The emergence of three viable Covid-19 vaccines in November meant a reversal of fortunes for stocks which have suffered this year as a result of global shutdowns, data from FE Analytics shows.

Oil and cyclical stocks rebounded as positive news on the vaccine front increased the likelihood of a return to more normal economic conditions next year.

Conversely, the rebound in markets led to a fall in the price of safe-haven gold which has enjoyed one of its more successful years in the wake of a global recession, as seven of the 10 worst-performing funds were gold strategies.

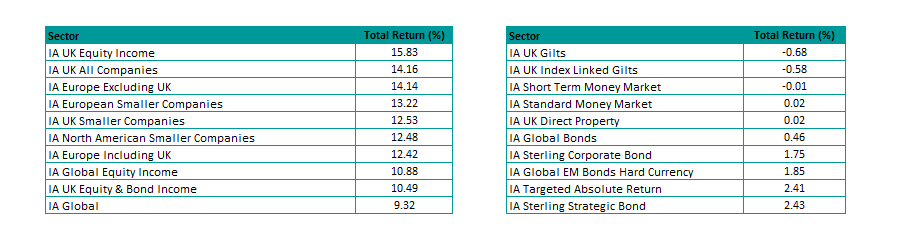

Best- and worst-performing sectors in November

Source: FE Analytics

A rise in UK equities and a bounce in the value of sterling meant two UK sectors were the top performing sectors last month, buoyed by news of a vaccine and expectations of a post-Brexit trade deal before the end of the year.

The IA UK Equity Income sector rose 15.83 per cent on average while the IA UK All Companies sector was up by 14.16 per cent.

The presence of several smaller companies’ sectors across different geographies showed greater risk-on appetite among investors and the anticipation for stronger growth in 2021.

Equity income strategies – with greater exposure to cyclical stocks – and value-oriented strategies also performed strongly as investors anticipated a return to more normal economic conditions.

Given the strength of the rebound, just a handful of sectors were relatively better off as only three sectors were in negative territory, two of which were UK gilt sectors.

This could, in part, be in response to chancellor of the exchequer Rishi Sunak’s Spending Review last week, which revealed that borrowing levels would hit record highs, and lower demand for the safe-haven assets in a more risk on environment.

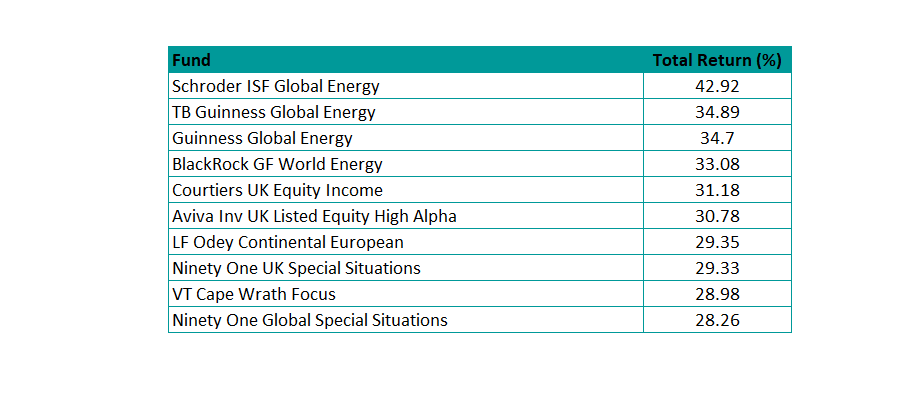

Best performing funds of November

Source: FE Analytics

The presence of four global energy funds in the top-10 performers is unsurprising considering the emergence of several vaccines, as the increased prospects for stronger growth in 2021 has seen oil & gas stocks rebound.

Indeed, the FTSE Oil & Gas sector topped the leader board in the UK rising 31.64 per cent on the back of the price of Brent rising from $38 to $48 a barrel.

As such, the $373.m Schroder ISF Global Energy fund overseen by Mark Lacey was the best performer in November with a total return of 46.73 per cent.

Other top performers included the TB Guinness Global Energy (34.89 per cent), Guinness Global Energy (34.7 per cent), and BlackRock GF World Energy (33.08 per cent).

UK value strategies such as the Aviva Inv UK Listed Equity High Alpha, VT Cape Wrath Focus and Ninety One UK Special Situations funds were among the biggest beneficiaries of a return to favour for the style.

“Value has rebounded,” said Ben Yearsley, director at Fairview Investing. “If a Brexit deal is imminently signed you could see the UK being the market to follow in 2021 as on many measures it looks good value against global peers.”

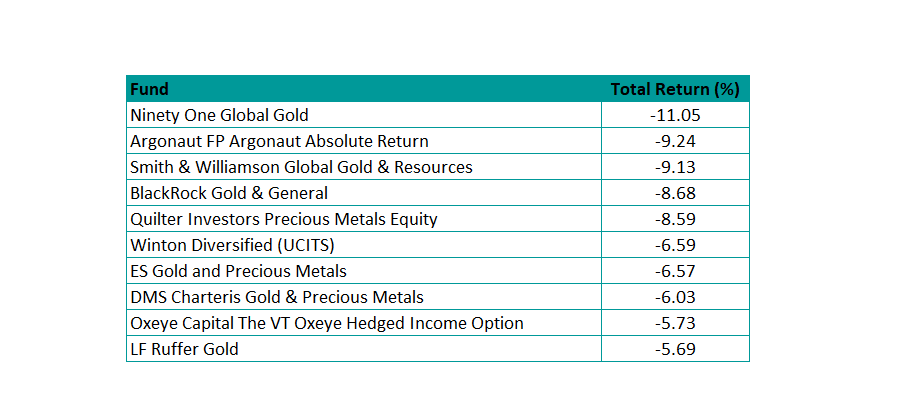

The clear theme amongst the worst performers in November was the presence of several gold strategies.

The yellow metal acts as a ‘safe heaven’ for investors during more uncertain times and has had a very successful year.

When the Covid-19 pandemic struck and markets sold-off in March, investors piled out of shares and into gold. This saw a bounce in bullion and prices had soared to over $2,000 per ounce by August. However, as investor risk appetite has returned, the price per ounce has steadily been declining and now stands at around $1,800, according to the Bloomberg gold index.

Worst performing funds of November

Source: FE Analytics

And with greater optimism in the wake of vaccine news, stock markets have been buoyed and the demand for the precious metal has declined.

As such, the worst performing fund of the month was the £365.8m Ninety One Global Gold fund, run by FE fundinfo Alpha Manager George Cheveley, which was down by 10.08 per cent in November, although it is still up 17.87 per cent year-to-date.

The Smith & Williamson Global Gold Resources, BlackRock Gold & General and Quilter Investors Previous Metals funds make up the gold-dominated worst five performers.

However, the one exception to the five worst performers is the FP Argonaut Absolute Return fund, run by Alpha Manager, Barry Norris.

Norris told Trustnet in October that he was shorting vaccine companies on the premise that they have little pricing power and would lose out to the first mover advantage.

“Argonaut’s Absolute Return fund was second worst performing falling 9.24 per cent showing that shorting is fraught with danger in volatile markets,” said Yearsley.