When investing, most fund managers aim to beat the market more than half of the time. Do this, and the returns should look after themselves.

For everyday investors, picking funds that go up more than they fall is a good rule of thumb. This consistency will help cautious investors avoid sleepless nights as they have more months in the black than the red. This can also reduce the risk of panic selling if a fund spends too long in freefall.

High-risk investors can also take heart that their picks are rising more often than not (and usually at a faster rate), as it means they are being rewarded for the risk.

In the first of a new series, Trustnet looks at the Investment Association (IA) sectors that have made gains in the most months over the past decade.

We also looked at the 10-year total return as well as the maximum drawdown, to reveal the best and worst overall options for low- and high-risk investors.

Equities

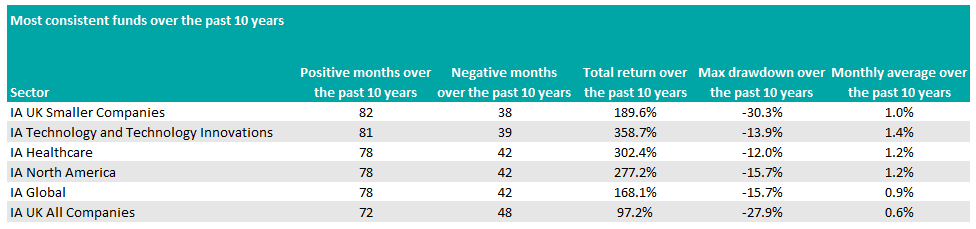

For those looking for a combination of high returns and consistency, the IA Technology and Technology Innovation sector was a good option over the past decade.

It delivered the best returns out of any other sector at 358.7% over 10 years, or 1.4% per month.

Big tech stocks have grown exponentially over the past decade, but inflationary concerns have led many of them to decline recently with the sector down 18% since the start of the year.

This same trade benefited funds in the US, where the likes of Microsoft and Apple have rallied over the past decade. This helps to explain the performance of the IA North America sector, which returned 277.2% over the period.

Source: FE Analytics

Funds in the sector were up in 78 of 120 months, but when the sector dropped it had a maximum drawdown of 15.7%, an above average fall in this study, suggesting the negative months were painful for investors.

US stocks also make up a large number of positions in the IA Global sector, with 68.5% of the MSCI World index held in US companies.

It had a similar return profile therefore to the US sector, with the average global fund in the red for 78 of the past 120 months. Overall the sector returned 168.1% over the decade with a maximum drawdown of 15.7% – identical to that of the IA North America sector.

The IA Healthcare sector also benefited from the same industry innovation witnessed in technology companies, leading to positive returns in 78 of 120 months.

Advancements in the sector were further fuelled by the pandemic, which added to the necessity for improved healthcare and resulted in a total return of 302.4% in the past 10 years.

A perhaps surprising entrant to the top of the list was the IA UK Smaller Companies sector, which kept up with many other markets on the global stage and was in positive territory in 82 months over the past decade.

It didn’t quite match the same returns as other sectors, up 189.6% over the past 10 years, as the maximum drawdown was one of the highest at 30.3%.

The sector has been hampered by Brexit and then the pandemic, but its overall make-up of technology and healthcare stocks made it a strong option for high-risk investors.

While the smaller companies sector was able to make good returns despite the pandemic and Brexit, other domestic sectors struggled.

The IA UK All Companies and IA UK Equity Income sectors were only up in 72 months over the past 10 years, with returns of 97.2% and 95.6% respectively and maximum drawdowns of 27.9% and 28.1%, suggesting investors were not paid for taking the risk in these areas.

-

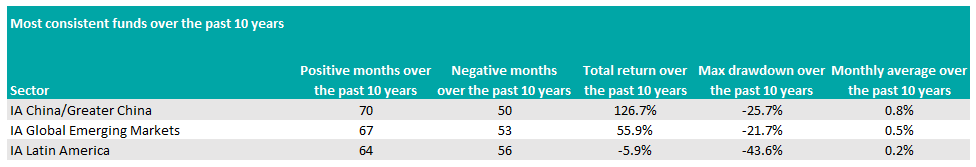

By far the worst equity sector of the past decade was IA Latin America, which was up in just 64 months out of 120. The region has been hit by a slumping oil price for much of the decade as well as some of the highest levels of Covid cases more recently. The average fund in the sector made an overall loss of 5.9% and had the largest drawdown of 43.6%.

Things have picked up slightly in recent months, with many countries setting their sights on Latin America’s oil resources as the Russia-Ukraine conflict has inflated the oil price.

Source: FE Analytics

The IA China/Greater China sector has also suffered from its own governance concerns. Investors who held assets in the sector over the past 10 years would have made a total return of 126.7%, but the number of positive months was low (70) as the Chinese Communist Party clamped down on companies in the technology and education sectors last year.

Like the US with global indices, China represents a large part of the IA Global Emerging Markets sector (31.8%). The average fund in this sector was only up in 67 of 120 months and made a total return of 55.9% over the decade.

Bonds

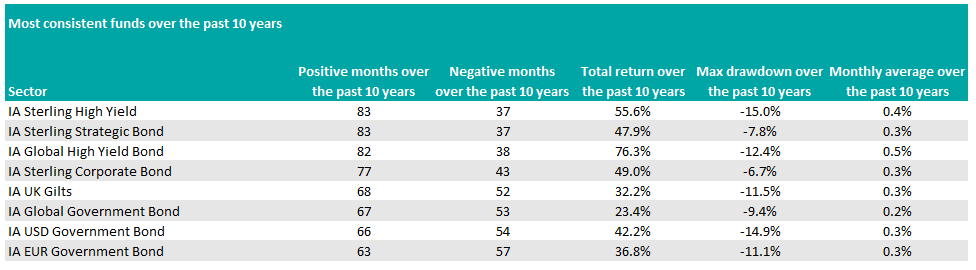

Starting with those that cannot afford panic-inducing falls, the IA Sterling Strategic Bond sector stands out as a consistent option, making positive gains in 83 of the past 120 months.

On average, funds in the sector have made a 47.9% over the past decade, a monthly return of 0.33%, while their average maximum drawdown was just 7.8% – half that of most equity sectors.

The sector is full of bond funds that can invest across the fixed income universe, from corporate and high yield to government bonds.

The best for both returns and maximum drawdown, however, was the IA Sterling Corporate Bond sector, which has made 58.8% over 10 years, while its largest consistent fall was 6.7%.

However, it has made gains in just 77 months of the past 120, suggesting that investors may be more likely to lose patience if the sector goes through a more sustained period of poor performance.

Other bond sectors that scored well on the list were IA Sterling High Yield and IA Global High Yield Bonds, which were up in 83 and 82 months over the past 10 years respectively. However, both had maximum drawdowns of more than 10%, suggesting they were more risky than other areas.

Source: FE Analytics

While high yield bonds consistently reported positive returns, some government bond sectors were only up in just over half of the months in the past 10 years, such as the IA EUR Government Bonds sector which was rose a little more than half the time: in 63 of the past 120 months.

On average, funds in the sector returned 36.8% over the past 10 years and the maximum drawdown of 11% was comparatively high.

Government bonds were not the place to be for cautious investors over the past decade, according to this report, with the IA USD Government Bond, IA Global Government Bond and IA UK Gilt sectors all languishing near the bottom of the table for positive months.