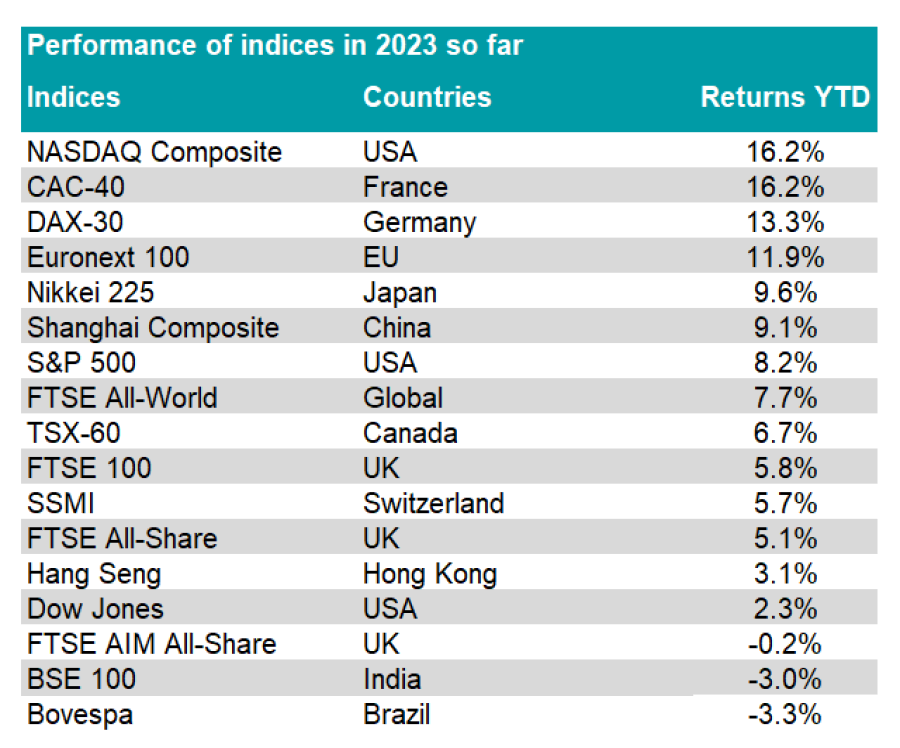

The French market has had a phenomenal start to the year, trouncing all other developed and most emerging markets in 2023 so far.

Taking the CAC 40, a benchmark index gathering the 40 largest French businesses by market capitalisation, across most of the major markets in the world it has made the highest returns, up 16.2%, as the below table shows.

It has topped the likes of the DAX-30, Euronext 100 (an index of broader European equities) and Nikkei 225.

Pierre Veyret, technical analyst at ActivTrades, said that energy, utilities, real estate and luxury shares have mostly propelled the CAC 40’s performance.

Performance of major indices worldwide

Source: Refinitiv

Trustnet has searched for the best ways to capture the performance of the French market. To do so, we have looked for funds recognised by the Investment Association (IA) with an allocation to France of at least 40% and only investing in equities.

There are three exchange-traded funds (ETFs) available in the IA universe specifically tracking the CAC 40 benchmark: Xtrackers CAC 40 UCITS ETF, Amundi CAC 40 ESG UCITS ETF, Lyxor CAC 40 (DR) UCITS ETF.

These three ETFs have been able to almost perfectly reflect the performance of the CAC 40 index over 10 years, with a correlation ratio of at least 0.99.

The three portfolios all hold LVMH Moet Henessy Louis Vuitton (LVMH) as top holding and Sanofi among their three main holdings. Xtrackers CAC 40 UCITS ETF and Lyxor CAC 40 (DR) UCITS ETF both hold TotalEnergies as second largest stock in their portfolios, while Amundi CAC 40 ESG UCITS ETF’s third largest holding is L’Oreal.

iShares also has an ETF targeting the French equity market, but the fund tracks the MSCI France index rather than the CAC 40. One of the differences is that the MSCI France index has 63 constituents instead of 40.

iShares MSCI France UCITS ETF was launched in September 2014 and has had a perfect correlation with the MSCI France index over eight years. Its top three holdings are LVMH, TotalEnergies and Sanofi.

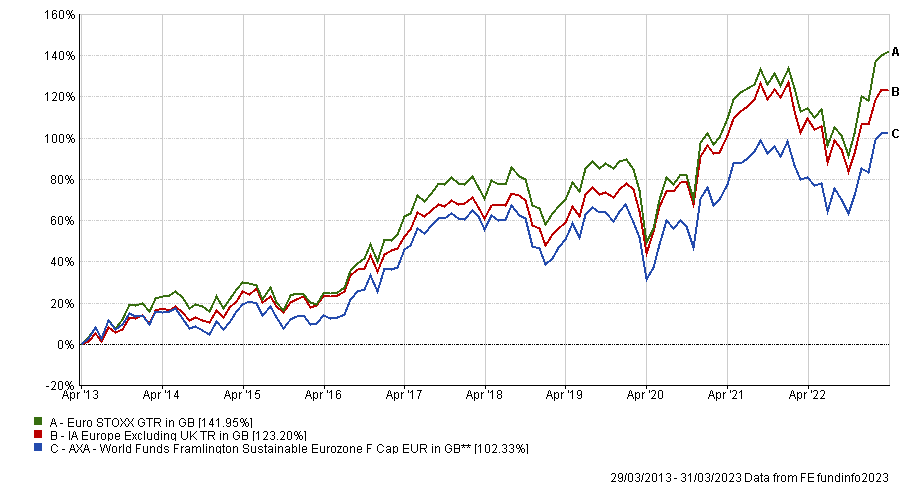

The active fund with the largest exposure to the French equity market is AXA World Funds Framlington Sustainable Eurozone, with a 48.5% allocation to the country, although the fund invests across the Eurozone. Its top three French holdings are LVMH, Schneider Electric and BNP Paribas.

It has underperformed both the IA Europe excluding UK sector and the Euro STOXX index over 10 years, but is among the top quartile of its sector in 2023 so far, up 13.2%.

Performance of funds vs sector and benchmark over 10yrs

Source: FE Analytics

AB Eurozone Equity Portfolio is another active fund with a significant exposure to the French equity market in the IA Europe excluding UK sector, with a 40.1% allocation to the country. The three largest French stocks in the portfolio are Sanofi, TotalEnergies and Pernod Ricard.

The fund has outperformed both its sector as well as the MSCI EMU benchmark over 10 years, although returns this year are slightly below the Axa fund above at 11.6%, placing it in the second quartile of the sector.

Performance of funds vs sector and benchmark over 10yrs

Source: FE Analytics

There are further European ETFs with a sizeable allocation to the French equity market, including iShares - EURO Total Market Growth Large UCITS ETF, Amundi - EURO STOXX 50 UCITS ETF, iShares VII plc - Core EURO STOXX 50 UCITS ETF and iShares Core EURO STOXX 50 UCITS ETF.

These all have a perfect correlation with the Euro STOXX 50 benchmark, except the iShares EURO Total Market Growth Large UCITS ETF which slightly deviated, with a correlation ratio of 0.91.

Amundi - Index MSCI EMU ESG Leaders Select is another passive fund tracking the performance of the MSCI EMU, but also an allocation of 40.8% to France. Its three largest French holdings are LVMH, TotalEnergies and L’Oreal.