Fixed income has been through a purple patch since the end of the great financial crisis but in 2022 the asset class couldn’t offer the diversification from equities that investors have relied upon.

Now, tables seem to have turned, as Colin Finlayson and FE fundinfo Alpha Manager Alexander Pelteshki, co-managers of the Aegon Strategic Bond fund, believe that it has become expensive to not hold the asset class.

The £421m fund has achieved an FE fundinfo Crown rating of four and, according to Square Mile researchers, has benefited from the style of the two managers, who took over in 2018.

“During this relatively short period, while maintaining the long-standing investment process, they have been more active and taken a higher level of conviction when expressing their views than previous managers, they said. “This so far has been rewarded with stronger performance.”

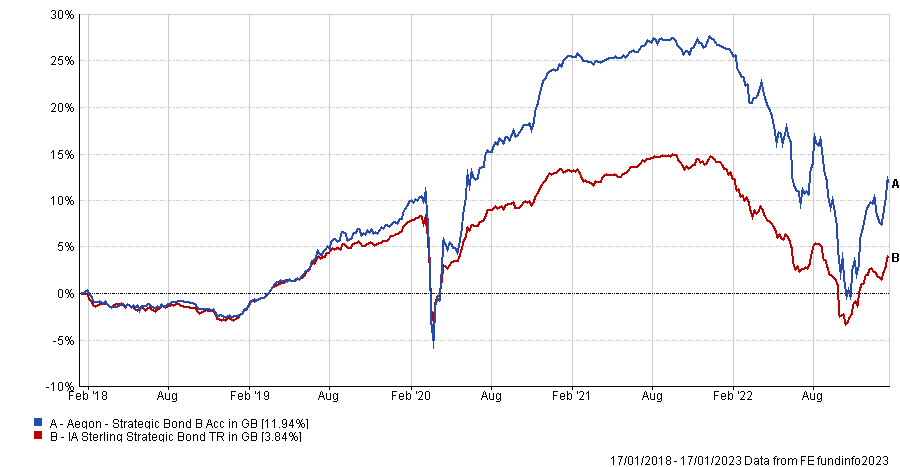

Performance of fund over 5yrs against sector

Source: FE Analytics

Below, the managers discuss why fixed income is offering a once-in-a-decade opportunity, where they are allocating and their views on inflation for 2023.

What is your investment process?

Finlayson: We follow an active approach which is based around a series of high-conviction positions and benefits from multiple alpha sources within the fixed-income universe to generate returns.

Our approach is quite simple because we only focus on fixed-income-based risks and returns. We don't invest in any other asset classes and don't take any foreign currency risk in our portfolio.

So what we offer investors is “a clean slice” of fixed-income, but with a lot of flexibility, as we look to invest in the best opportunities across the full fixed-income universe by using an active and dynamic approach to generate alpha.

Dynamism for us means being able to move between government bonds, investment grade, high yield and emerging markets and to add and remove risk as we believe appropriate at any given time.

Where are you finding opportunities at the moment?

Pelteshki: We find ourselves in a uniquely attractive fixed-income environment – one that we haven't seen for more than a decade. We’ve come through a horrible period but the yields are now such that the question is not whether you should be buying fixed income – you now need to justify why you’re not holding it. It’s now becoming expensive not to be in fixed income as an asset class.

For the first time in at least five years, we're increasing our allocation in emerging markets fixed income, which is due to the positive combination of falling interest rate expectations, China's reopening and the current commodity prices, all of which make up an interesting cocktail.

We also continue to find good risk-adjusted returns in developed market, investment-grade credit and in particular in high yield.

European credit markets are particularly attractive, as we believe that future updates on the energy front and the recession front could surprise positively. European credit markets are much cheaper and better placed for any spread recovery versus US credit. They have also outperformed in the past eight weeks already.

Within the individual sectors, we are very much in favour of financials, which is now strong after years of repair and deleveraging.

What were your best and worst calls over the past 12 months?

Finlayson: Having seen inflation peak in the US last summer, we decided to start adding interest-rate and duration risk back into the portfolio, as yields had backed up enough in the government bond space and that additional interest rate risk was attractive looking longer term.

In hindsight, we were six weeks too early on that position, given what followed and Kwasi Kwarteng’s mini-Budget. From then until now we've seen quite a meaningful fall in government bond yields.

Pelteshki: The best call was probably to quickly exit our positions in a German real estate company called Adler, which had started to look less positive and is now in the headlines for possible litigations. Its bonds are now trading below 50 cents on the euro.

This is an example of the dynamism that we mentioned before and that helped us navigate through 2022’s volatility and inflation.

Where do you see inflation going forward?

Finlayson: It's very likely that the average level of inflation from the next five years will be higher than it was in the previous five years. The ultra-low inflation world we were in pre-pandemic is behind us, but this doesn’t mean we’ll have overly elevated prices for the foreseeable future – they will probably settle somewhere above the average where they’ve been more recently instead.

We think inflation could also fall faster than the market is currently expecting and come down to much more manageable levels, which will allow all the major central banks to end their tightening cycles.

For the UK and the US, this is most likely to happen in the first six months of this year, where we think we are very much at the beginning of the end of that hiking cycle. In Europe, we’re a bit more uncertain as to the whether the European Central Bank will continue to hike rates after the middle of the year.

In the second half of the year, it will be very difficult for the Fed to keep rates at the elevated level it hopes for, which is somewhere between 5% and 5.25%, so it will ultimately have to pivot or adjust the current view to one where it is either open to cutting rates or actually doing so.

In the UK, there’s growing chances that the Bank of England won't raise rates as high as the market is currently expecting and a very good chance that it could be the first central bank that ends up cutting rates in the next billing cycle.

What do you do outside of fund management?

Finlayson: I’m an avid supporter of the Glasgow Warriors and the national Scottish rugby team, which I’ve seen play in Ireland, Wales, France, Italy and wherever it might be that they’re playing.

Pelteshki: I like both watching and participating in winter sports.