Assets in the technology and industrials sectors have typically been overlooked by income investors due to their low yields, but they may become a more prevalent allocation in equity income portfolios, according to Richard Saldanha, manager of the Aviva Global Equity Income fund.

Yields in these sectors are still relatively low, but Saldanha said that their dividends are growing at an appealing rate.

If the global economy enters a recession, these types of companies have a better chance of growing their dividends than traditional income sectors which could be forced to cut dividends, he added.

Saldanha’s fund was a top-quartile performer in the IA Global Equity Income fund over the past three, five and 10 years, with returns climbing 62.9 percentage points ahead of its peers over the decade at 207.8%.

Here, he tells Trustnet why his contrarian approach has helped the fund to outperform over the long-term.

Total return of fund vs sector over the past 10 years

Source: FE Analytics

What is your investment strategy?

We're really trying to look for cash-compounding companies that have grown their dividends historically over multiple cycles.

We’re also trying to protect on the downside, so we also focus on mature businesses that are quite defensive and pay attractive yields. The final thing we look for is upside, and that brings us outside of traditional income sectors.

What kinds of unusual sectors?

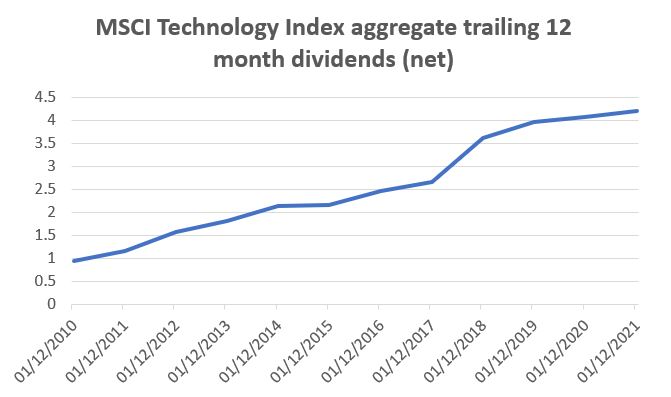

There's been a real change in terms of the opportunity set for income investors over the past couple of decades. We're finding a lot more companies that are paying dividends in growth-orientated sectors.

Two in particular where we’ve seen the biggest change have been tech and industrials. We own a whole spectrum of companies within those sectors that have quite resilient business models and had some quite attractive dividend growth.

We've been seeing real opportunity there the past two-to-four years so that’s where we’ve pivoted the fund.

Source: Aviva Investors

Why do you avoid traditional income sectors?

During Covid we saw dividend cuts across a range of sectors but our companies held up quite well – about 95% of the companies in the portfolio either maintained or increased their dividend during that period.

I think the reason for that is because we don't have a lot of exposure to some of those traditional income sectors like commodities. We don't own any banks in the fund right now either.

We avoid those quite cyclical companies with low returns on capital because we’ve seen in the past that they’ve had to cut their dividends during downturns.

Technology companies and industrials on the other hand, have been able to maintain their dividends during some of these periods.

Do you have to sacrifice some of the yield by holding those companies?

Those mature businesses you see in income portfolios tend to be high yielding, which is great, but they don’t offer you much capital growth.

On the other side, you’ve got businesses with exceptional levels of cash flow and income growth, but the starting yields tend to be a bit lower.

The key for me is striking the right balance between delivering an attractive yield and more importantly, that we’re growing that yield.

What sets you apart from your peers?

I think that our focus on upside is quite an important element because, historically, income funds have done a good job of protecting capital, and we've seen that this year, but they haven't necessarily done a good job of keeping pace with the market, particularly during periods of growth.

I think income investors really need to look at sectors like tech and industrials because you can get some pretty attractive opportunities. We've been focused there from a portfolio standpoint and I think that's what's helped deliver our capital and income growth.

What was your best performer this year?

The holding that delivered the best performance this year is actually an industrial company called Booz Allen Hamilton. It’s a US-listed stock that does very specialised work in things like defence, intelligence and civil services.

This business sits in industrials but is very defensive, generates a lot of cash flow and has grown their its dividend by 20% per annum over the past five years.

The stock is up 30% year-to-date and it’s contributed around 1.5 percentage points to the fund’s performance. It's one of the biggest holdings of the portfolio right now at almost 3.5% of the fund, and even though it's outperformed, we still think the valuation is attractive.

Share price of Booz Allen Hamilton in 2022

Source: Google Finance

What was your biggest detractor from performance?

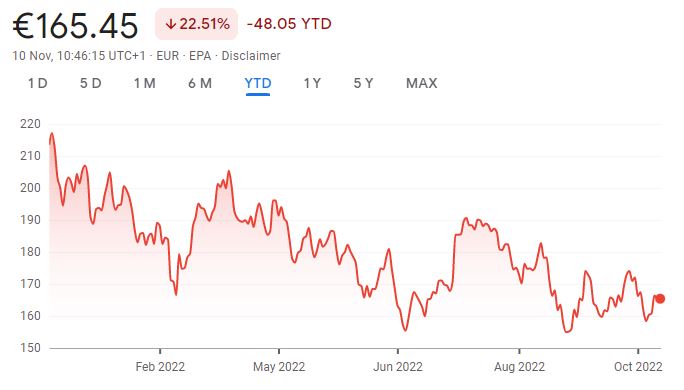

One of the worst performers this year has been a technology company we own in the portfolio called Capgemini. The tech sector has come under pressure this year, but fundamentally, we think this business is doing just fine.

It is not seeing any real slowdown in terms of end demand, but the one area where it is facing pressure is wage cost.

This stock detracted about 50 basis points from the portfolio’s performance but we continue to like the company and we still feel comfortable owning it even though it has it has been a significant detractor.

Share price of Capgemini in 2022

Source: Google Finance

What do you like to do outside of stock picking?

I’m a massive sports fan – either watching or playing – so I love football and cricket. I recently took up golf, but I’ve got a young son so I’m finding less time to go out on the golf course.