UK investors have had a tough past decade or so as the domestic market has lagged international peers and struggled to keep pace with the rise in technology.

Often viewed as an ‘old economy’ market, full of oil majors, mining giants and banks, domestic stocks fell out of favour during the decade after the financial crisis, when the era of cheap money paved the way for innovative startups.

But things could be on the up. The index approached a new record high earlier this month following a virtually uninterrupted run from mid-December and Mark Barnett, manager of TM Tellworth UK Income & Growth, said this could be an interesting period for UK companies, who have had to deal with myriad headwinds including Brexit, the Covid pandemic and more recently rising inflation.

The current macroeconomic environment is much kinder, with higher inflation and rising interest rates suiting stocks with strong cashflows and dividends.

“The good news for investors is that the UK market offers numerous companies of this type, most of which are trading at low valuations given the constant negative sentiment towards UK equities since the Brexit referendum,” he said.

“This positive backdrop is likely to persist as long as financial conditions continue to normalise, moving away from the abnormal policy settings that have persisted since the financial crisis.”

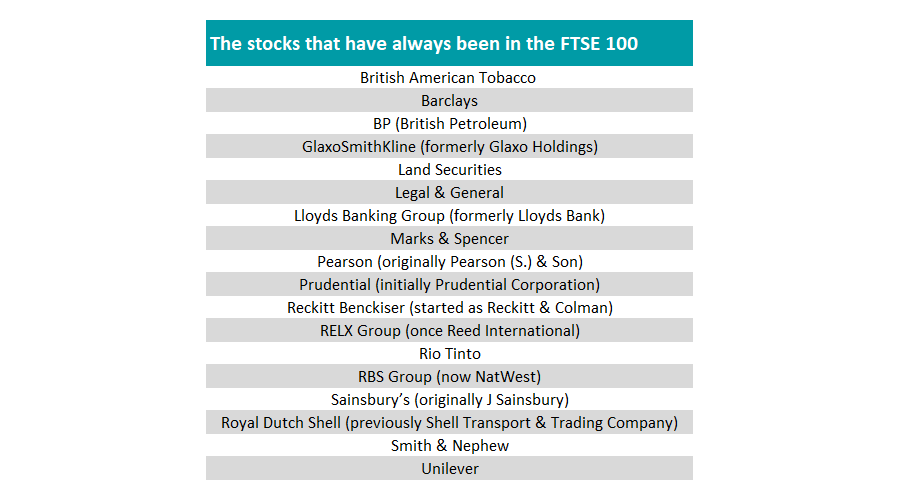

With the FTSE 100 turning 40 years old earlier this month, Barnett highlighted three companies that have always been part of the index, and should continue to do well in the future.

BP

First up is oil giant BP, which is a play related to the manager’s bullish sector stance. After “several years of underinvestment” in traditional fossil fuels, he argued that there could be a “prolonged period of elevated commodity prices”.

“This should in turn provide the energy industry with strong free cash flow that can be used both to return cash to shareholders in the near term and at the same time to build low-carbon businesses that will be well-positioned to dominate the demand for clean energy in the long term,” he said.

Total return of BP shares vs FTSE 100 over 20yrs

Source: FE Analytics

This coincides with a strong balance sheet – the strongest it has been in 20 years, according to Barnett – and upgrades to its credit rating.

“The operational performance remains robust and management have demonstrated a strict adherence to capex discipline which prioritises value over volume. The shares are trading at a sector high 15% free cash flow yield, which is a valuation that indicates BP’s ability to sustain its cash flows into the future is underappreciated,” he said.

Lloyds Banking Group

Another FTSE 100 stalwart worthy of consideration is Lloyds Banking Group, which has had a particularly tough time since the financial crisis as regulators have forced UK banks to hold bask significant cash books in case of an emergency.

“Furthermore, the asset books have been extensively stress-tested, including through the pandemic, and these companies have now reached a position to stop accumulating regulatory capital and start returning money to shareholders,” said Barnett.

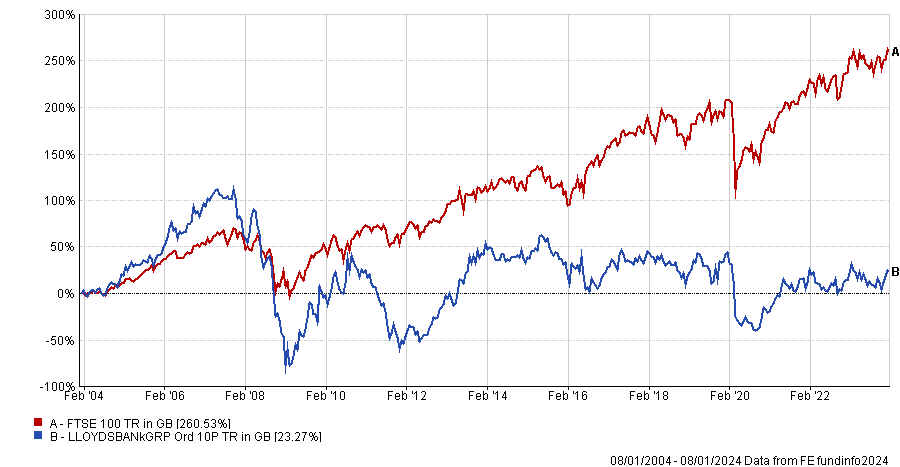

Total return of Lloyds shares vs FTSE 100 over 20yrs

Source: FE Analytics

However, he stressed that valuations are “at odds” with the balance sheet strength and resilience in the outlook for return on equity as the market continues to worry about macroeconomic concerns, which he said are already reflected in the share price.

“In fact, house prices have started to stabilise and unemployment has remained under control. As such the credit cycle priced into current multiples has not materialised,” he noted.

“Given the robust return on tangible equity (ROTE) guidance and dividend commitments, the valuation of 0.8x book value and 6x forecast price-to-earnings (P/E) multiple looks too low.”

RELX

Lastly, RELX (formerly Reed International at the FTSE 100’s inception) is another to consider. The analytics business turns large data sets into actionable decision-making tools to help its customers make better decisions.

“With the amount of global data growing exponentially and showing little sign of slowing, the core driver of demand for RELX’s services shows strong long-term growth,” said Barnett.

The firm is growing faster than it was before Covid as there is more emphasis on technological advancement and the historic drag from declining print revenues has become increasingly small.

“This improving revenue mix has caused an acceleration in the revenue growth rate of the business from 4% in the previous decade to 6% in the last two years with scope to improve further as the legal business starts to contribute equivalent growth rates as Risk and Science divisions,” the TM Tellworth UK Income & Growth manager said.

Total return of RELX shares vs FTSE 100 over 20yrs

Source: FE Analytics

While the valuation “already reflects the quality of this business and the premium awarded to a company that has established a strong track record of consistency”, Barnett said single-digit earnings per share growth should be achievable, while the ongoing share buyback policy suggests a further rerating “is not required to justify holding the shares”.

Source: Tellworth