If investors are planning to sell out of the of the M&G Optimal Income fund, what should they consider buying in its place?

The M&G Optimal Income fund is one of the best known strategic bond strategies, both for its size and flexible investment process. But more recently consistent outflows and near-term underperformance have brought the fund a different kind of attention.

Having looked at whether investors should sell out or remain in the M&G portfolio, fund pickers highlighted some alternative options.

M&G Global Macro Bond

When looking for an alternative to M&G Optimal Income, AJ Bell analyst Laith Khalaf said investors should be asking why they held it in the first place - whether for total return, income or more of a multi-asset choice.

“If you’re after a total return vehicle as a diversifier against the equities in your portfolio, I’d suggest considering another from M&G, the Global Macro Bond fund,” Khalaf said.

“The fund has a go-anywhere approach, which gives it the flexibility to seek out returns and protect investors if interest rates start to rise in developed bond markets.”

The $2.2bn M&G Global Macro Bond fund has been run by Jim Leaviss since 1999, with deputy manager Eva Sun-Wai joining at the start of this year.

The five FE fundinfo Crown-rated fund invests across a range of different markets and issuers based on in-depth analysis on global, regional and country-specific macroeconomic factors.

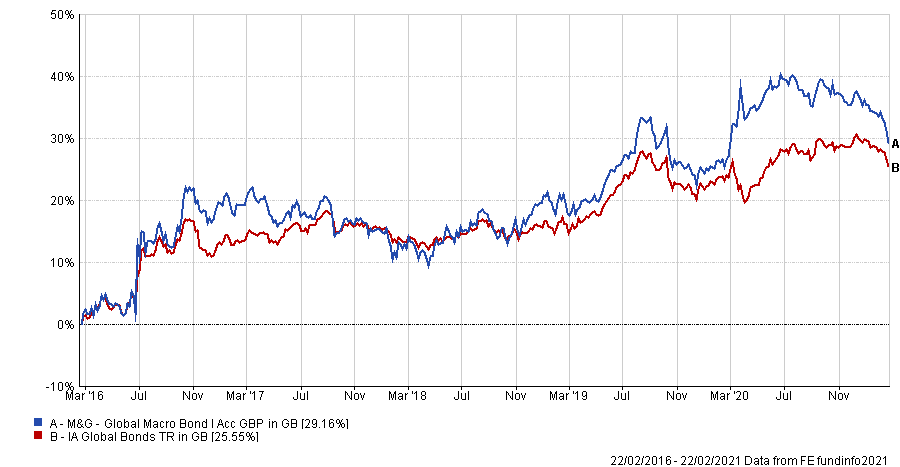

Over the past five years the fund has outperformed the IA Global Bonds sector, with a total return of 29.16 per cent versus 25.55 per cent.

Performance of fund vs sector over 5yrs

Source: FE Analytics

The fund has an ongoing charges figure (OCF) of 0.63 per cent.

Baillie Gifford High Yield Bond

But if an investor held M&G Optimal Income for income then an alternative could be the Baillie Gifford High Yield Bond fund, according to Khalaf.

Run by Robert Baltzer and Lucy Isles, the fund’s bottom-up process looks for 50-90 companies which the managers think can weather economic fluctuations, instead trying to time markets.

However, Khalaf pointed out that this portfolio will be “more highly correlated to equity markets”.

Over five years Baillie Gifford High Yield Bond has outperformed the IA Sterling High Yield sector, making a total return of 40.50 per cent.

Performance of fund vs sector over 5yrs

Source: FE Analytics

The £915.3m fund has a yield of 4.20 per cent and an OCF of 0.37 per cent.

Personal Assets Trust

Finally, if an investor is seeking out a multi-asset alternative Khalaf recommends Personal Assets Trust, which is managed by Troy Asset Management.

Run by FE fundinfo Alpha Manager Sebastian Lyon, the £1.4bn trust – which like all of Troy’s funds puts capital preservation at its core – invests in quality blue-chip equities, index-linked bonds, gold and cash.

Khalaf said that the trust’s ability to invest outside of just bonds is a positive in the current low interest rate environment.

He said: “Given where interest rates are, I’d be very wary of over-reliance in bonds in a portfolio simply because they are less volatile than equities, there’s still a large amount of risk baked into sky high prices.”

Compared to its sector and benchmark, Personal Assets Trust’s defensive positioning means it has underperformed over the past five years, shown in the graph below.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

The trust holds an FE fundinfo Crown rating of five and has ongoing charges of 0.86 per cent. It is running at a 1.1 per cent premium with currently no gearing and a dividend yield of 1.3 per cent.

Ninety One Global Total Return Credit

Picking something from the same sector as the M&G fund, Ben Yearsley, co-founder and director of Fairview Investing, highlighted the Ninety One Global Total Return Credit fund.

Although it also resides in the IA Sterling Strategic Bond sector, the Ninety One fund “is a very different position,” according to Yearsley, as unlike M&G Optimal Income it only invests in corporate bonds. It also approaches investment opportunities in a very different way to the M&G fund.

Yearsley said: “A key difference between this fund and the M&G one is this is driven by bottom-up factors, whereas Optimal Income is more of a top-down play.

“Only investing in corporate bonds sounds narrow, but the managers will look at a full spectrum globally and end up with 120 or so any one time. Each bond is considered on its own merits and has to be able to contribute towards the return target.”

The £186.6m Ninety One Global Total Return Credit fund is co-managed by Garland Hansmann, Jeff Boswell and Tim Schwarz.

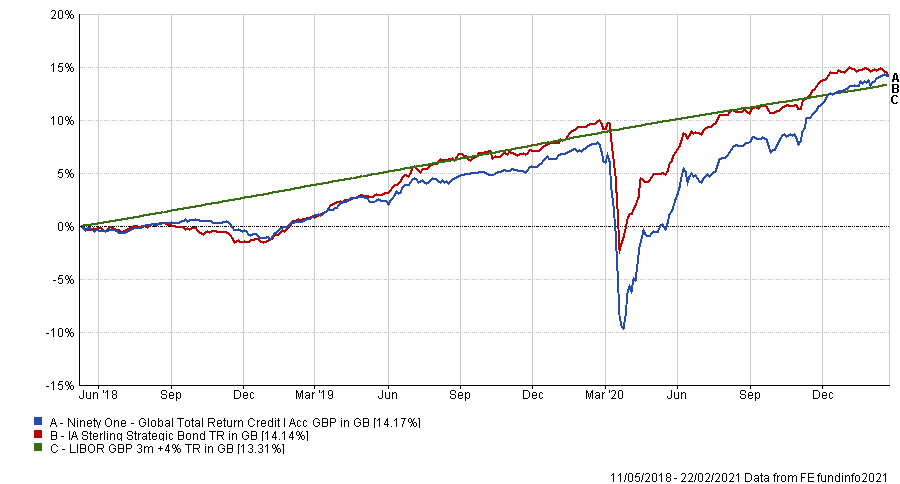

Since the fund launched in mid-2018 it has made a total return of 14.17 per cent, outperforming the IA Sterling Strategic Bond sector (14.11 per cent) and the LIBOR GBP 3m+4% benchmark (13.31 per cent).

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

It has a yield of 3.46 per cent and an OCF of 0.77 per cent.

Jupiter Strategic Bond

The final fund pick comes from Teodor Dilov, fund analyst at interactive investor, who chose the £4.3bn Jupiter Strategic Bond fund.

Dilov said that he liked the Jupiter Strategic Bond especially for investors with a lower risk profile.

He said that similarly to the M&G option the Jupiter fund “has the freedom to invest across the bond market, including high-yield bonds, investment-grade bonds, government bonds and convertibles, along with the use of derivatives to mitigate the risk of falling bond prices”.

The investment process is grounded in FE fundinfo Alpha Manager Ariel Bezalel’s views of the global economy.

Dilov said Bezalel uses this to determine how much risk is appropriate and which sector and countries present the best investment opportunities, while considering factors such as inflation, interest rates and economic growth.

“As avoiding losses is the strategy’s top priority, when investing in high-yield bonds the manager prefers the most senior bonds in a company’s capital structure – typically secured on the company’s assets. Companies that are paying down their debts over time and improve their credit worthiness are preferred,” he added.

Compared to its average IA Sterling Strategic Bond peer, Jupiter Strategic Bond has outperformed over five years, returning 29.15 per cent.

Performance of fund vs sector over 5yrs

Source: FE Analytics

It has a yield of 3.70 per cent and an OCF of 0.73 per cent.