The consensus view at this time last year was that a recession was around the corner, as the inversion of the yield curve in the bond markets implied an imminent economic downturn.

Moreover, markets were forecasting negative returns from the S&P 500 and an outperformance of Chinese assets as the world’s second largest economy had just lifted its strict Covid restrictions.

Fast forward 12 months, the much anticipated recession did not occur, which resulted into an uncertain macroenvironment. As central banks kept hiking rates during the year, the big questions were how high they would need to go and for how long they would have to stay elevated to stop inflation. Central banks eventually paused their hiking cycle in November and there are now hopes that they might start cutting rates in 2024.

For bond markets, it has implied wild swings during the year, with government bonds offering yields over 5% for prolonged periods. This have come down now, with the 10-year gilt paying 3.66% and the equivalent US treasury 3.87% at the start of 2024.

On stock markets, the tech heavy S&P 500 rallied, although performance was driven by only seven stocks related to artificial intelligence (AI). Meanwhile, China has been a laggard due to weak economic data and further commotions in the property sector.

Ben Yearsley, director of Fairview Investing, said: “From a fund perspective there were really only two stories in 2023, tech and China. Tech was great, China dreadful.”

In terms of Investment Association sectors, IA Latin America and IA India/Indian Subcontinent were second and third respectively after IA Technology & Technology Innovation.

But looking at the year as a whole misses some of the nuances that took place on a quarterly basis. Below, Trustnet breaks down the year into four distinct blocks.

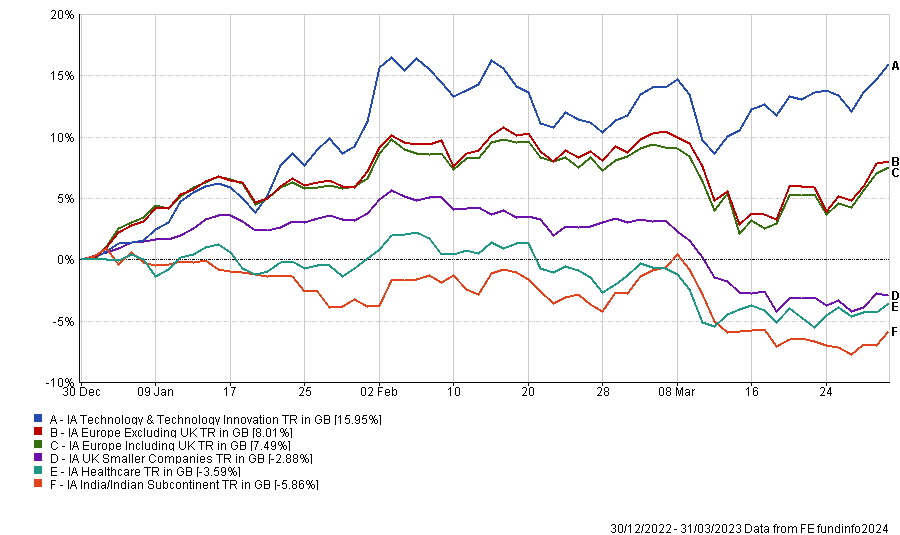

First quarter: Tech rebounds and Europe surprises on the upside

Technology was one the worst performing sectors in 2022 as the return of inflation favoured the value style of investment. Yet, the sector bounced back as early as the first quarter of 2023, boosted by the AI hype, following the launch of ChatGPT.

Continental European equities also did well in that quarter against all odds, as the region faced – and is still facing – tremendous challenges with its energy supply following the Russian invasion of Ukraine.

The European luxury sector shone in particular, helped by China’s reopening. In that period, LVMH became the first European company to ever reach a market capitalisation of $500bn, although it has since then fallen back below $385bn.

Best and worst performing sectors of Q1 2023

Source: FE Analytics

The other way around, healthcare and Indian equities did poorly in the first quarter of 2023.

The underperformance of the healthcare sector came as a surprise to Paul Major, manager of the Bellevue Healthcare Trust. With the expected recession, Major wondered why investors had not flocked to defensive growth, which is a style healthcare stocks are often associated with.

As for Indian equities, they suffered from the uncertainties in the global economy at the beginning of 2023 as well as of the publication of the Hindenburg Research, which accused Indian multinational conglomerate Adani Group of stock price manipulation.

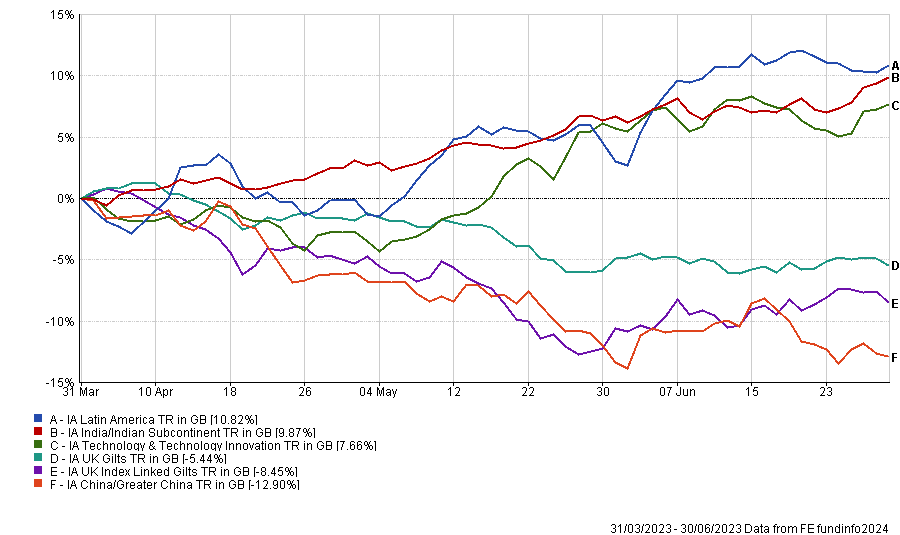

Second quarter: Latin America and India outperform, while AI asserts its dominance

The dominance of the AI thematic peaked in the second quarter of the year. At that point, several investors switched to a picks-and-shovels approach and chose to back AI enablers, such as semiconductor businesses, rather than directly taking positions in AI companies.

This has led to the meteoric rise of hardware and software supplier Nvidia, whose share price surged 293% between 1 January 2023 and 31 December 2023.

Yet, the best performing sector of the quarter was IA Latin America, as the region benefited from the souring relations between the US and China. Indian equities also started their rebound in the quarter.

Best and worst performing sectors of Q2 2023

Source: FE Analytics

It is also in this period that weaknesses in the Chinese economy became more visible, leading investors to abandon the market.

The IA UK Gilts and IA UK Index Linked UK Gilts also struggled in the second quarter of 2023 as a result of entrenched inflation and fears of a higher terminal rate.

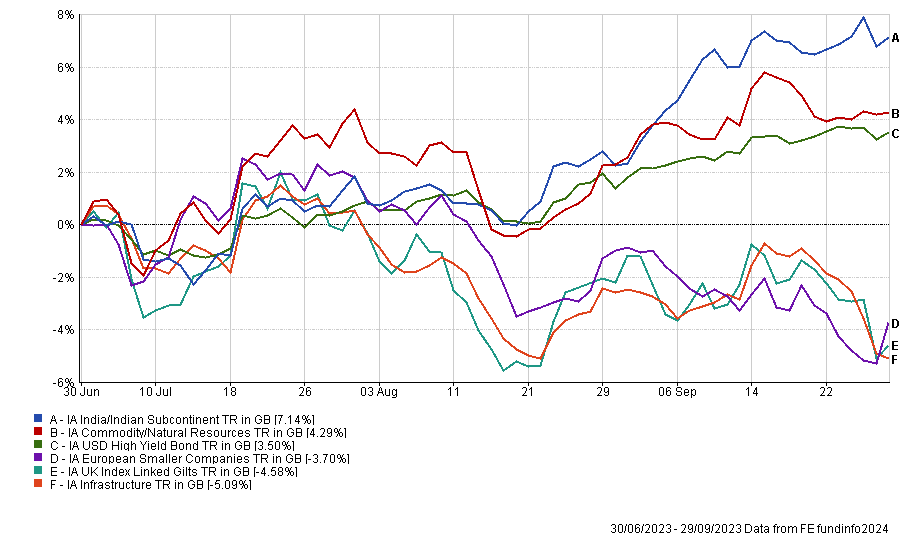

Third quarter: India and commodities take the lead as technology slows down

Technology slowed down in the third quarter of 2023 and even delivered negative returns due to fears that interest rates may stay higher for longer.

For similar reasons, the IA Commodity/Natural Resources did well as investors switched to energy stocks, which often work as a protection against inflation.

Meanwhile, Indian equities took the lead, continuing their rebound from the first quarter, thanks to robust economic growth and strong corporate earnings.

High yields sectors were also among the best performers between July and September, in particular the IA USD High Yield Bond sector, with the average fund returning 3.5%.

In a comment published in August 2023, Collin Martin, director, fixed income strategist at Schwab Center for Financial Research wrote: “Coming into the year, we were cautious on high-yield bonds given the risks of rising rates and tighter financial conditions. Investors generally have shrugged off those risks, pulling high-yield spreads down and prices up.”

Best and worst performing sectors of Q3 2023

Source: FE Analytics

The IA UK Index Linked Gilts sector was once more among the laggards. As the Bank of England paused its rates hike, it led investors to sell their holdings with the expectation that rates had peaked.

Yet, the worst performing sector was IA Infrastructure, which also had made negative returns in the two previous quarters, as the asset class is often perceived as being sensitive to interest rates.

Jean-Pierre Petit, president of the Cahiers Verts de l'Economie, wrote in a commentary piece for Quaero Capital in August 2023: “It is undeniable that the real rate shock of 2022-23 has affected the performance of infrastructure assets. Initially, rising inflation benefited the sector. But thereafter, there was a sharp underperformance of infrastructure linked to a fairly powerful derating.”

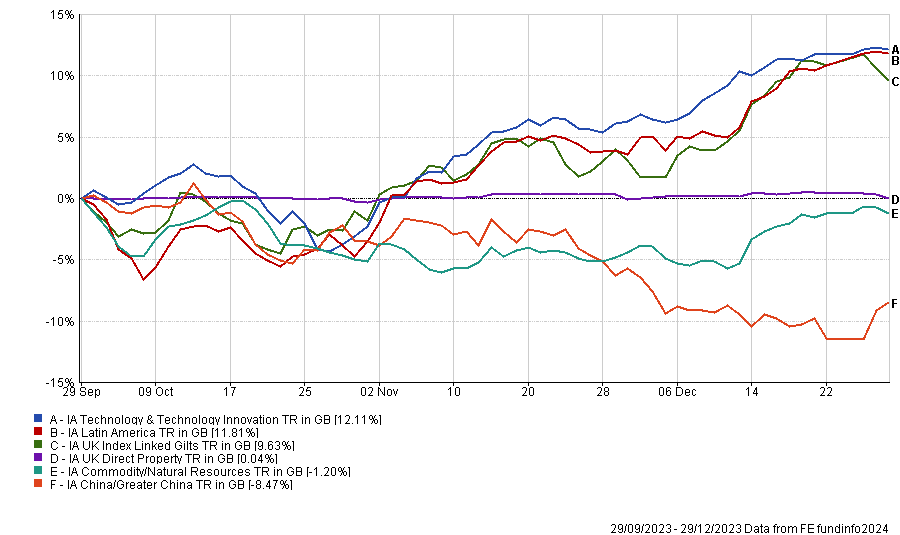

Fourth quarter: Tech and gilts benefits from rate cuts expectations

As central banks paused their hiking cycle in the Autumn and hinted at potential rate cuts in 2024, the technology sector clawed back its crown in the last quarter of the year. A reason for this is that tech stocks tend to do well when interest rates are lower as their future earnings are measured against the return investors can get from lower risk assets.

In the UK, the economic outlook weakened in the final quarter of 2023, leading markets to expect the Bank of England to cut rates in 2024, potentially before the Federal Reserve, to avoid a hard landing scenario. This helped both the IA UK Gilts and IA UK Index Linked Gilts sectors to rise to the top of the charts.

The IA Latin America sector finished second between IA Technology & Technology Innovation and IA UK Index Linked Gilts.

Best and worst performing sectors of Q4 2023

Source: FE Analytics

Once more, China was the worst sector of the quarter, although economic data from December 2023 pointed to a mixed recovery. The services sector showed signs of improvements, while factory activity remained weak.

The IA Commodity/Natural Resources also performed poorly in a year where the sector has delivered negative returns in every quarter except the third.

Kevin Boscher, chief investment officer at Ravenscroft, said: “Commodity prices have been negatively impacted over the past few months by a disappointing Chinese economy, rising interest rates and real yields, slowing growth and a strong Dollar.”