Only 13.6 per cent of fixed income funds managed to eke out a positive return in 2021’s first two months after inflation fears sparked a bond market rout, Trustnet research shows.

Bond markets have fallen in recent weeks as investors started to worry about the prospect of higher inflation and lower levels of monetary stimulus should the coronavirus vaccine rollout spark a strong economic rebound.

According to FE Analytics, the Bloomberg Barclays Global Treasury index fell 5.5 per cent between the start of 2021 and the end of February, while the Bloomberg Barclays Sterling Gilts index lost 7.5 per cent.

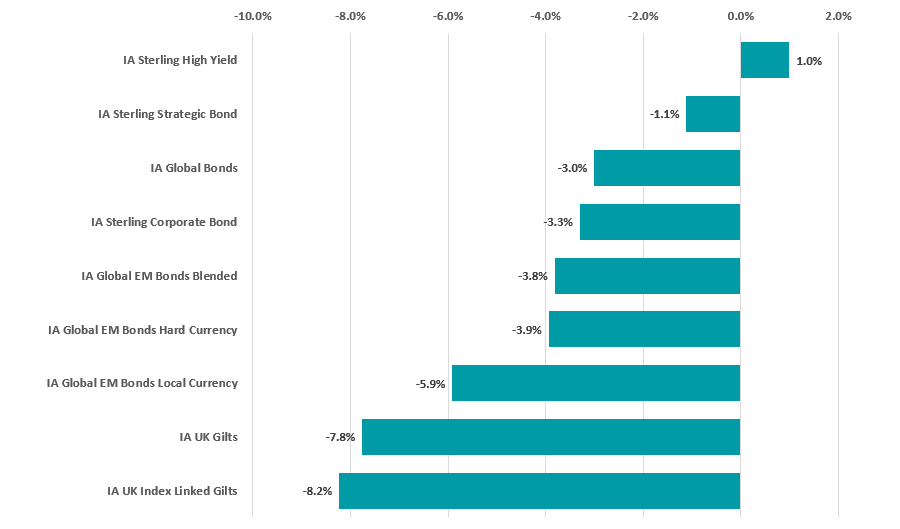

The chart below shows how this impacted the various bond sectors in the Investment Association universe.

Performance of bond sectors during Jan and Feb 2021

Source: FinXL

As can be seen, the average fund lost money in every sector aside from IA Sterling High Yield. Gilts came off worst, as government bond funds – with their lower yields – bore the brunt of the sell-off.

Across these nine sectors, there are 575 funds and our data shows all but 78 of them made a negative return for the first two months of 2021. This means that 86.4 per cent of bond funds are sitting on losses.

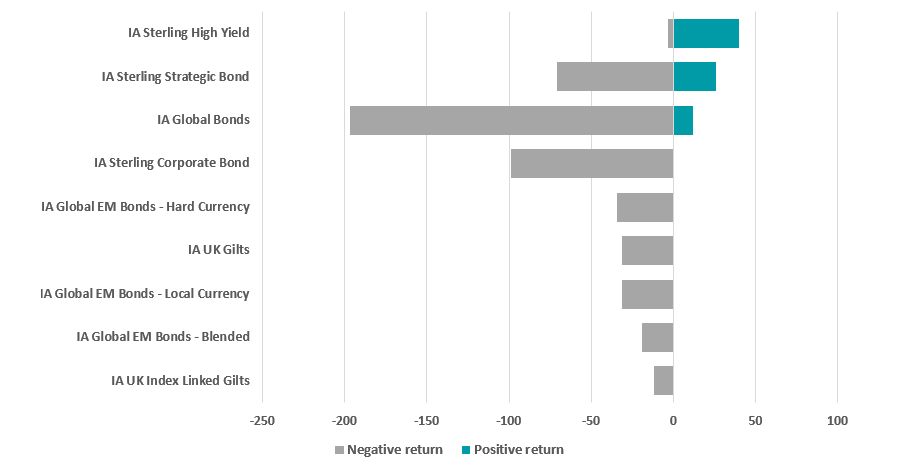

To show the split between the positive and negative funds in each sector, we’ve come up with the below chart.

Split between positive and negative funds in Jan and Feb 2021

Source: FinXL

In IA Sterling High Yield, 40 funds made a positive return while three lost money. In IA Sterling Strategic Bond, 26 are positive and 71 are negative while in IA Global 12 are positive and 197 are down.

Every fund in all of the remaining six bond sectors are down for the two months in question.

So which funds did manage to generate a positive return for their investors during the bond market sell-off? Below are the 33 that returned 1 per cent or more.

Source: FE Analytics

Michael Scott’s Man GLG High Yield Opportunities fund sits at the top with its 4.25 per cent total return.

The £102m fund only launched in July 2019 and was the highest returning member of the IA Sterling High Yield sector in 2020 with a total return of 15.66 per cent, compared with 4 per cent from its average peer.

Funds that made it onto the above list with a longer track record include Steve Kotsen’s £2.4bn Nomura US High Yield Bond, Martin Reeves’ £1.4bn L&G High Income Trust, Eric Holt’s £1.8bn Royal London Sterling Extra Yield Bond and Stefan Isaacs’ £1.5bn M&G Global High Yield Bond funds.

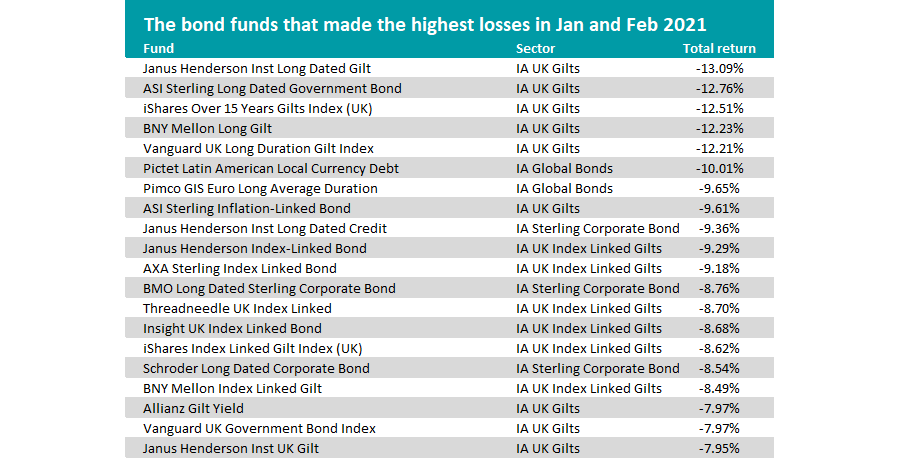

Of course, plenty of funds made losses in January and February. The 20 with the biggest falls can be seen below and it should be no surprise that it is dominated by gilt funds.

Source: FE Analytics

However, not every investor believes that higher inflation presents an immediate risk to bond investors. Luca Paolini, chief strategist at Pictet Asset Management, thinks that the economic recovery will not lead to a “rapid pick-up in inflation”.

He argued that the large amount of spare capacity in the global economy means that any overshooting of central bank's inflation objectives is likely to be only temporary; he does not see underlying inflation picking up for at least a year.

“A stronger global economy and the spectre of rising inflation aren’t particularly welcome signals for bonds. However, we remain sanguine,” Paolini said.

“Monetary stimulus, while fading, remains sufficiently strong to support certain parts of the fixed income market. Total public and private liquidity across US, China, the eurozone, Japan and UK stands at 14 per cent of GDP according to our models – down sharply from a peak of 28 per cent in mid-2020, but still comfortably above its long-run average of 11 per cent.

“The recent sell-off in bond markets has served to increase the appeal of US Treasuries and emerging market local currency bonds. We hold overweight positions in both.”