The IA Global sector is arguably the most competitive in the Investment Association universe, with 566 funds attempting to make outsized returns.

One way investors could look to whittle down the array of options is to look at veteran fund managers who have delivered time and again – after all, there has been no shortage of hurdles in the world of global equities over the past few decades.

Below, Trustnet researched the funds that have been managed by the same person since 2004 or earlier and have produced top-quartile returns over the past three years, showing those who have been through it all and continue to make top returns.

One of those funds is GS Goldman Sachs Global CORE® Equity Portfolio, managed by Len Ioffe since October 2004. In January 2013, he was joined by Osman Ali and Takashi Suwabe.

Their portfolio aims to replicate the same style, sector, risk and capitalisation characteristics as the fund’s benchmark (the MSCI World index), with the underlying stock and country selection responsible for generating outperformance.

Due to the benchmark-aware approach, the fund has a low tracking error. However, it is not a full replication of the MSCI World index. For example, it is underweight Tesla relative to the benchmark and does not hold Exxon Mobil, both of which are top 10 constituents of the MSCI World index.

Furthermore, it has overweight positions in European stocks such as ASML and Novo Nordisk, with both featuring among the fund’s top 10 holdings.

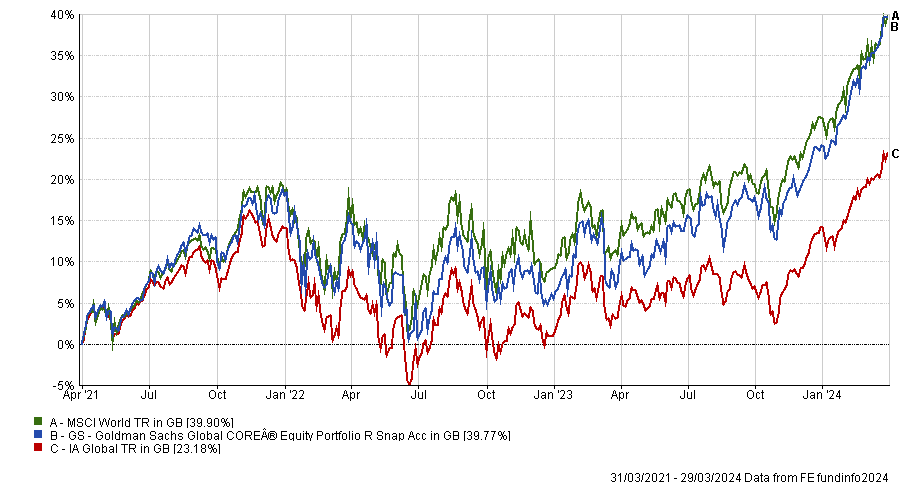

Although it sits in the top quartile of the IA Global sector over three years, it has slightly lagged the MSCI World index. This underperformance can be attributed to recent market returns being driven by a handful of names. Moreover, the fund has been more volatile than the benchmark as well as its sector peers in this timeframe.

Performance of fund over 3yrs (to last month end) vs sector and benchmark

Source: FE Analytics

The higher volatility relative to the benchmark and the sector has also been a feature of the fund over the past decade. However, it has delivered returns in excess of the MSCI World index in that period, while also ranking among the sector’s top quartile funds.

The other veteran manager to achieve the same feat is Mike Willans, who has been at the helm of WS Canlife Global Equity since 2004 and was joined by Bima Patel in 2018.

They build their portfolio by combining both top-down macro views and bottom-up stock picking. The managers also try to spread their allocation across different sectors and factors to ensure balance and diversification.

Moreover, Willans and Patel may invest in bonds and other collective investment schemes to diversify their sources of return. For instance, the fund currently invests in US utilities tracker iShares S&P 500 Utilities and X Harvest CSI 300, which replicates the performance of the 300 largest companies listed on the Shanghai and Shenzhen stock exchanges.

When it comes to stock selection, the two managers consider factors such as a company’ market position, the strength of its brand, its susceptibility to current market and economic trends and the drivers behind its earnings and dividend growth.

Performance of fund over 3yrs (to last month end) vs sector and benchmark

Source: FE Analytics

Its five largest holdings include Microsoft, Apple, Amazon, Alphabet and JP Morgan Chase & Co, according to FE Analytics.

The fund has also made a top-quartile performance over five years, but sits in the second quartile of the IA Global sector over a decade. Nonetheless, it has consistently been one of the least volatile funds in the sector, both over three and 10 years.