Franklin UK Mid Cap was one of the UK funds hit hardest in last year’s coronavirus crash and underperformed in the following rally but analysts argue that this shouldn’t be cause for concern for those holding this long-term outperformer.

The UK is expected to enjoy a strong resurgence this year after the uncertainty posed by Brexit and Covid-19 has been abated. While there is still a way to go, the continuing success of the vaccine roll-out has given hope that the UK will return to some semblance of normality later this year.

With this in mind, Trustnet turns the focus towards the £1.1bn Franklin UK Mid Cap fund which, after several very strong years of performance, went through a difficult 2020.

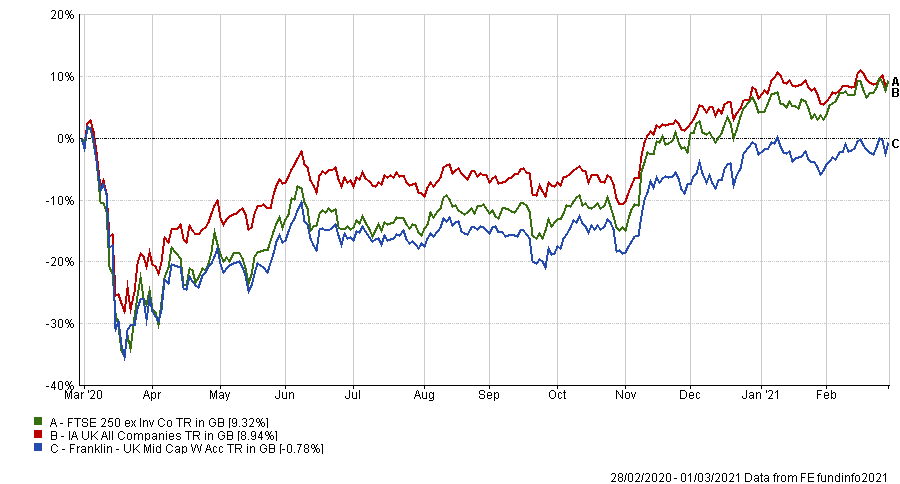

Indeed, since March 2020, the fund has made a loss of 0.78 per cent, while the average fund in the IA UK All Companies sector made a return of 8.94 per cent and the FTSE 250 ex Inv Co index gained 9.32 per cent.

Performance of fund vs sector & benchmark over 1yr

Source: FE Analytics

FE Analytics also shows that the fund’s maximum drawdown during the sell-off was a bottom-quartile 34.73 per cent, compared with 27.92 per cent for the IA UK All Companies sector. It was only slightly worse than the FTSE 250 ex Investment Companies index’s 33.72 per cent drawdown.

Therefore, Trustnet asked a selection of market commentators, when at this crucial juncture of UK resurgence, should investors hold onto or even buy Franklin UK Mid Cap - or should they sell-out completely?

Andy Merricks, manager of the EF 8am Focused fund, said: “By any measure, the fund has had a stinker of a 12-month period.

“However, it’s important when choosing to invest in, or stay invested in a fund to look at more than just a short-term timeframe, as long as the same manager is in place as previously.”

Richard Bullas and Mark Hall took the reins of the fund in 2020 but have both been part of the investment team since 2013. They took over when previous manager Paul Spencer retired at the end of 2020.

The investment approach focuses on individual company analysis and managing a concentrated portfolio of high-conviction ideas, holding companies with sustainable growth prospects and attractive valuations.

Merricks said: “I personally lean towards the mid- and-small-cap sectors in the UK when looking for better longer-term returns from the market and the concentration will mean that they will tend to do better should we negotiate the Brexit issues successfully.

“If you are already in the Franklin UK Mid Cap fund and have stuck with it this far, then I don’t see any obvious reasons to abandon it now. Whether you would commit new capital to it or are in favour of alternatives would be another question.”

Bullas and Hall have proved to be adept across other Franklin UK strategies and combine the expertise of themselves and other stock pickers in the Franklin UK Equity Income and Franklin UK Managers Focus funds.

AJ Bell analyst Laith Khalaf said: “Since the turn of the century, FTSE 250 stocks have been the place to be, and even more so if you’ve got a fund manager who can add selection gains to performance too.”

He added that Bullas and the “collegiate” team of managers he works with have significant experience in the sector and offer investors stock picking expertise in a dynamic area of the market.

“While 2020 wasn’t a great year, it came on top of three years of outperformance for Richard Bullas,” he said.

Performance of fund vs sector & benchmark in the years prior to 2020

Source: FE Analytics

Looking at data from 31 December 2016 to 31 December 2019, the fund was up 55.69 per cent while its benchmark made 31.22 per cent and the average peer in the IA UK All Companies sector was up 23.75 per cent.

“Bullas’ preference for undervalued companies is combined with a focus on quality characteristics that helps take some of the risk out of the investment approach,” Khalaf added.

“Mid-cap investors should always take a long-term view and expect choppiness, but this fund is a strong candidate for inclusion in a mid-cap portfolio.”

Adrian Lowcock, head of personal investing at Willis Owen, explained that usually a fund manager change can be cause for concern but agreed that Bullas’ long-association with the fund is reassuring.

He said the fund lagged in the second half of 2020 as momentum growth stocks led the market - which is an area this fund doesn’t invest in.

“The manager instead looks for companies which are attractively valued and he pays attention to the wider social and economic overview,” said Lowcock.

He noted that, as well as conviction in its existing holdings, the fund has added Greggs and Wetherspoons as two stocks that could perform well in the recovery.

As such, this will help to support its investments in housebuilding, engineering and building materials which were badly hit in the pandemic-driven downturn but could equally pick-up in the recovery.

“We believe the fund is well placed to benefit once the economic recovery gets underway due the fundamental strength of the companies held,” Lowcock added.

“Normally we would want to see how things settle in the fund with a new manager at the helm. However this is a close knit team and as such we have little concerns there will be much change and continue to rate this fund as a buy.”

Performance of fund vs sector & benchmark over 10yrs

Source: FE Analytics

Over the last 10 years, Franklin UK Mid Cap has returned 159.51 per cent, versus 135.81 per cent from the FTSE 250 ex Inv Co benchmark and 85.95 per cent from the average IA UK All Companies sector peer.

It has an ongoing charges figure (OCF) of 0.82 per cent.