Baillie Gifford’s Douglas Brodie has won the coveted Best Alpha Manager of the Year award, following an incredibly strong 2020 for the Edinburgh-based investment house.

The FE fundinfo Alpha Manager Awards celebrate the best fund managers from among those who have been able to consistently create risk-adjusted alpha.

Brodie – who is the head of Baillie Gifford’s global discovery team and manages the £2.1bn Baillie Gifford Global Discovery fund – scooped the top prize in the award – being named the best overall FE fundinfo Alpha Manager.

Baillie Gifford Global Discovery is currently in the IA Global sector’s top quartile over one, three, five and 10 years. During 2020, when the firm’s quality-growth approach was very much in favour, the fund made a 76.80 per cent total return – the sixth highest of the peer group’s 414 members.

Performance of fund vs sector over 2020

Source: FE Analytics

Charles Younes, research manager at FE fundinfo, said: “Winning the Best Alpha Manager award is a phenomenal achievement.

“In what has been a highly challenging year for all active fund managers, Douglas’ performance has been simply exceptional. 2020 was clearly Baillie Gifford’s year and it was impossible to not recognise Douglas and the Global Discovery fund for its long and consistent track record in unveiling hidden gems and navigating the volatility seen in the global markets.”

Last year saw many of the Baillie Gifford’s funds generate some of their respective sector’s highest returns, as the pandemic and massive levels of stimulus prompted investors to back quality-growth stocks, especially those in the tech space – a preferred hunting ground of Baillie Gifford.

This means that the group won a total for four gongs in this year’s FE fundinfo Alpha Manager Awards – as well as Best Alpha Manager, Brodie also won the Best Alpha Manager – Global Developed Equities category.

Tom Slater, manager of the £6.7bn Baillie Gifford American fund, took home the Best Alpha Manager – US Equities and Best New Alpha Manager awards. Baillie Gifford American was 2020’s best performer of the entire Investment Association universe after making 121.84 per cent

Tanvi Kandlur, senior fund analyst at FE fundinfo, added: “Like Douglas Brodie, Tom Slater also enjoyed a phenomenal year with his Bailie Gifford American fund.

“This is the first year Tom was eligible for an Alpha Manager rating and we have been impressed by his ability in maintaining his position as the top performing fund in the IA North American sector and delivering an incredible return over 2020.”

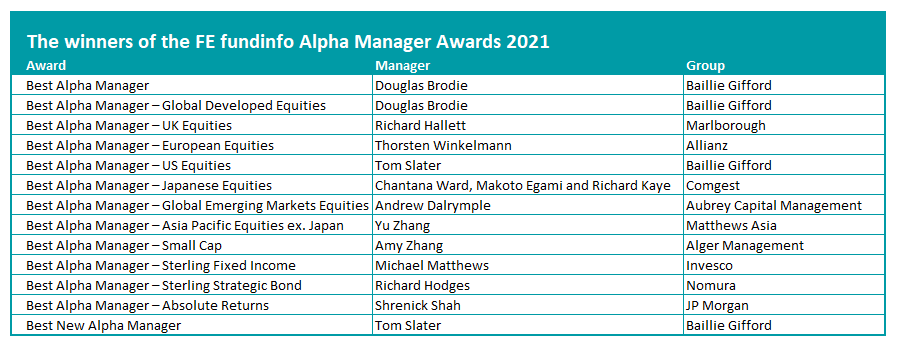

Baillie Gifford was the only fund manager house to win more than one award in the 2021 FE fundinfo Alpha Manager Awards. The winners in the remaining nine categories can be seen in the table below.

Source: FE fundinfo

Younes finished: “Once again the 2021 Alpha Managers have demonstrated their value for investors and led the charge for good active fund management.

“Not only have they safeguarded assets during a period like no other in living memory – a global pandemic that triggered the worst economic downturn since the Great Depression – but also capitalised quickly on the opportunities in the global market recovery of the second half of 2020. We offer our warmest congratulations to them all.”