Technology funds bounced back strongly in April after the inflation-linked sell-off in March, while UK and European smaller companies also did well in the vaccine-linked recovery trade.

However, Japanese and Indian funds went the other way as a slow roll-out of vaccines in these countries allowed coronavirus cases to spike.

After a ground-breaking 2020, clean energy plays also suffered as increased inflation expectations hit their implied earnings.

Ben Yearsley, investment consultant at Fairview Investing, said: “With economic forecasts being revised upwards in the UK it is no surprise seeing smaller companies doing well and they should be prime beneficiaries of one of the best growth outlooks in decades.

“Many investors are underweight smaller companies, both domestically and overseas, and this could cost them in 2021.”

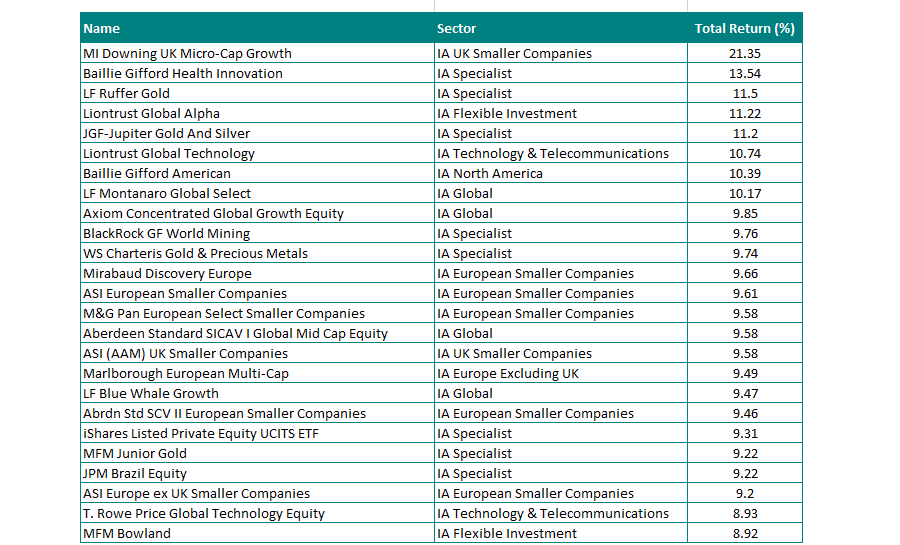

Best performing funds in April

Source: FE Analytics

Top of the performance list in April was the MI Downing UK Micro-Cap Growth fund, which has been run by Judith MacKenzie since 2011.

It marks a change in fortune for the £1.7m fund, after it endured a torrid 2020 when it lost 9.93 per cent.

In second place in April was another strategy from the IA Specialist sector, Baillie Gifford Health Innovation, which made 13.54 per cent.

The fund invests mainly in global equities selected from innovative companies involved in the healthcare industry, but is not restricted by any index.

In fourth place was the five FE fundinfo Crown-Rated Liontrust Global Alpha fund, which has been run by Robin Geffen since 2001.

Sitting in the IA Flexible sector, the fund can invest directly or indirectly in a mix of asset classes from around the world, including fixed income and alternatives.

The largest holding is the Liontrust Global Smaller Companies fund, at 5.6 per cent, which made a total return of 8.12 per cent in April.

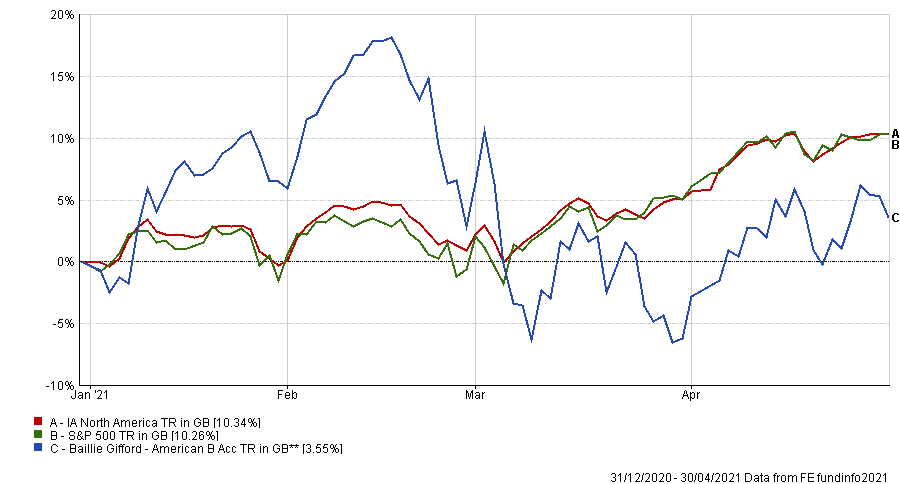

Baillie Gifford American is another notable addition to the list. Having enjoyed a stellar 2020 when it returned 121.84 per cent, the fund endured a difficult March, losing 12.91 per cent as its favoured growth stocks fell on inflation concerns and it dropped to the bottom of its peer group.

Performance of Baillie Gifford American in 2021

Source: FE Analytics

However, that was cancelled out with a return of 10.39 per cent in April. The fund is up 3.55 per cent for 2021 as a whole.

According to the team at FE Investments, the fund’s management team chooses not to dilute the impact of strong companies in the name of diversification and its benchmark-agnostic approach suggests that it will behave differently to the S&P 500.

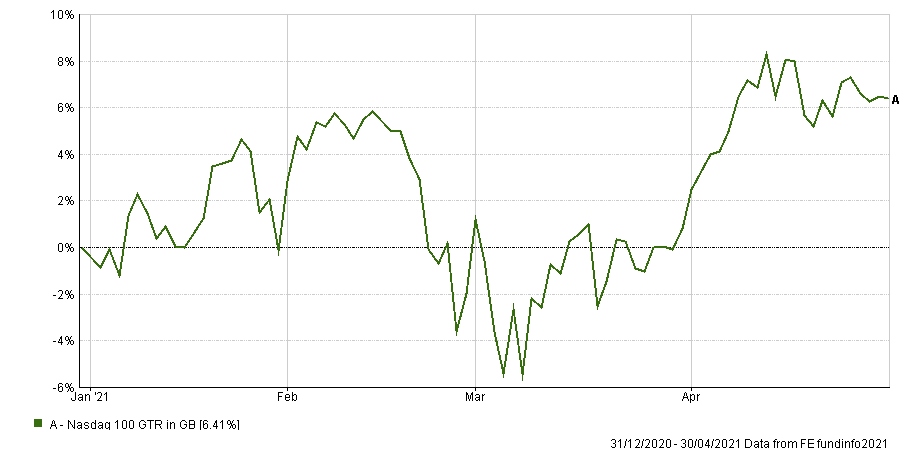

Liontrust Global Technology, which is also run by Geffen, made 10.74 per cent in April.

Performance of Nasdaq 100 in 2021

Source: FE Analytics

In what was a good month for gold, the $1.2bn JGF Jupiter Gold & Silver and £681.2m LF Ruffer Gold funds also both made impressive gains.

The Jupiter fund, managed by Ned Naylor-Leyland, comprises both bullion and mining shares.

According to Rayner Spencer Mills Research, the fund’s ability to tactically allocate the portfolio depending on the prevailing precious metal markets provides the manager with the opportunity to deliver alpha against spot prices.

Six of last month’s top-25 best performing funds are invested in the yellow metal. Again, concerns over rising prices in the US piqued investors’ interest in gold as a viable hedge against inflation.

Fawad Razaqzada, market analyst at ThinkMarkets, noted: “The Fed expects inflation to settle down after a temporary acceleration. However, the key risk is if their assumption turns out to be wrong and price pressures remain elevated.”

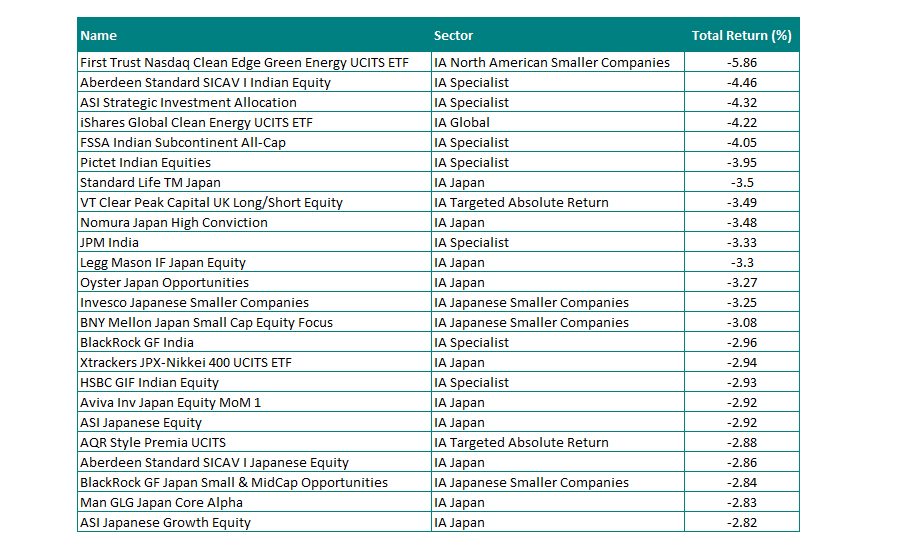

Worst performing funds in April

Source: FE Analytics

At the other end of the table, the First Trust Nasdaq Clean Edge Green Energy and iShares Global Clean Energy ETFs endured heavy losses in April.

The $5.5bn iShares Global Clean Energy ETF has had a tough 2021 overall: in January, its index was called into question for being too concentrated and its holdings in small-cap stocks caused some liquidity issues.

Meanwhile, 12 of the bottom-25 funds came from the IA Japan and IA Japanese Smaller Companies sectors.