Inflation has been the driving force in markets over the past year or so, with rising prices and higher interest rates to combat this causing myriad problems for investors and businesses alike.

Rising prices benefit some areas of the market and significantly hamper others and after a decade of anaemic inflation ultra-low rates investors were somewhat unprepared for the sudden shift in conditions.

Some believe they should get used to it, as inflation is likely to be stickier than expected.

Sven Schubert, senior investment strategist at Vontobel, said that inflation might feel like “gum on your shoe” and that whether it will return to central banks’ targets in the next two years is questionable.

The Bank of England rose interest rates to 4.5% last week, which is the 12th consecutive hike and the highest level for almost 15 years. This hike followed the increase in interest rates in the US and the EU the week before.

While Vontobel said that inflation might be sticky, some economists predicted an inflation drop by next year.

Joseph Hill, senior investment analyst at Hargreaves Lansdown, said: “Despite annual CPI inflation still being in double digits at 10.1% for March, there is good news on the horizon.

“March’s data is a notch lower than in previous months, and the Bank now expects inflation to drop to 5% by the end of this year as energy price escalation eases, falling to the target rate of 2% by the end of 2024.”

However, he noted that central banksa re still some way from being able to “declare victory” over higher prices. As a result, Hargreaves Lansdown gave its three preferred funds to help fight inflation.

It includes Aviva UK Listed Equity Income, with manager Chris Murphy aiming to generate an income return greater than the FTSE All Share index over the long term. To do so, Murphy combines income and growth in his fund.

Hill said: “He blends companies able to offer a high yield now with others he thinks are capable of strong dividend growth in the future.

“Lots of these are large companies, many with global operations. That means their success can depend on the state of the global economy, not just how well the UK does.”

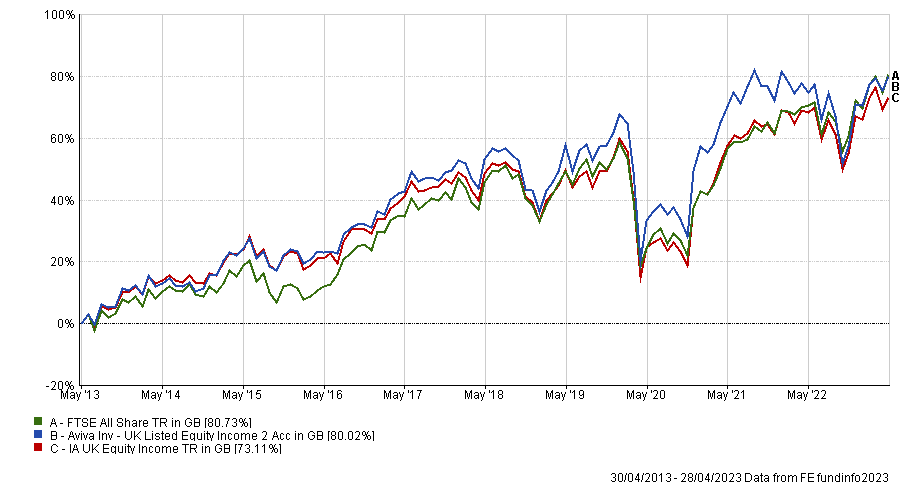

Performance of fund vs benchmark and sector over 10yrs

Source: FE Analytics

Over 10 years, the fund underperformed its benchmark by a small margin but has done better than the sector average. However, it’s been in the first quartile of the IA UK Equity Income sector over six months and has a historical yield of 4.5%.

Also in the IA UK Equity Income sector but with a historical yield of 4.44%, Hargreaves Lansdown’s analysts picked Janus Henderson UK Responsible Income, which aims to provide income alongside capital growth over the long term.

A difference between the two funds is that Janus Henderson UK Responsible Income applies a responsible investment screening, which means it avoids businesses considered to have a significant negative impact on people, the environment and animals.

That includes areas such as tobacco and oil & gas, in spite of the relatively high dividends those stocks provide. It means that the manager, Andrew Jones, has to tap into the wider market to find income.

Performance of fund vs benchmark and sector over 10yrs

Source: FE Analytics

Over 10 years, the fund has outperformed both its benchmark and sector. It has also been a top-quartile fund in the IA UK Equity Income sector over one and five years.

Outside of the UK Equity Income sector, Hargreaves Lansdown chose Legal & General UK 100 Index, which invests in the FTSE 100 more broadly.

Hill said: “While the FTSE 100 is a UK index, many of the companies listed on it also earn money overseas.

“That means investors will be indirectly investing in foreign economies as well as the UK. The fund invests in every company in the index and in the same proportion.”

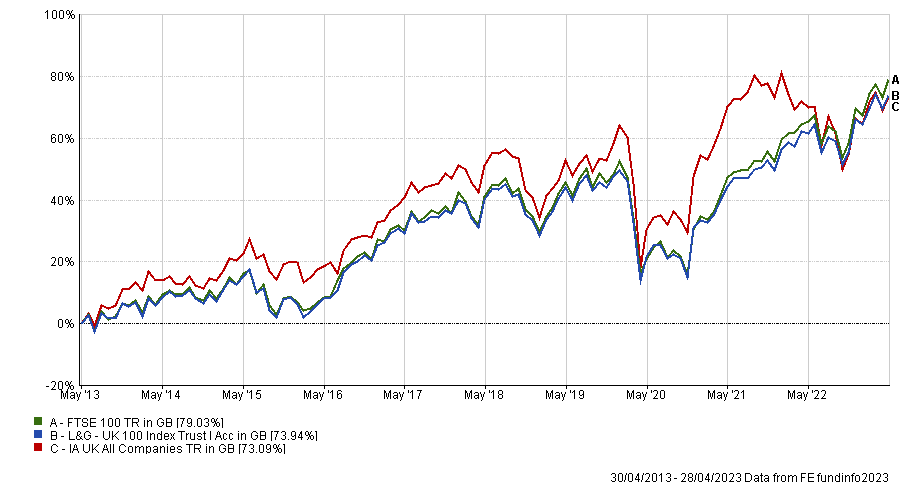

Performance of fund vs benchmark and sector over 10 yrs

Source: FE Analytics

As expected from an index fund, the Legal & General UK 100 Index has a correlation ratio of 0.97 with the FTSE 100, although the fund has underperformed its benchmark by 5%. It has, however, done better than the IA UK All Companies sector average and yielded 3.5% historically.