The UK and Asia are two markets that investors could consider for income, according to Adrian Lowcock, head of personal investing at Willis Owen.

Last year was a difficult one for income investors after the coronavirus pandemic and widespread lockdowns caused many companies to cut or cancel their dividends

The UK, for example, has long been seen as a prime hunting ground for income investors thanks to a strong dividend paying culture among many of its biggest companies, but the

Covid-19 pandemic caused the biggest decline in dividends on record during Q2 2020, according to the Link UK Dividend Monitor.

Lowcock said: “Covid-19 has proven tumultuous for markets in the past year. However, with the success of the vaccine programme in the UK, investor optimism is returning and with that a boost to income funds.”

Below, Willis Owen’s personal head of investing (pictured) highlighted three funds for investors seeking income options.

Threadneedle UK Equity Income

The first pick is Threadneedle UK Equity Income, run by Richard Colwell – who Lowcock described as “one of the best-known specialists in this sector”.

The £3.5bn fund has a flexible approach investing, holding both growth and value stocks.

The primary focus of the process is stock selection, Lowcock said.

Colwell owns a blend of high-quality companies with strong cash generation and out-of-favour companies with recovery potential, some of which may not currently pay a dividend.

Some of the fund’s top holdings are well-known blue-chip stocks, including AstraZeneca, GlaxoSmithKline, Imperial Brands and Unilever.

But even with these large-cap names Colwell will also take significant bets against the sector index to match his thematic views, Lowcock said.

In the latest fund commentary, Colwell commented on the state of the UK income market, saying that conditions have now stabilised.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

Over five years Threadneedle UK Equity Income has made a total return of 32.21 per cent, an underperformance versus the FTSE All Share index (36.40 per cent) but beating its average IA UK Equity Income peer (24.81 per cent).

The fund has an ongoing charges figures (OCF) of 0.82 per cent and is currently yielding of 3 per cent.

Man GLG Income

Lowcock’s next fund offers a value style option for income in the UK market.

Manager Henry Dixon’s Man GLG Income fund is run under what Lowcock called “a highly disciplined approach”, which is underpinned by Dixon’s philosophy that “pricing inefficiencies can be profitably exploited”.

Lowcock added that Dixon looks for companies, typically in the mid and small-cap space, which he thinks are trading below estimated asset value or has a profit stream is undervalued relative to the cost of capital.

There are also strict requirements over companies’ dividends, which needs to be at least equal to the UK stock market.

Man GLG Income has outperformed over five years relative to both its FTSE All Share benchmark and IA UK Equity Income sector, with a total return of 24.81 per cent.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

The £1.8bn fund has an OCF of 0.90 per cent and a yield of 4.27 per cent.

Schroder Asian Income

Lowcock’s final pick looks outside of the UK for income.

The £1.4bn Schroder Asian Income fund “offers a way for income seekers to gain exposure to a region with attractive income opportunities”, he said.

Richard Sennitt has run the fund since 2001, deploying a “methodical process” to look for financially sound companies that provide a healthy yield and have management that aims to improve shareholder returns over time.

“Shares will only be purchased if they meet strict valuation criteria. The emphasis on high-quality businesses that can maintain and grow dividends has rewarded investors over the long term,” Lowcock said.

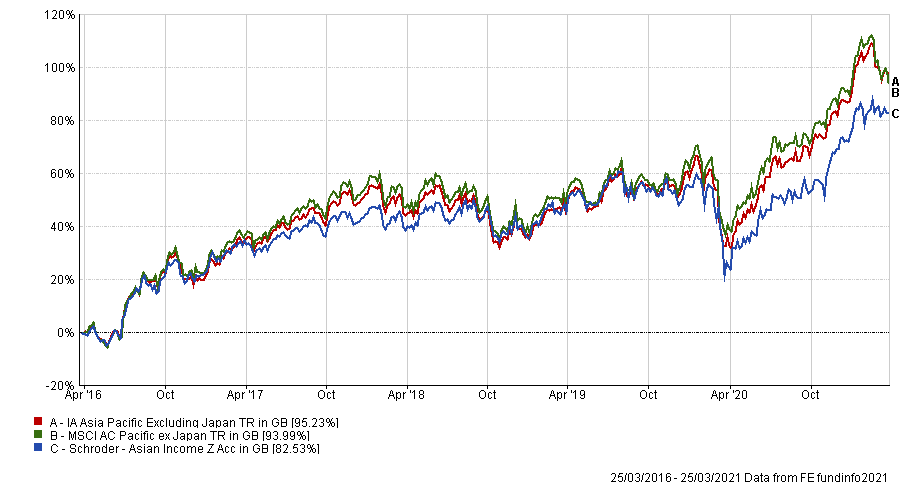

Schroder Asian Income fund has underperformed compared to its IA Asia Pacific Excluding Japan peers (95.23 per cent) and its MSCI AC Pacific ex Japan benchmark (93.99 per cent) over five years, making a total return of 82.53 per cent.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

The fund has an OCF of 0.90 per cent and is yielding 3.03 per cent.