Investment trusts had a tough ride over the past 12 months but wider share price discounts can create good opportunities for contrarian investors.

Discounts in the investment companies sector reached the widest levels since the financial crisis in 2023 as a ‘perfect storm’ of rising interest rates, macroeconomic uncertainty and geopolitical conflict all weighed heavily on market sentiment.

However, they have since bounced back, tightening sharply since their low on 31 October after the Federal Reserve hinted it could cut rates sooner than expected.

The sector average discount – excluding 3i Group, which skews the figures significantly – remains wide at 15% (10% with 3i included). This is more than double the average since the financial crisis (7%) and still offers an attractive entry point, according to a report by Numis Securities’ head of the investment companies research Ewan Lovett-Turner and his team.

Below they highlight four areas of interest that investors may wish to take a closer look at.

UK trusts

First up is the beleaguered UK stock market, which has underperformed its overseas developed market rivals for years. It continues to be shunned, according to Lovett-Turner, with wealth managers shifting to global portfolios and consistent retail outflows.

“We acknowledge that the economic outlook remains uncertain and the economy is teetering on the edge of recession, with the impact of rate increases perhaps only starting to fully be felt. However, valuations have priced in a lot of bad news and we do not believe it will take much to positively improve sentiment – as the Santa rally in small-caps demonstrated,” he said.

“In our view, value remains in small-caps and we highlight Henderson Smaller Companies as an attractive opportunity. Fidelity Special Values remains our top pick in the IT UK All Companies space owing to its contrarian approach, with a record of outperforming in a variety of market conditions.”

Performance of funds vs sectors over 10yrs

Source: FE Analytics

The former is in the IT UK Smaller Companies sector’s second quartile over one, five and 10 years, although it has failed to beat the sector average during the past decade. Meanwhile the latter has been the best trust in the IT UK All Companies sector over three and 10 years.

Emerging markets

Staying with equities, Lovett-Turner and his team also highlighted the emerging markets, which have lagged their developed peers since the financial crisis.

He said they are “well placed to outperform” as they have been “on the front foot” in tackling inflation and have lower levels of debt, as well as valuations, which are now at a 45% discount to developed markets.

“We believe China may offer an attractive contrarian value play, but we focus on beneficiaries of diversification away from China including India (JPMorgan Indian) and Vietnam (VinaCapital Vietnam Opportunity), which are well placed to continue their respective structural growth stories. We also believe BlackRock Frontiers offers an attractive way to access a range of markets,” he said.

Growth trusts

Another area of interest is investment companies using the growth style, which has been a darling for much of the past decade but came under pressure in 2022 and, despite a tech rally, has struggled to regain the ground lost.

“Despite markets in 2023 being dominated by technology companies, sentiment towards ‘growth’ stocks was generally weak, with market leadership concentrated on the ‘Magnificent Seven’ artificial intelligence beneficiaries,” said Lovett-Turner.

“Growth-biased trusts rallied in late 2023 on lowering inflation and declining rate expectations but unsurprisingly given the strength of the rally, have been weaker in early 2024.”

He suggested that central banks may not cut interest rates as quickly as some expect, noting that in this environment investment returns are likely to be driven more by company-specific performance, rather than style factors.

“We believe the unique portfolio of Scottish Mortgage has return drivers that can deliver regardless of the interest rate environment, while Smithson’s concentrated portfolio of 30 positions with strong fundamentals offers value on a 12% discount,” he said.

“We also believe that the outlook for Chrysalis Investment looks positive, with an upcoming portfolio exit and likely returns of capital amongst the catalysts for a rerating.”

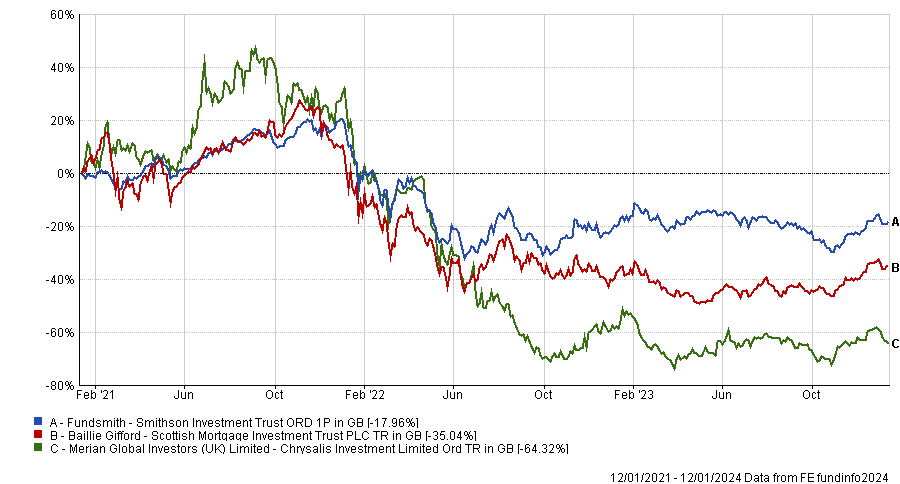

The past three years have been unkind to all three funds, which are down between 18% and 64.3%, as the below chart shows.

Performance of funds over 10yrs

Source: FE Analytics

Despite this, Scottish Mortgage remains the top performing IT Global trust over a decade, up 299.3%, while Smithson has made 34.2% over five years – the third best out of five in the IT Global Smaller Companies sector. Chrysalis tops the IT Growth Capital sector over five years, although there are only two qualifying names and it has made a 35.3% loss over this period.

Alternatives

Outside of equity markets, the listed infrastructure sectors “continue to present compelling risk-adjusted return potential”, Lovett-Turner said, noting their “high quality cashflows from irreplicable portfolios of critical assets”.

“Capital allocation has come into focus with companies responding to the higher rate environment with proactive disposal activity, which positively has been achieved at or ahead of book value, providing support for NAVs, while also raising proceeds to pay down RCFs [revolving credit facilities] and fund share buyback programmes.”

Here he noted there are opportunities across three different areas: core (International Public Partnerships); mid-market infrastructure (3i Infrastructure); and Renewable Energy (Bluefield Solar Income). There is also an idiosyncratic story with Cordiant Digital due to contagion from issues with its closest peer.

Private equity also looks attractive, with the head of investment companies research suggesting the sector should have a higher weighting in investors’ portfolios.

“Earnings growth from portfolio companies has remained strong, which is the key driver of long-term returns, whilst investors’ concerns about valuations are being addressed by recent realisation activity uplifts,” he said.

“This is demonstrated by HgCapital*, which remains one of our highest conviction bets, delivering several exits/transactions at substantial uplifts in 2023. Exit activity has been more limited at Oakley Capital Investment, but we believe that the fund’s entrepreneurial led approach is a key differentiator and offers value on a 29% discount.

“We also believe Pantheon International is an attractive way to gain widely diversified exposure to the private equity industry, focused on high-quality management teams with proven track-records and is cheap on a 34% discount given its market-leading approach to capital allocation.”

*FE fundinfo is a portfolio company of HgCapital