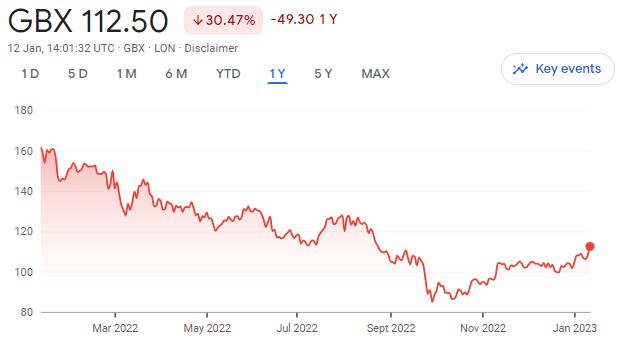

BNY Mellon Global Income has been one of the top performing funds in the IA Global Equity Income sector for the past decade, delivering top-quartile returns over the past one, three, five and 10 years.

It has managed to weather various market downturns in that time and come out on top, with returns up 197.2% over the past decade – 59.8 percentage points ahead of its peer group.

Here, manager Jon Bell tells Trustnet why he holds tobacco stocks despite the firm’s environmental, social and governance (ESG) framework and why one of his top holdings may become obsolete.

Total return of fund vs sector over the past decade

Source: FE Analytics

What is your investment process?

The goal is to generate income but not at the expense of capital. We're not striving for the highest level of income, we’re looking to provide a sustainable and ideally growing income stream.

Ultimately, we want to deliver superior returns to global equity markets with lower volatility.

What sets you apart from your peers?

We can only buy companies if they yield 25% more than the global index and if the yield falls below the level of the index, then we become forced sellers of that stock.

By definition, it means our portfolio will always yield more than the market so we will always be compounding a higher level of income than the market.

It also means we can't barbell the portfolio, so we can't create a premium level of income by blending some high dividend yields with some low dividend yields, which can be very risky.

There were some periods such as 2020, when we would have been better off in relative performance terms by owning some lower-yielding growth, but we didn't change our discipline and were rewarded for that last year as growth stocks came under significant pressure.

Where are you seeing unsustainable dividends?

Energy is a high-yielding sector and saw some dividend cuts during the pandemic, obviously with companies like Shell reducing their dividend.

It’s a sector which is offering some pretty high dividend yields currently, but on a longer-term view, may not be sustainable given the energy transition.

Wouldn’t you say those companies have a key role to play in the transition?

I agree with that – we do own energy stocks and one of the best performing stocks in the portfolio last year was Marathon Petroleum, which was up nearly 90% and made a significant positive contribution to performance of around 1.25 percentage points.

Marathon is a bit different because it's a refining and pipeline business. Refining is a pretty cyclical industry so you wouldn't necessarily want to own that in a fund that's looking for a reliable dividend stream but being underpinned by the pipeline business gave us the confidence to own it.

Share price of Marathon Petroleum

Source: Google Finance

Do you use ESG principles in your fund?

We incorporate ESG characteristics into our stock analysis, but it is not about making a moral judgement – it is about understanding the risk and reward for a particular security.

People used to see ESG as a non-financial risk, but it clearly does have a financial impact on companies with poor governance because that is likely to lead to lower returns.

How does your top holding in British American Tobacco fit in with that?

Quite obviously, the tobacco sector has social risks, but British American Tobacco has been able to grow its dividend. For better or for worse, it has great pricing power.

We had 15% in tobacco 10 years ago but we’ve taken that down to 5% last year and now less because the potential upside for a tobacco company is now greatly reduced due to the rise of sustainable investing.

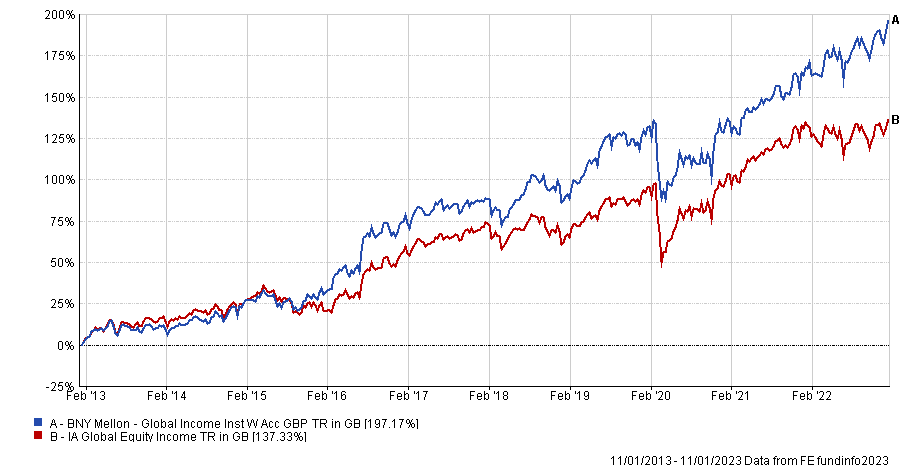

Share price of British American Tobacco over the past year

Source: Google Finance

With the shrinking upside potential, can you see yourself owning that much longer?

We've taken about 50% out of the holding over the past three months so I think that tells you something about how we see the current valuation.

There is still a significant runway for this company to generate cash and generate dividends, but whether we own it for the long term or not will depend on how the share price performs.

Tobacco was the best performing sector for a long period of time, but do I think it will be for the next 10 years? No.

What was your best performing stock last year?

The biggest contributor – BAE Systems – added 1.3 percentage points and was up around 60%. We have a large position so it made a big contribution, but the best performing stock was Marathon Petroleum.

The largest contribution to the overall dividend payment last year would have come from British American Tobacco.

Share price of BAE Systems over the past year

Source: Google Finance

What was your worst performer?

The worst was the UK housebuilder, Taylor Wimpey, which was down 35% and made a negative contribution of about 4.5%.

Our consumer discretionary exposure has tended to be focused on areas that haven't really recovered post pandemic. Autos and housing are areas where the valuations didn't recover and we felt that would somewhat protect us against a slowing economic environment, but it didn't actually protect us that much.

Trading at a discount to a build out value to its land bank, we do still see Taylor Wimpey as a pretty attractive stock, so we've maintained the position and added to a little bit on weakness.

Share price of Taylor Wimpey over the past year

Source: Google Finance

What do you do outside of fund management?

Driving my children around to their various sporting commitments. I’m definitely more of an armchair sportsman, whether it's watching my sons play or watching sports on the telly.