Companies that reinvest profits in their own growth instead of paying shareholders dividend are less likely to go extinct, said Scottish Mortgage’s Tom Slater.

For investors who see the world in the same way as the veteran fund manager, Peel Hunt analysts Anthony Leatham, Markuz Jaffe and Thomas Pocock have put together an investment playbook for growth and recovery with their top trust picks for 2024, beginning with UK equities.

UK equities have been battered in the past two years, with discounts to world markets reaching 34% for the FTSE 100 and 43% for the FTSE 250. In this context, value investing has outperformed and the two strategies chosen below both take a value approach.

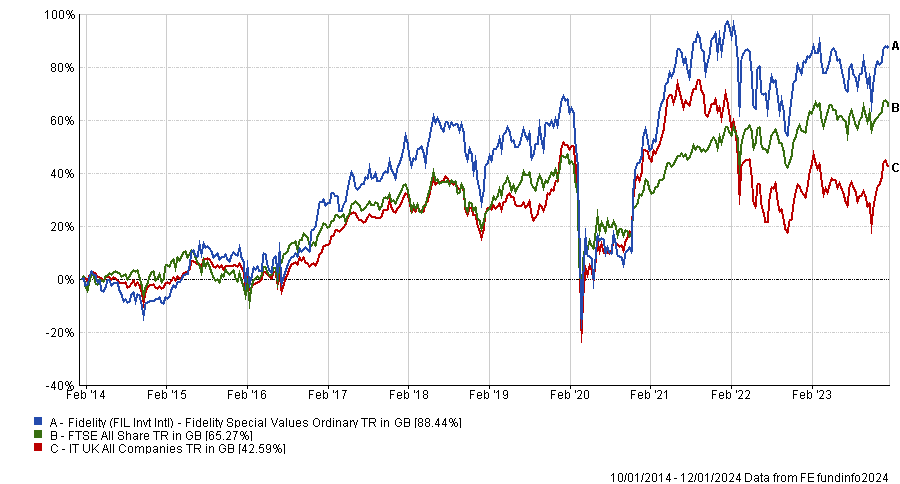

The first up is Fidelity Special Values, which offers “multiple layers of value”, as it currently trades on a 8% discount to net asset value (NAV) and on a 25% discount to the FTSE All Share index.

It is managed by FE fundinfo Alpha Manager Alex Wright, who takes a contrarian view on the market, focusing on under-researched mid- and small-cap segments of the market and doubled the performance of the benchmark since his appointment in 2012.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

Another strategy with a “particularly stark” discount to global markets and an 11% discount to NAV, Aberforth Smaller Companies should outperform “as international and domestic buyers begin to realise the returns on offer at the small-cap end of the UK market”.

The trust’s underlying price-to-earnings ratio is also near a record low, and Leatham and his team pointed to historical evidence suggesting that the trust should support a future five-year annualised return of more than 20%.

Albeit convinced of the recovery potential in UK equities, Leatham and his team were also “aware” that a number of investors are looking to position their regional bets around a core global equity strategy.

Given this premise, it might not surprise that their only global pick, the £1.3bn Bankers Investment Trust, is overweight the UK and underweight the US and the technology sector, which has, however, detracted from its five-year annualised performance coming in at 9%, lagging the FTSE World index.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

The trust is managed by Alex Crooke and convinced Leatham for its ability to adjust both its regional and style allocations in line both with bottom-up and top-down considerations.

“In a changing and volatile environment, this flexible approach combined with a best-of-Janus Henderson manager skill provides a solid core global equity allocation for investors,” Leatham said.

“The current 12% discount has dropped to the widest level in a decade and is inexpensive versus its longer-term average rating of closer to par.”

For capital growth from further afield, Leatham suggested looking at Japan with the Nippon Active Value Fund, at India with Ashoka India Equity and the emerging markets with Mobius Investment Trust.

Launched in 2020, Nippon Active Value has convinced with its success in “unlocking value” in Japanese companies and has become a consolidator in the market, having reached assets under management (AUM) of £318m by absorbing the abrdn Japan Investment Trust and the Atlantis Japan Growth Fund in October 2023.

The India-focused Ashoka India Equity has an “impressive” track record and since its launch five years ago. It has more than doubled investors’ money, as shown in the chart below.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

“The scale and duration of Ashoka India Equity’s outperformance strongly suggests to us that White Oak has developed a successful and repeatable investment process that should continue to generate alpha for shareholders,” said Leatham.

“The strong performance and structure of the trust has helped it to mitigate discount volatility and ensure alignment of interest with the team’s ‘performance first’ culture.”

Finally, the Mobius Investment Trust has reached a 9% discount, having been trading at par for much of its life. This was viewed as “an attractive entry point” into a “unique” strategy, which identifies companies with deep moats, high financial productivity and “outstanding” entrepreneurs. The managers focus on downside protection both at the company and country risk levels.

For investors looking for thematic plays, the Peel Hunt analysts highlighted fintech and healthcare, with Augmentum Fintech set to benefit from “the expertise of the team, the quality and growth trajectory of the portfolio, the momentum in the asset class and the disciplined approach to investment and valuations” and Syncona, with “15 milestones expected across its portfolio over the next 12 months” and a “lack of operational explanations behind the current 31% discount”, both offering “compelling value” to potential investors.

Other picks included the Property Investment Trust, HarbourVest Global Private Equity, Pantheon Infrastructure, Oakley Capital, Triple Point Digital 9 Infrastructure and the Gresham House Energy Storage Fund.

Source: FE Analytics