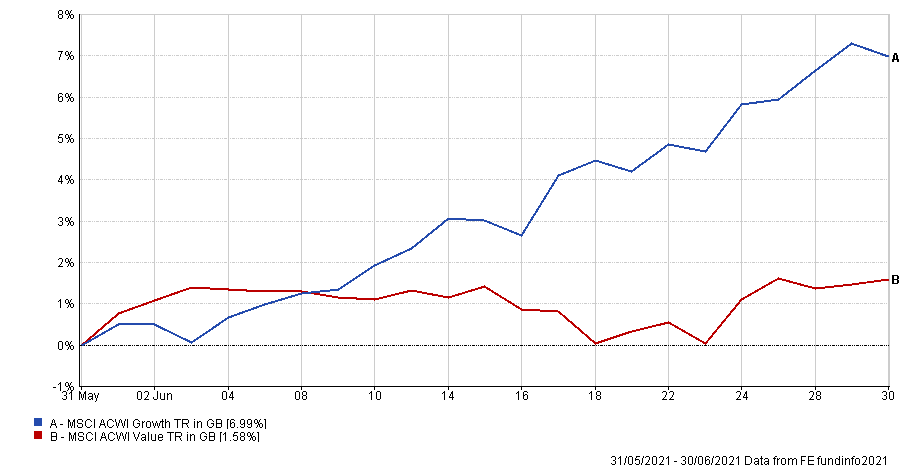

Funds managed by Baillie Gifford and other growth managers returned to the top of the performance rankings last month, after a pause in the ‘re-opening trade’ saw the growth investment style outperform.

The general trend in markets since the first coronavirus vaccines were unveiled in November last year has been for investors to pile into value stocks. While these had been shunned for much of the past decade, they typically outperform in times of stronger economic growth and higher inflation – as is expected to be seen as the world opens up from the coronavirus pandemic.

However, this wasn’t the case in June as investors returned to the growth style. This has an impact on the performance of fund sectors and individual strategies, causing Baillie Gifford to generate some of the industry’s highest returns.

Performance of investment style during Jun 2021

Source: FE Analytics

Source: FE Analytics

Fairview Consulting director Ben Yearsley said: “It is easy to get into a mindset that only one style will win and forget there are many interesting companies around throwing off lots of cash.

“Again, this was seen in June with Baillie Gifford’s high growth style back to the fore. It’s all about balance in portfolios in my view – growth for long term, but don’t forget value can make you money too.”

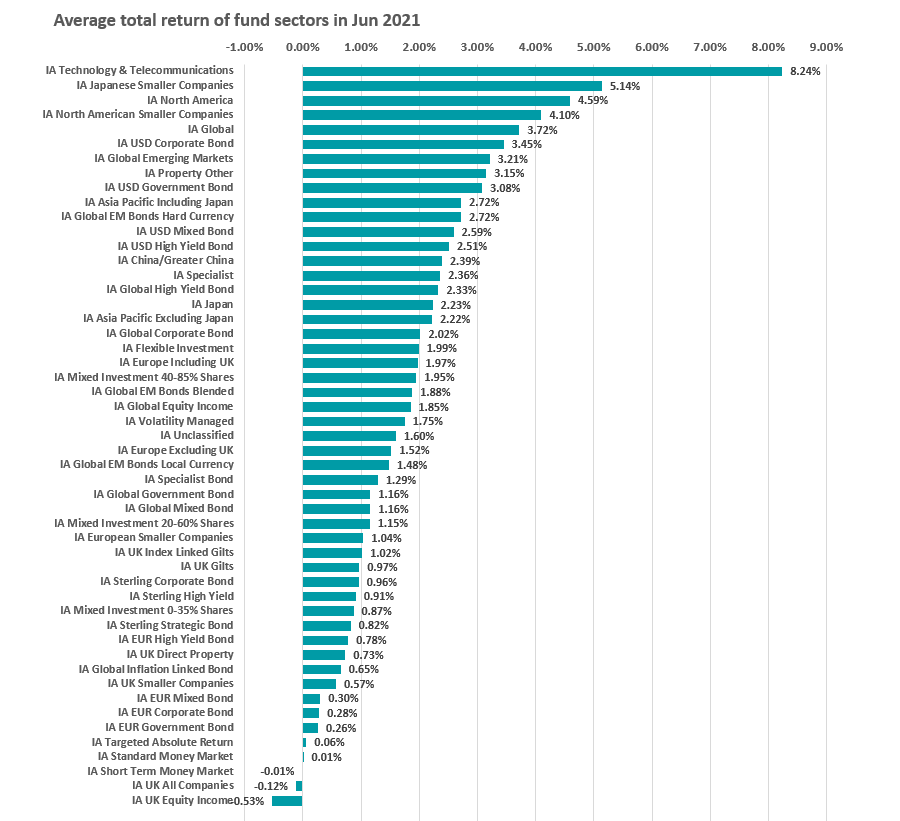

The chart below shows how this played out among the 50-plus sectors in the Investment Association universe.

Source: FE Analytics

IA Technology & Telecommunications, where funds tend to build portfolios around growth stocks, led the way with an 8.24 per cent average return.

Many funds in the IA Japanese Smaller Companies, IA North America, IA North American Smaller Companies and IA Global peer groups also have a bias to growth.

The UK, on the other hand, is seen as a more value-orientated market. This is reflected in IA UK Equity Income and IA UK All Companies sitting at the bottom of the sector rankings.

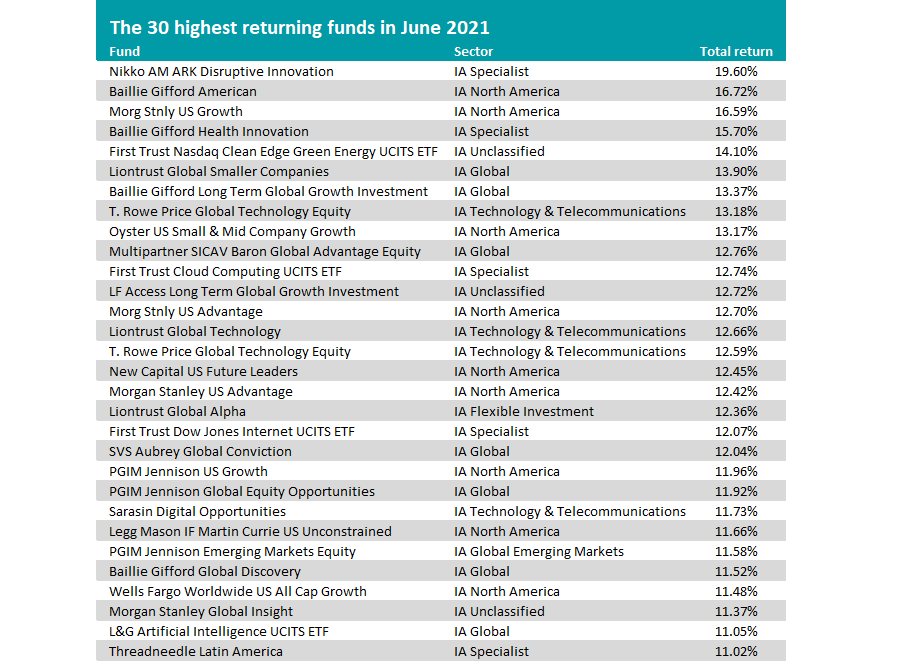

Source: FE Analytics

Turning to individual funds, Nikko AM ARK Disruptive Innovation made the months highest return after gaining just under 20 per cent.

The fund seeks to advantage of “changing trends caused by technology-enabled innovations that cut across economic sectors, industries and geographic regions”.

Its portfolio is built from ARK’s best ideas in areas like industrial innovation, genomics innovation, next-generation internet and fintech innovation.

As noted above, June was a strong month for Edinburgh-based fund house Baillie Gifford as three of its funds (Baillie Gifford American, Baillie Gifford Health Innovation and Baillie Gifford Long Term Global Growth Investment) made it into the 10 highest returners of the whole Investment Association universe.

Tech funds are another common feature in the above list, with T. Rowe Price Global Technology Equity, First Trust Cloud Computing UCITS ETF, Liontrust Global Technology, Sarasin Digital Opportunities and L&G Artificial Intelligence UCITS ETF all making more than 10 per cent last month.

Source: FE Analytics

The worst performance in June came from gold funds, as the table above clearly shows. ES Baker Steel Gold & Precious Metals, JGF-Jupiter Gold And Silver and Ninety One Global Gold fell the hardest.

The yellow metal fell $135 per troy ounce to end June at $1,773. The decline was prompted by a stronger US dollar and nervousness that the Federal Reserve might start to tighten policy sooner than anticipated.