Investors approaching their middle age should be looking to shift from more growth-focused strategies and begin consolidating the returns they’ve already made, according to Murdoch Asset Management’s Austen Robilliard.

As part of the series on the FE Adviser Fund Index (AFI) benchmarks, moving from the AFI Cautious index to one with an increased risk appetite – the AFI Balanced index.

The FE AFI benchmarks consist of portfolios of 10 weighted fund picks chosen by a panel of leading UK financial advisers for three different age groups.

One panellist is Austen Robilliard, head of investments at Murdoch Asset Management, who has picked three funds which he has held for the long-term and best epitomise the risk profile of the AFI Balanced index.

While the AFI Cautious index is designed for an investor in their late 50s, the AFI Balanced is constructed for a person in their mid-40s.

Robilliard, who has been an AFI panellist since 2019, explained that those who are looking to retire in 15-20 years can afford to take a bit more risk as they have time to make up the shortfalls.

Considering too that they may have children around university age and other financial liabilities, that may limit the amount of money they can invest into their retirement.

Given that risk profile, Robilliard recommends keeping a keen eye on capital preservation.

Performance of AFI Balanced index over 10yrs

Source: FE Analytics

Over a 10 year period, the AFI Balanced index has made a total return of 85.02 per cent, while the FTSE UK Private Investor Balanced index made 113.61 per cent and the IA Mixed Investment 40-85% Shares sector gained 85.22 per cent.

Below, Robilliard highlights three funds which he believes are key components within this risk profile-based index.

SVM UK Opportunities

Since the news of a vaccine gave a boost to the cyclical stocks that have suffered during the Covid-19 pandemic, Robilliard believes the £139.8m SVM UK Opportunities fund is a pertinent choice for the current environment and is Murdoch Asset Management’s preferred value fund.

That fund has been managed by long-term value investor Neil Veitch since 2006.

This included various airline, travel, leisure, hotel and other cyclical stocks that suffered as global activity ground to a halt.

“Veitch is a very good value manager and was up 31 per cent last calendar year and in 2018 he was in the third quartile even though value sold off a lot,” he said. “His stock selection has been positive, but his value style bias has been a detractor. Given how unloved value as a style has been in the UK since the EU referendum, for a value manager to keep pace with wider markets is an achievement”

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

Over a three-year period, the SVM UK Opportunities fund had made a total return of 2.52 per cent, in comparison to 0.88 per cent for the IA UK All Companies average sector peer and a loss of 0.94 per cent for the FTSE All Share. It has an ongoing charges figure (OCF) of 0.99 per cent.

Artemis US Select

One of the core holdings of the balanced portfolio is the £2.1bn, five FE fundinfo Crown-rated Artemis US Select fund run by Cormac Weldon.

“While the fund underperformed in 2016 by circa 6 per cent, it was still up 26 per cent in absolute terms and that was the only year he underperformed the sector average since joining Artemis,” said Robilliard. “Weldon is not wedded to a particular style and is agnostic in his stockpicks, with him focusing on the fundamentals of each business.”

The fund holds Amazon, Microsoft and Facebook alongside rail transportation company Norfolk Southern within its top holdings.

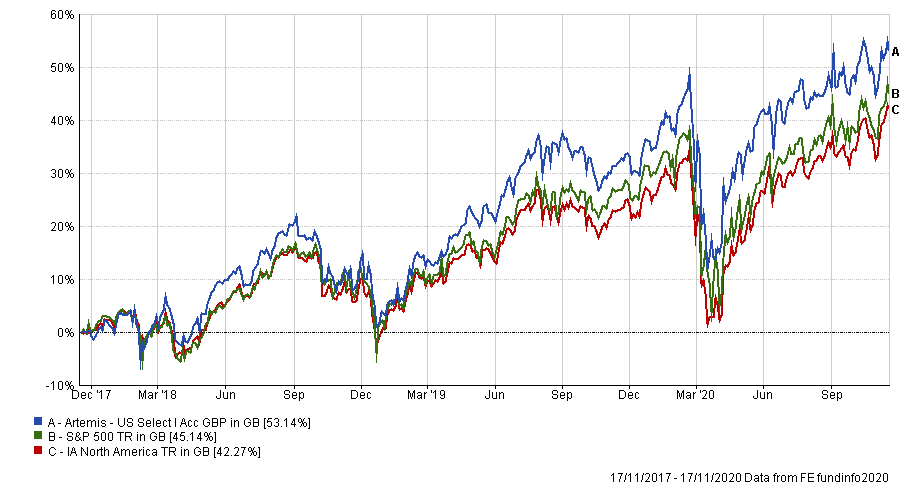

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

The Artemis US Select fund has made 53.14 per cent over the three year period, while its S&P 500 benchmark has made 45.14 per cent and the average IA North America peer has returned 42.27 per cent. It has an OCF of 0.85 per cent.

Merian UK Mid Cap

Robilliard’s final choice is the £3.1bn Merian UK Mid Cap fund, run by FE fundinfo Alpha Manager, Richard Watts.

“The fund has been a long-term favourite of ours due to its experienced team, their stock analysis capabilities and an approach that is looking for companies which benefit from structural growth drivers,” he said.

“The acquisition by Jupiter was initially an area of concern but were comforted by the whole team moving across and having autonomy.”

He added: “The long-term numbers have been impressive and whilst the fund has gone through periods of underperformance, they tend to be short-lived and the fund has a habit of surprising on the upside – even if the macro-economic environment would suggest it could struggle.”

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

Since November 2017, the Merian UK Mid Cap fund has made a total return of 7 per cent, against a 2.27 gain for the FTSE 250 ex Investment Trusts index and 0.88 per cent for the IA UK All Companies sector. It has an OCF of 0.85 per cent.