Markets had a better time in 2023 than they did in 2022, but the past year has been full of surprises nonetheless.

Despite economic and geopolitical turmoil, the much anticipated recession did not materialise, and while it could still happen in 2024, many market participants are now even contemplating the possibility of a soft landing.

Meanwhile, technology has come back to the fore after a dire 2022, with the outperformance of the ‘Magnificent seven’. Below, Trustnet asks fund managers and wealth managers what lessons they have learnt from 2023.

Look beyond market sentiment

The key lesson of 2023 for John Husselbee, head of the Liontrust multi-asset investment team, is to look beyond market sentiment and take a long-term view.

He said: “This year has been a reminder that while knee-jerk reactions to negative market conditions can be tempting, history shows it is so often guaranteed to destroy value because it means selling out of markets at the wrong time.

“The recoveries seen in markets this year show that it would have been a mistake to sell after the significant drawdowns seen in 2022. The longer that investors stay invested, the more opportunities they have to grow their wealth over time.”

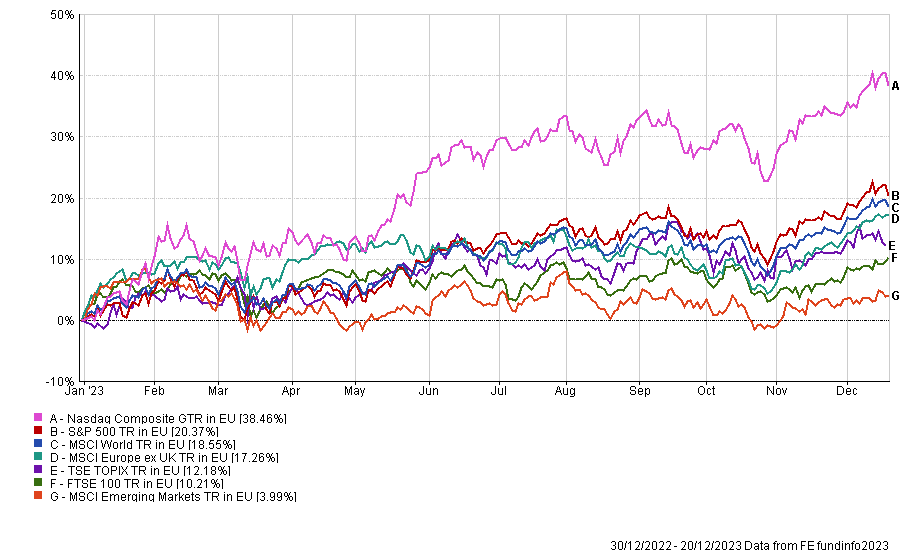

Performance of indices in 2023

Source: FE Analytics

While investors might have been tempted in 2023 by the savings rates offered by banks following an aggressive series of interest rate hikes, Husselbee highlighted that inflation is the worst enemy of savings. Therefore, he called long-term investors aiming to enhance the real returns from their savings to consider equities, as they have historically outperformed cash, bonds and inflation.

He also noted that bonds have begun to show again their merits as a defensive ballast against equity selloffs this year, after tumbling alongside equities in 2022.

Husselbee added: “No-one can predict what will happen in financial markets. However, in the face of economic and geopolitical uncertainty, prudent investors remember that it is a diversified and disciplined approach that has historically delivered real returns.”

Stick to what you know

While predictions of recession at the start of 2023 were widespread, they didn’t materialise during the year. Stuart Gray, co-portfolio manager of Alliance Trust, said: “It’s been a year that reminded us how hard it is predict the macro picture and markets generally.

“Instead of second guessing the speed of global GDP growth, or which country will be up or down, we have stuck to our guns and focused on bottom-up stock picking.

“Our stock pickers give us a range of different ideas that pay off at different times, which makes our portfolio resilient to different market environments.”

As a result, Gray urged investors to keep their portfolio well diversified instead of taking macro calls, whether it is in 2024 or beyond. “Stick to what you know,” he concluded.

Concentrate only on holding the best quality businesses

Unlike Gray, FE fundinfo Alpha Manager Gerrit Smit, manager of the Stonehage Fleming Global Best Ideas Equity fund, believes investors stack their odds in their favour when they concentrate on holding the best quality businesses, as their chance of recovery is “extraordinarily” favourable following a material setback

Smit said: “Last year many high-quality businesses were severely de-rated due to the Fed’s aggressive tightening, but they have bounced back in style. Microsoft collapsed 37% peak-to-trough in 2022, but has now recovered to record highs. Year-to-date it has returned 56%.”

Furthermore, Smit warned that higher interest rates are already taking a toll , which means business with weaker balance sheets and high capital needs could lose market share.

Smit added: “Walt Disney geared itself to buy Fox and now finds it challenging to finance its loss-making digital subscription business while peers are cash generative. Disney has lagged the market this year, returning less than 4% year-to-date.”

Growth is becoming harder to find

Growth investing has come back in favour in 2023 following a kicking in 2022, but market returns have been concentrated in a handful of companies.

While many see an ominous warning, James Thomson, lead manager, Rathbone Global Opportunities Fund, believes it is a reflection of a world where growth is becoming harder to find. As a result, investors are chasing the few companies that provide it.

He said: “I think investment returns will be lower over the coming years and more inconsistent, but that doesn’t mean investors should steer clear.

“There will be different problems to face, yet I’m always impressed with the adaptability and resilience of businesses. Yes, economic growth is slowing, but the pace of change only gets quicker. If you’re waiting for the perfect moment, it will never come. The best returns often come when you least expect it.”

We should be humble about our ability to predict the future for companies

For Simon Skinner, head of the global investment team at Orbis Investments, a lesson to remember from 2023 is to be humble about your ability to predict companies’ future and to be particularly cautious when people are already very optimistic about them.

Such companies include the ‘Magnificent Seven’, which led the market in 2023 thanks to the hype around artificial intelligence. Although Skinner acknowledged they are “excellent businesses with strong prospects”, they are already so well recognised that they might not be that attractive anymore.

He said: “It’s likely that the fundamentals of these businesses will continue to do well for at least the foreseeable future.

“But if those fundamentals turn out to be anything less than fantastic, those companies might not turn out to be the investment proposition a lot of people are hoping. A significant change in sentiment could be quite painful from an investment perspective.”

The unexpected can and often happens in stock markets.

For Job Curtis, portfolio manager of the City of London Investment Trust, a lesson to remember is that the unexpected can (and often does) happen in stock markets.

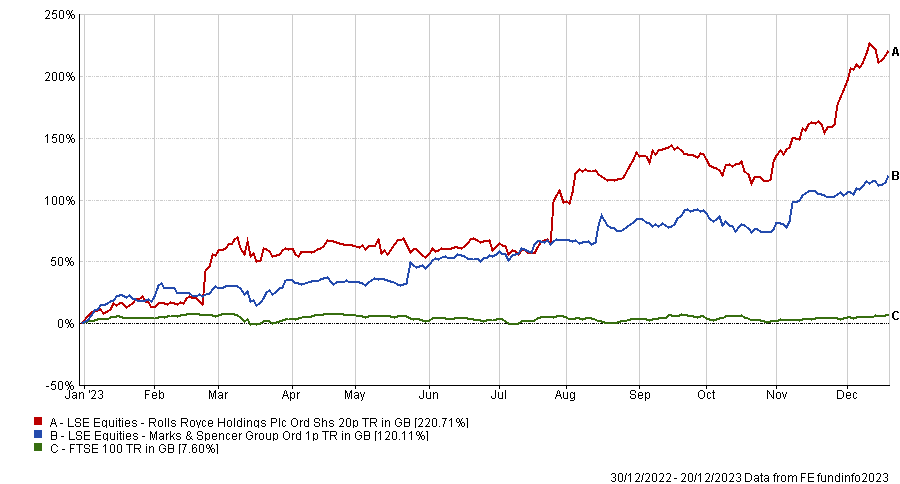

He gave the example of Rolls Royce and Marks & Spencer that have been the best performing UK shares in 2023 after many years of underperformance.

Curtis said: “It goes to show that corporate fortunes do not go in only one direction and that managements can make a difference.

“The economic backdrop also helps and Rolls Royce has benefited from the recovery of the airline sector since the Covid lockdowns. More robust than expected consumer spending has helped Marks & Spencer.”

Performance of stocks vs FTSE 100 in 2023

Source: FE Analytics

Long-term returns are likely to be greatest where your view is most differentiated

While stock markets have been driven by a narrow cohort of companies in 2023, Monks Investment Trust has chosen to look beyond that.

Instead, managers Malcom MacColl and Spencer Adair invested in “attractively valued opportunities” underpinned by structural changes like infrastructure upgrade, the need for increased computing power and the evolution of healthcare.

Jon Henry, investment specialist at Monks Investment Trust, said: “We think it is most likely that value for shareholders over the long term will be driven by progression in these areas, rather than oscillations in inflation and interest rate expectations.

“Patience and an open mind remains key,” he concluded.