Bonds have struggled as markets worked through an “aggressive” hiking cycle but some asset allocators expect fixed income assets to regain their earlier allure.

While bonds fell alongside equities last year, they look poised to play their balancing role again as central banks are nearing the end of the hiking cycle.

The US Federal Reserve raised interest rates by 25 basis points to 5% to 5.25% last week to curb inflation and the Bank of England is expected to follow suit on Thursday. But there are signs that inflation has started to peak and many expect a pause in hikes soon.

Mike Riddell, head of macro unconstrained at Allianz Global Investors, said: “We are approaching the end of one of the most aggressive global interest rate hiking cycles in history.

“The BoE was one of the first developed market central banks to hike back in November 2021, but we think that it did not do enough. The BoE therefore needs to tighten policy further and we’ll likely need more than another 25bps hike in this cycle.”

The reason why the fixed-income space is becoming more attractive as a result of the hiking cycle is that bond prices have fallen, leading to higher yields. Therefore, investors are getting rewarded for holding bonds as their income-paying attributes have returned to the fore.

Trustnet asked Darius McDermott, managing director of FundCalibre, to pick his three favourite bond funds in this environment.

For a large exposure to sovereign bonds, McDermott chose Allianz Strategic Bond. It is managed by Riddell who said in October that the economy is already “in a bit of a recession”, which is a favourable environment for government bonds.

McDermott said: “This fund is all about looking at the bigger picture. Riddell is not afraid to radically alter the positioning quickly – as he did going into - and during - the coronavirus crisis, delivering spectacular results.

“The fund has low correlation with equities and therefore is one of the few strategic bond funds to offer genuine diversification. It has 91.7% in treasuries today, with US, Swedish and German government bonds in top 10.”

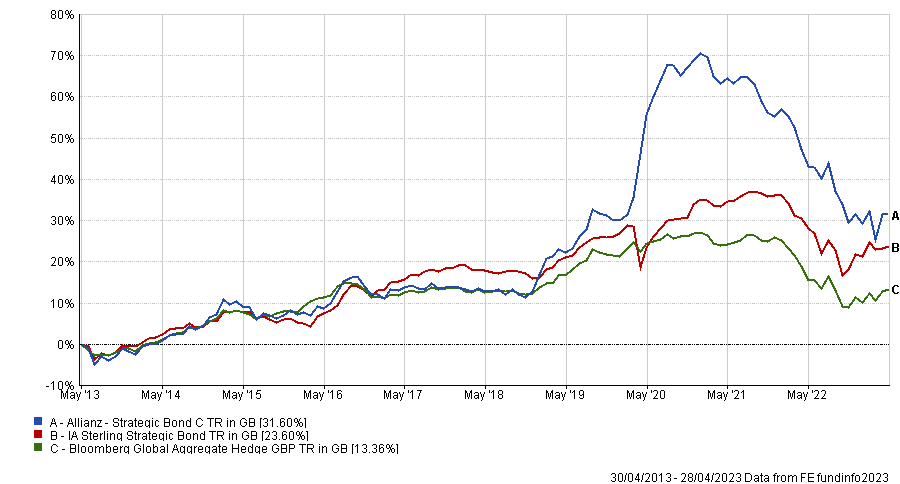

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Allianz Strategic Bond has outperformed both its sector and benchmark over five and 10 years but is in the bottom quartile over one and three years as rates were hiked. It’s returned to form more recently and is currently the highest returning strategic bond fund over three months.

M&G Global Macro Bond is another fund with a sizeable exposure to government bonds but still keeps corporate bonds in the mix.

Manager Jim Leaviss said last month that more than half of today’s inflation is due to supply chain disruption, which is out of central banks’ control. Therefore, he does not exclude a stagflation scenario and has positioned the fund defensively. It has its largest allocation in government bonds, with 55.8% of the fund’s investments allocated into this asset class.

McDermott said: “Leaviss has a vast array of tools at his disposal for this fund and uses them all to great effect.

“From his own ability to read the macroeconomic environment, to his team’s stock-picking skills and full flexibility of the fund in terms of bonds, currencies and the use of derivatives, it is a formidable mix.”

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

M&G Global Macro Bond is in the IA Global Mixed Bond sector’s first quartile over five and 10 years but relative returns are more patchy in the more volatile recent state of the bond market.

For a flexible “go-anywhere” approach, McDermott chose Jupiter Strategic Bond which aims to achieve a high income with the prospect of capital growth.

The fund invests globally in high yield, investment grade, government and convertible bonds, but also in preference shares.

McDermott said: “The aim is to achieve a moderate income, but with the prospect for growth, although in practice the manager is prepared to sacrifice yield in order to preserve capital.

“The manager, Ariel Bezalel, is quite cautious in his approach and emphasises limiting potential losses in tough markets.”

Performance of fund vs sector over 10yrs

Source: FE Analytics

Like the other funds highlighted, Jupiter Strategic Bond has a strong long-term track record but has underperformed in the past year or so as the fixed income market was thrown into turmoil. It has returned to the top quartile over three and six months, however.