The incoming managers of Matthew Dobbs’ Schroders Asian equity funds have rotated portfolios into areas of the market with greater recovery potential, while stressing that the approach and process used on the well-known funds has continuity with the past.

With the retirement of well-known Schroders fund manager Matthew Dobbs last month Trustnet spoke to incoming managers Richard Sennitt and Abbas Barkhordar about how they’re bedding into his former funds.

Dobbs was a manager for almost 40 years at Schroders where he ran several Asian equity strategies, including the £1.7bn Schroder Asian Alpha Plus fund, £1bn Schroder Asia Pacific investment trust and £749.7m Schroder Oriental Income fund, as well as some global and small-cap portfolios.

Sennitt himself is well-known for running Asian equity funds, including the £1bn Schroder Asian Income fund which he’s managed for a decade. He took over as lead manager of Dobbs’ Asian mandates and is supported by Barkhordar.

This handover marked the execution of Schroders’ long-term succession strategy for Dobbs, which the firm said has been planned “over a number of years”.

The departure of such a well-known and experienced manager can sometimes be a cause for concern for investors, who may worry that a shift in management could trigger an upset in the fund’s investment process, according to Sennitt.

But he clarified that this handover still means “business as usual” for the funds and was focused on ensuring the “continuity of an approach is going to be applied”.

Sennitt added: “Ensuring that there is continuity I think that’s the key thing.

“Because I suppose, what you don't really want is to be in a situation where you don't really know what the person who's going to be taking over is likely [to do], what process they're going to be using, or are they going to change things, and so on.

“I'd like to think, certainly from our position here, that given that I've worked with Matthew for 30 years, literally sitting next to him, that it is pretty clear that there is a continuity.”

Sennitt added: “It's not just about the manager who's named on the portfolio, it is about the team as a whole. And I think where we've got a particularly rich depth is the resources out in the region as well as obviously all the teams elsewhere in the company.”

While the new managers have focused on maintaining the investment process, they’ve still made some changes to the funds’ portfolios, namely in Schroder Asian Alpha Plus to try and capture more of the potential Covid recovery in the region.

Parts of Asia are currently enjoying a period of relative normality, especially north Asian countries such as China as they were able to manage the pandemic better than other areas, but this has been reflected in the performance of their stock markets.

Sennitt explained that there might be “less of an opportunity for a rebound” in countries such as these, therefore he expects to see more of a “growth bump” in the countries that struggled to manage the pandemic as well as China and others.

“What that has meant is that we have rotated a bit of money into some of those south-east Asian markets and into India as well as we've seen a bit of a opportunity there,” he added.

This shift from north into more south-eastern Asian markets also involves a sectoral rotation, as the north is more growth biased with IT and e-commerce companies and the south has more cyclical plays, such as financials.

This was a conscious decision to move out of some of the more “expensive areas”, reducing exposure to internet platforms and “rotating the portfolio a little bit more towards some of those things which have lagged”, Sennitt explained.

This is partly due to the divergence of both valuation and performance over the past year, where just a few companies generated the majority of returns, according to Barkhordar.

He said: “You can lose quite a bit of nuance and looking at just the aggregate numbers and talking about markets as a whole.

“Something that's really struck us in the last year has been that divergence, whether it's sectorial or geographically. It does mean that you might have to work a bit harder for returns going forward and rotate into those areas which have lagged. But we do think the market is missing a recovery [there].”

Two of those areas the managers have focused on are banks and real estate.

Looking first at banks and these have been “a pretty difficult area over the last couple of years”, Sennitt said. But banks are trading on distressed multiples, he still sees them as an investment opportunity.

He said: “We think that the outlook for credit costs has the potential to surprise on the upside there, so we have added a little bit into some of those names.”

Sennitt clarified that they were not just “buying things at a value for value sake”.

“There has to be a sort of if you'd like a rationale for buying something that’s cheap,” he said. “And the feeling has been that some of these concerns over the squeeze in margins and increase in in credit costs that have come through from Covid are perhaps a little bit overdone and therefore on that basis there's scope for these stocks to actually start to rerate up a little bit as things start to recover.”

Moving onto real estate and Sennitt said it was more of a focus on commercial real estate companies.

He said: “They're very cheap against their sort of NAV [net asset value] but they're also benefiting from [the ongoing growth in some of their portfolios and some are thinking about growth into China and so on which, we think is a positive.”

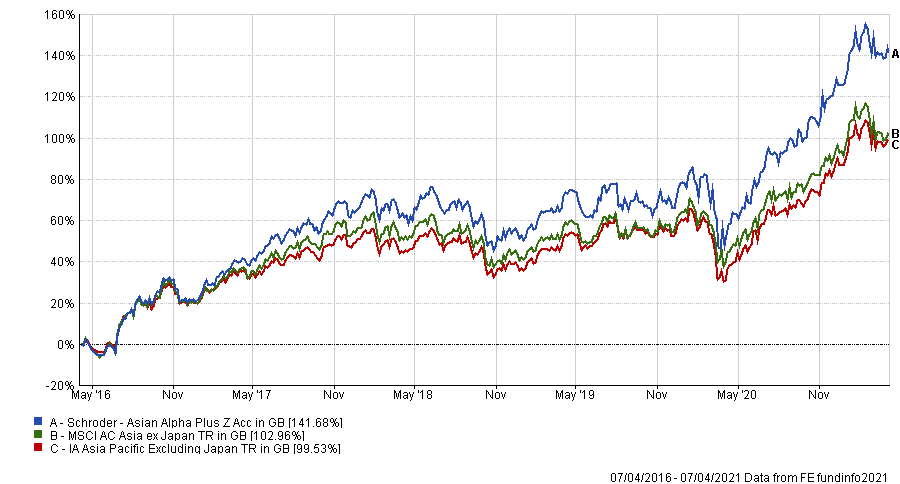

Over the past five years the Schroder Asian Alpha Plus fund has made a total return of 141.68 per cent, outperforming both its benchmark and sector peers.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

The fund has an ongoing charges figure of 0.92 per cent.