not looking much better.

German industry is struggling with higher energy costs and growth has evaporated. The European Central Bank could cut rates now that inflation is close to target, but rate cuts alone will not be enough to stimulate growth, Willis said.

- Table Mountain turns into the Matterhorn: 80%

Last August was the Bank of England’s final rate hike and since then, the old lady of Threadneedle Street has been happy to watch and wait, hoping that higher rates will bring down inflation without too much collateral damage.

Even though the Bank of England has been at the forefront of the ‘higher for longer’ narrative, history shows that the path of interest rates resembles the Matterhorn (a mountain with a sharp peak and symmetrical sides) more closely than Table Mountain (which has a flat top).

A contrarian view, to which Willis assigns a high likelihood, involves the Bank of England becoming the first major central bank to cut rates.

- The Bank of Japan does the unthinkable: 80%

Inflation is taking root in Japan after decades of deflation and the Bank of Japan has started dropping hints about ending yield curve control.

The next step will be hiking rates, which would impact liquidity globally as market participants unwind the carry trade of borrowing cheaply in Japan then investing in more rewarding opportunities elsewhere.

- The UK investment trust market reopens: 80%

Much of the investment trust sector has derated due to higher interest rates but boards and managers are now addressing wide discounts with share repurchase programmes.

Columbia Threadneedle expects the investment trust sector as a whole to recover now that rates have peaked. Willis thinks renewable energy trusts will lead from the front as the UK endeavours to decarbonise its infrastructure and improve energy security.

- Small-caps outperform: 70%

“After a torrid time over the past few years, small-cap investors may be emerging from their hiding places with the prospect of soft economic landings and interest rate cuts,” Willis said. “UK small companies look in reasonable shape but are priced at valuations that imply a deep 2008-09 type recession.”

Small-caps tend to outperform as the economy recovers, so once the worst of the economic data is over, a combination of lower rates and attractive valuations should favour these companies.

- Trump triumphs: 70%

The US election “feels like an unpopularity contest,” Willis said, given that president Joe Biden and Donald Trump both have high disapproval ratings, but Trump is ahead in the swing states. “Trump is trusted more on the economy, which is remarkable given Biden’s spending to avoid a recession,” he added.

- The labour market fails to weaken: 70%

US unemployment at 3.7% remains close to historic lows and companies have been reluctant to let go of staff they struggled to re-hire after the pandemic.

“In an election year, with employment so important to both consumer sentiment and voting intentions, expect plenty of pressure on the Federal Reserve from Democrats to cut rates, and Republicans to cry foul when they do,” Willis said.

- Corporate earnings fail to meet lofty expectations: 70%

The consensus view for high single-digit earnings growth next year does not correlate to the anticipated economic slowdown.

Money is no longer cheap but well-run companies with healthy cash flows and strong balance sheets should outperform, while debt-laden companies will struggle, creating plenty of opportunities for stock pickers.

Somewhat likely predictions…

- The ‘Magnificent Seven’ deliver mediocre returns: 60%

The Magnificent Seven tech giants have achieved a remarkable dominance over global equity markets. They comprise a larger share of the MSCI World index than the UK, China, France and Japan combined. Apple and Microsoft individually have a higher market capitalisation than the FTSE 100.

After stellar performance last year and with high multiples, Willis does not think all seven companies will continue to thrive. “Some of them will remain magnificent, probably not all,” he said.

- Emerging market rate cuts fuel a boom: 60%

Many emerging market central banks reacted swiftly to inflationary pressures by hiking rates but now inflation is easing rapidly they have plenty of room to cut. Brazil, for example, recently dropped rates by 50 basis points yet interest rates are still more than 700 basis points above inflation. A series of further cuts would help the Brazilian economy to prosper.

- A Labour landslide: 60%

The Labour party is the favourite to win the UK election but could Labour win big? Some of the more reliable polls suggest that a Labour landslide is possible and a 100 seat majority would enable the incoming government to plan for the longer term, Willis explained.

- The US dollar loses its lustre: 60%

This trend began last year. A weaker dollar would be welcomed outside the US and would represent a loosening of global monetary conditions. Any risk-off event or shock to the system, however, would see support rushing back to the safe haven currency.

- Inflation reaccelerates: 50%

Inflation comes in waves and has historically tended to return after the initial surge. Central banks are not ready to declare victory over inflation just yet – especially as the most recent UK and US inflation figures were higher than expected – and they may not cut rates as fast as the market is expecting.

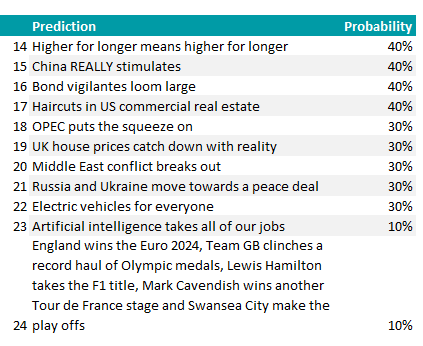

Possible but not probable predictions

Willis also suggested a number of hypotheses for next year that could conceivably come to pass, but which he feels have a less than 50% chance of happening.

Tail risks: scenarios that could play out this year

Source: Columbia Threadneedle Investments