With a positive outlook on Japan’s Covid-19 recovery, FE fundinfo Alpha Manager Shintaro Harada said he is focusing on five key themes for the long term in his Nomura Japan High Conviction fund.

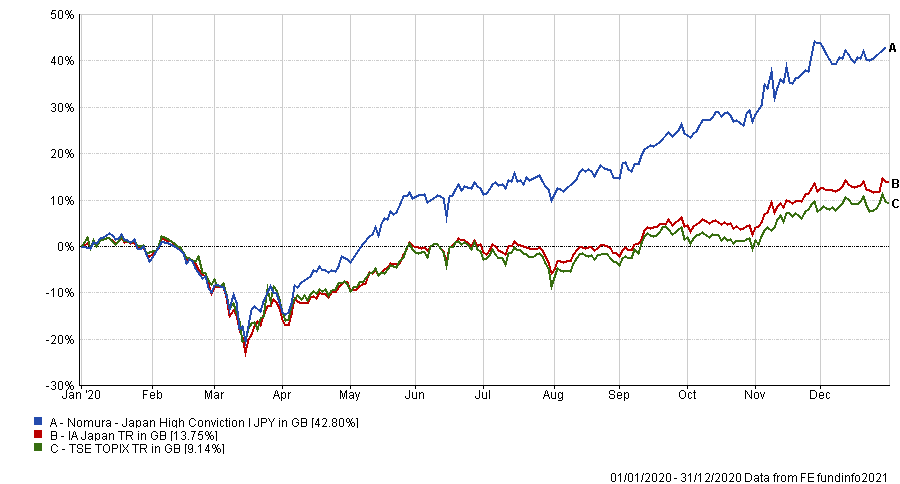

The £695m Nomura Japan High Conviction fund was the best performing IA Japan fund last year, making a total return of 42.80 per cent.

Performance of fund vs sector and benchmark during 2020

Source: FE Analytics

The fund has a benchmark agnostic approach, focusing on a concentrated portfolio of Japanese equities that Harada believes have strong, sustainable characteristics and can sustain a high return on equity.

Harada (pictured) explained that Nomura Japan High Conviction is focused on five themes that had been expedited by the pandemic, but he thinks will continue to provide opportunities over the long term.

These themes are factory automation, digitalisation, energy saving technology, ageing population and consumption growth in Asia.

The manager said several of the stocks within these five trends had proved to be “consistent winners in the coronavirus era”.

Factory automation

Harada highlighted Keyence Corporation as a play on first theme of factory automation .

The company specialises in developing products and facilities used in factory assembly lines, such as automation sensors, vision systems, barcode readers and laser markers.

With social distancing measures looking to remain enforced in the workplace indefinitely, this will drive the demand for higher levels of automation providing solutions to this, Harada said.

“The pandemic has given impetus for greater automation in many industries, as a post-lockdown world may require a reduction of human contact,” he added.

Energy saving technology

Within the energy saving technology trend, Harada highlighted Daikin, the Nomura Japan High Conviction fund’s biggest holding.

Daikin is a global company that develops air conditioners and air ventilation products. The air ventilation side of the business is the part Harada focused on more and thinks that this will become especially important in a post-pandemic world.

As more people work from home and a greater awareness of disease control is normalised, Harada said the air quality in indoors spaces will take on renewed importance.

He said: “Daikin has identified opportunities in providing antibacterial ventilation equipment for pharmaceutical production facilities and hospitals, air-conditioners that can automatically clean and disinfect, as well as expanding their sales of air purifiers.”

Another play on the energy saving technology theme is Nidec, which manufacture electric motors.

Harada explained that the demand for more energy efficient motor options looks set to continue in tandem with the heightened demand for more robotics, energy-efficient appliances, data centres and electric vehicles beyond the pandemic.

Consumption growth in Asia

Investing in the consumption growth in Asia theme, Harada holds Fast Retailing, which owns global brands such as Uniqlo.

Harada said Fast Retailing focuses on Asian markets in particular, which was beneficial during the pandemic as Covid-19 cases were more subdued there than other parts of the world.

“Fast Retailing appears to be better positioned compared to its global peers. While revenues declined in the first half of 2020, a recovery kicked in driven by a robust recovery in China and Japan. Uniqlo has shown resilience in the pandemic as workers choose to wear practical, affordable and comfortable casual wear that are suitable for working from home,” he said.

Digitalisation

Harada’s final stock pick is within the digitalisation theme.

M3 Inc is a medical web portal that has five main elements to the business, one of which is marketing for pharmaceutical companies. This allows medical firms to communicate with healthcare professionals virtually instead of face-to-face meetings.

Looking back at when Japan was in the midst of the Covid-19 pandemic, its experience was markedly different to other parts of the world, with notably lower cases and deaths while avoiding a full-scale lockdown.

Harada explained that despite the densely populated cities and ageing population, Japan’s ‘hybrid’ system of public and private healthcare managed to contain the virus. He said a lot of this was due to the general public’s willingness to follow stay at home and social distancing orders.

Harada said: “Many Japanese companies have shown their resilience in the face of the pandemic, staging a recovery with determination to maintain operations as safely as possible amid the pandemic.”

He added that when it comes to the recovery “Japan has the added advantage of its close proximity to China and other Asian countries where Covid-19 cases have been relatively subdued. These economies are also enjoying the earliest recoveries from the pandemic induced slowdown, which is also supportive for Japan.”

Discussing his outlook for Japan, Harada expects a return to some level of normalisation but added “the path to economic recovery is beset with uncertainty.”

“The recovery of China, Japan’s largest trading partner, highlights the advantages of global manufacturers that can rely on exports for growth,” he added.

“Since taking the helm, [Yoshihide] Suga’s government has pledged to cut greenhouse gas emissions to net zero by 2050, vowing to transform Japan's policy on coal-fired power generation, and boost innovation in renewable energy.”

Yoshihide Suga succeeded longstanding prime minister Shinzo Abe last year. Since coming into office Suga has already pledged significant economic stimulus worth $700bn to support the Japanese recovery.

As Harada mentioned the stimulus looks to promote new green and digital technology within Japan.

Harada said: “Faced with difficulties in responding to the pandemic, prime minister Suga has seen his approval rating fall over the recent months. However, I do agree with his policies to tackle inefficiencies in Japan, as they are vital to the future of the economy.

“These include reforming the inefficiencies within the government, establishing a national digital agency to push for the digital transformation of SMEs, as well as promoting digital transformation and work style reforms to increase white-collar productivity.”

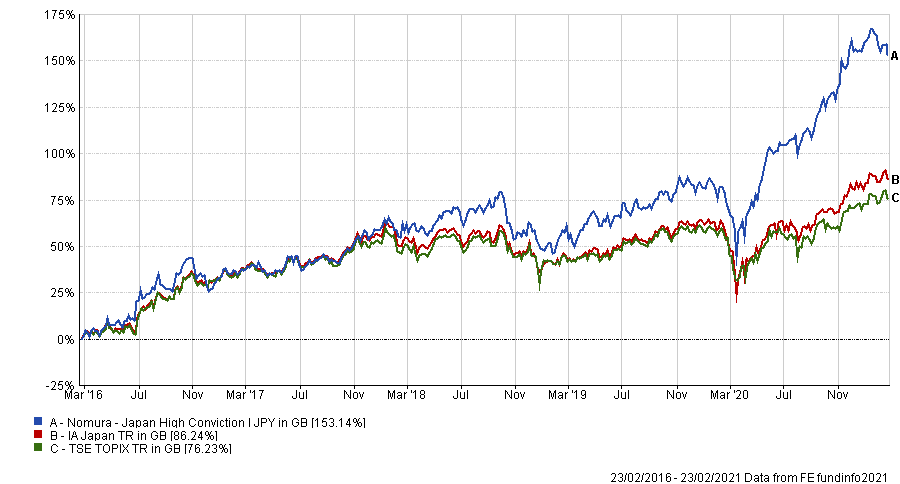

Over the past five years Nomura Japan High Conviction has outperformed both its IA Japan sector and the Topix benchmark, with a total return of 153.14 per cent.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

The FE fundinfo Five Crown rated fund has an ongoing charges figure (OCF) of 0.83 per cent.