The Chinese market is likely to rebound from its recent correction in the second half of this year – but Jason Pidcock has warned investors in his Jupiter Asian Income fund that they won’t benefit from this recovery.

Pidcock has been underweight China ever since he launched his fund in March 2016, saying: “I prefer to invest in countries that are ideally democracies, but importantly where there's an independent judiciary.”

He reduced his position even further in the third quarter of last year, selling out of insurer Ping An and tech giant Tencent following the government’s heavy-handed intervention into numerous sectors.

China now accounts for just 1.5% of the manager’s portfolio, even though it makes up 27.2% of his FTSE AW Asia Pacific ex-Japan benchmark.

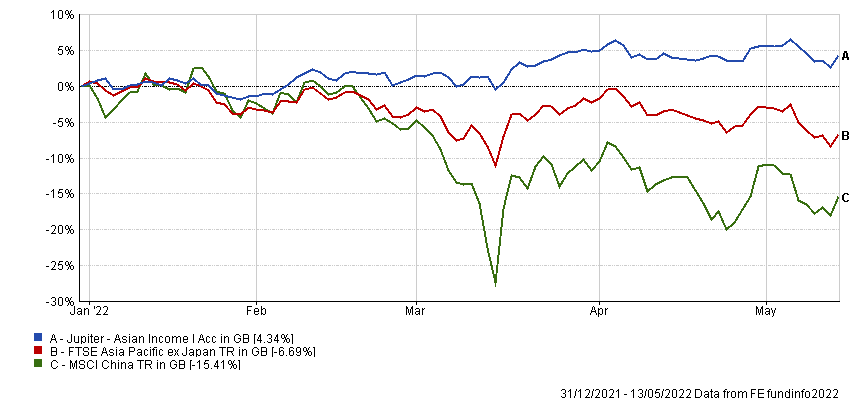

This position has protected Pidcock this year and helped turn around a period of underperformance. The MSCI China index is down 15.4% in 2022 so far, compared with losses of 6.7% from Jupiter Asian Income's FTSE AW Asia Pacific ex-Japan benchmark. The fund is up 4.3%.

Performance of fund vs indices in 2022

Source: FE Analytics

However, Pidcock warned that his aversion to China will not always be a tailwind.

“When the Covid lockdowns relax, there will be a recovery in the Chinese economy,” he said. “The government can't keep things as they are because the country is simply not growing at the moment.

“At some point in the second half of this year, there will be a bounce in the stock market. It could be from even lower levels, or it could start tomorrow. But the way I'm thinking is that I have a lot of indirect exposure through companies in Korea, Taiwan, Singapore and Australia that are selling into China, so if and when there's an economic rebound, my exposure will come that way.”

Pidcock described himself as a top-down stockpicker, saying he considered geopolitics, national politics, economics, interest rates and bond yields in each country in his universe before deciding whether to buy any companies listed there.

The manager said geopolitics is currently the most important of these factors, adding that tensions between the West and both Russia and China will probably get worse before they get better.

Yet despite the falls in these countries’ markets, he warned this threat is being largely overlooked by investors.

“On 24 February this year, the world changed in a massive way,” he continued. “It is now very different from the past 20 years: investment strategies that worked over that time won't necessarily work in future and I think people have to adjust.”

While the war in Ukraine has slowly begun to disappear from the front pages, Pidcock said its impact could be just as significant and long lasting as that of the fall of the Berlin Wall in 1989.

This marked the beginning of the end of the Cold War and communism in Europe and accelerated globalisation, which exerted a huge disinflationary force on markets over the next 30 years. Yet Pidcock said this ‘peace dividend’ will now be reversed.

“The strategic supply of commodities won't be taken for granted as it has been for a long time now and stagflation will become more common,” he added.

“Sector and country asset allocation are going to be very important for all investors. I know this is going to sound patronising, but I don’t think a lot of people under the age of 35 who are managing money have got their head around the fact that we're in a different world.

“For some people, 20 years is an eternity. They might look at it and think, ‘that's what works’. Well, it might have worked for that period, but it won't necessarily work going forward.”

Another likely side effect of Russia’s invasion of Ukraine will be a long-term increase in defence spending.

Pidcock was positive on this sector before the war, pointing out it has the highest barriers to entry of any industry as it is also the most heavily regulated. This means that when governments increase defence budgets, existing companies capture all the extra spending.

Exposure to this industry has been another tailwind for the fund’s recent performance, as has Pidcock’s willingness to invest in oil & gas and his aversion to fashionable ESG-labelled stocks, which had been bid up to excessive valuations before the start of the year.

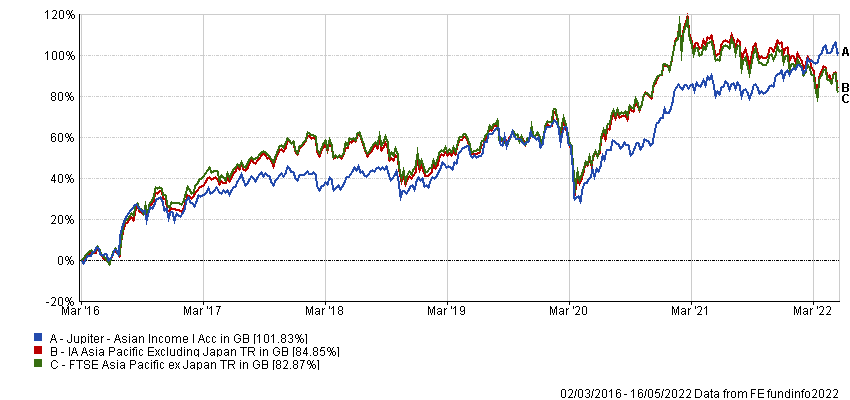

Data from FE Analytics shows the £1bn Jupiter Asian Income fund has now made 101.8% since launch in March 2016, compared with gains of 84.9% from its IA Asia Pacific ex Japan sector and 82.9% from its benchmark.

Performance of fund vs sector and index since launch

Source: FE Analytics

This doesn’t mean Pidcock ignores ESG issues, though, and he factors the likely impact of climate change and sea-level rises into his investment process.

“The increase in CO2 levels is really in the bag and there's nothing we can do about it,” he explained.

“Something can be inevitable, but there may not be any sign of it whatsoever for five or 10 years, then it happens all at once. That is what a tipping point is.

“I'm not somebody that believes I can change the world by the makeup of my portfolio. But I don't want to be picking up pennies in front of the steamroller if I think that something is likely to happen in the next decade.”

Jupiter Asian Income is yielding 3.7%.