The upcoming recession could be far longer and more severe than investors are anticipating, but pockets of the market will flourish despite the harsh conditions.

This is the view of Gervais Williams, manager of the Premier Miton UK Multi Cap Income fund, who believes smaller companies with no debt and cash to buy up competitors will thrive in the coming years.

So far, 2022 has been a poor one for investors, with much-loved growth stocks such as the US tech giants coming under severe pressure from rising inflation and interest rates.

“In contrast to other times when we have had wobbles in the market and the central banks have added more fuel to the fire, this time they have an objective to bring demand into balance with supply i.e. compress demand,” said Williams.

“Rather than companies getting more sales due to the stimulus, they are getting the opposite: constraint. It hasn’t happened a lot yet but it will lead to falling sales, which means less profit and companies will get desperate and cut prices to keep sales, which can lead to a marked decline.”

This, combined with rising overheads due to the increasing cost of raw materials, means that some companies with a lot of debt will struggle to remain solvent.

However, unlike in 2008 and 2020, when the effects were short-lived and investors enjoyed a sharp rebound, Williams argued that this is not the case this time around.

As a result, “we are looking at a profound sea change in investment trends coming through which is decades long”.

One area that should do well is income stocks and in particular those in the UK, which have been unloved for some time but is holding up reasonably well this year.

“The whole point about the UK, and particularly equity income stocks, is that they are not trying to be unicorns. They are a bit boring but the best part of that is they generate excess cash, so when everyone is running out of money, at that stage they become king,” he said.

“If things do get as bad as I fear and we get a lot of companies going insolvent and governments run out of money, then what you will find is there will be a lot of companies to acquire.”

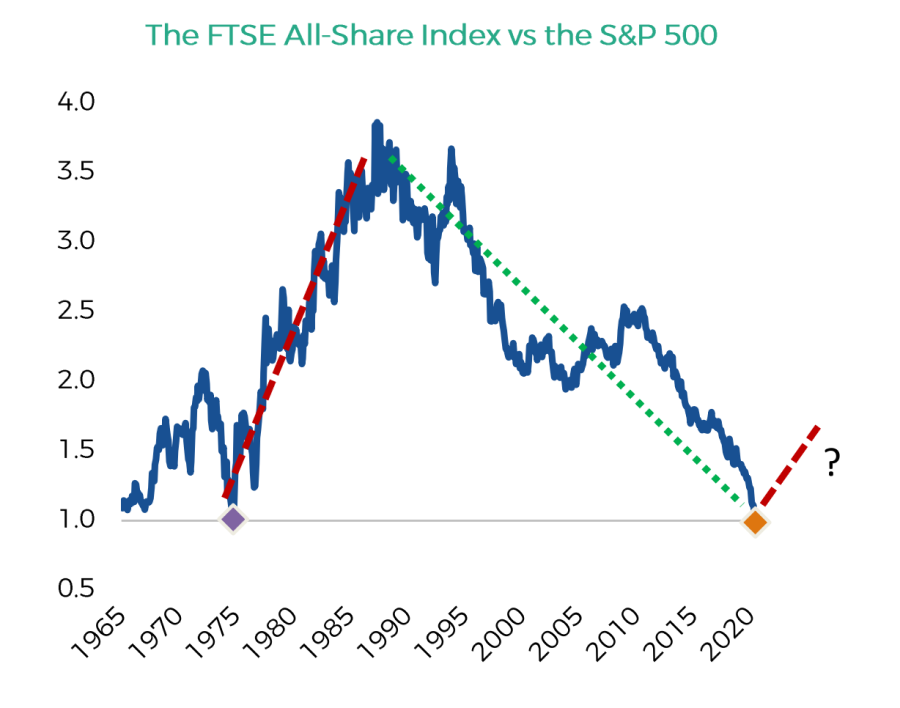

This was the case in the 1960s and 1970s when globalisation was yet to be a factor and inflation was higher (as it is today).

The below chart shows this. UK companies far outpaced their US rivals during this time, but have come back over the past 30 years.

Source: Premier Miton

“Back in the 1970s, the UK economy was pretty rubbish, we had some dodgy politics and uncertainty, but the stock market was one of the best performing in the world. It beat the S&P 500 for 20 years. So it is not just an accident that the UK market has outperformed this year: it is the start of a new trend,” said Williams.

There could be a double benefit from smaller companies, which have suffered so far this year but typically perform well over the long term in all market conditions.

In 2022, the dollar has been strong while the pound has been weak, which has benefited companies in the FTSE 100, which derive around half of their earnings from overseas.

“But if you take my idea that we are at the end of globalisation, we will have recessions, interest rate rises and tax rises which means consumers will be unemployed and struggling. World growth will be nothing like it has been for the past 30 years and the returns on big companies is aligned to global growth,” he said.

“The advantage to small caps is that many can grow when the world is not. At the moment people are terrified, but the opportunities are huge. You can drive a coach and horses through the valuation differences between some of the mainstream companies and the small caps.”

One company that he thinks will do well in the new market environment is XPS, an actuary business that helps pension funds address various issues such as matching liabilities.

“It is a brilliant business. It looks after its customers beautifully and has incredibly high levels of service, which is required if you want to hold onto your customers at high margins,” said Williams.

“It has now started to achieve breakthrough and was appointed to the BT pension scheme a couple of years ago, which turned a lot of heads because that is a big scheme that could have gone to any of the major players.”

The company is on a price-to-earnings (P/E) ratio of 12x for the year to the end of March 2023 (projected earnings for this financial year) and pays a dividend yield of around 5.1% historic and 5.7% prospective.

Another firm he is backing is Mears Group, which he has added to Premier Miton UK Multi Cap Income relatively recently. The firm provides the maintenance to people in social housing, working with housing associations on large contracts.

“It is excellent at that. Customer service is outstanding. Workers have continued to go to people’s homes even through Covid with masks on because you can’t leave people with issues,” he said.

One area that has been a bit tricky is its housing development programme. The firm buys properties and renovates them before selling to housing associations.

“Mears Group does that but during the pandemic it wasn’t doing a lot,” Williams noted, although this has picked up this year.

While the firm does have some debt, this is related to the buildings that it buys for housing associations, which have an agreement to buy the properties off the firm.

The final quiver to its bow is its contract to look after immigrants when they arrive into the country. Mears is the firm that runs the administration on hotels, which have been used for Afghan refugees in the interim before they can find social housing.

“This pattern has lasted longer than expected. Social housing was expected quite quickly but it has not been the case,” said Williams.

“It is generating cash, doing well in terms of earnings but again is on a ridiculous P/E valuation of 9.4x.”