Japan recovered well from Covid-19 due to stringent testing and effective lockdowns. However, an impressive virus response also exposed a few areas in need of reform and, under a new prime minister, long-term opportunities in the country have emerged.

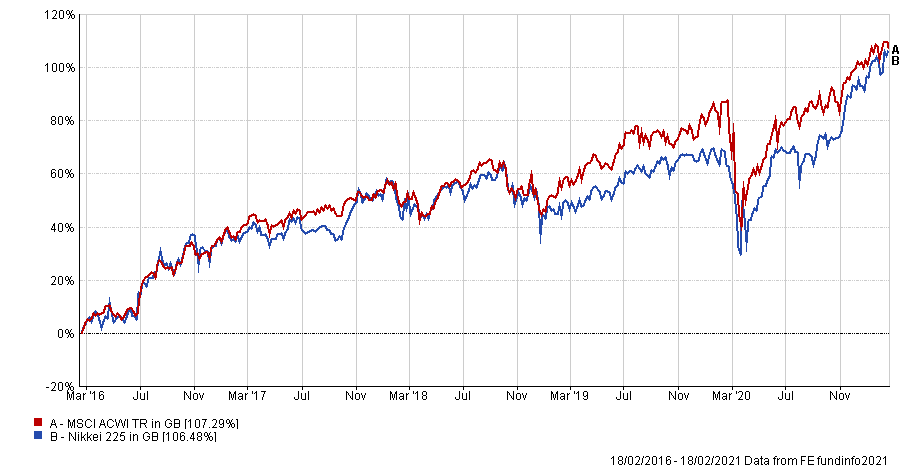

Earlier this week, Japan’s Nikkei 225 breached 30,000 for the first time since 1990, reflecting improving investor sentiment in the region.

As virus-related headwinds fade amid successful vaccination programmes, Japan looks well placed to enjoy in the global recovery, argued Fidelity Japan Trust manager Nicholas Price.

“Overall, I remain cautiously optimistic on the investment outlook for Japanese stocks,” he said.

“The Covid-19 pandemic clearly still poses near-term risks, but the gradual roll out of vaccines and continued monetary and fiscal policy stimulus are positive for the global growth outlook and will be supportive of Japanese equities.”

Performance of Japanese and global equities over 5yrs

Source: FE Analytics

With that, Price outlined that the markets are in an earnings driven phase, in particular individual stocks as oppose to the multiple expansion seen in 2020.

He also identified that digital infrastructure and clean energy are two important long-term opportunities in the country.

When prime minister Shinzo Abe stepped down in September of last year, market concerns regarding the transfer of power were abated with the election of Yoshihide Suga – an appointment that represented a continuation of the macroeconomic and foreign policies of the previous administration.

Suga also put the focus on domestic reform and, in particular, the digitalisation of the public sector which has severely lagged behind.

It was purported that government offices were reporting Covid-19 statistics on fax machines such was the level of antiquity in the sector.

“Radical changes in government infrastructure usually elicit strong opposition, but the Covid-19 crisis provided cover for an overhaul of the current system,” said Price.

“The digitalisation drive is also creating opportunities in the private sector, as the pandemic highlighted the need for companies to enhance their digital capabilities after years of underinvestment in their information technology IT infrastructure. “

The Fidelity Japan Trust has exposure to these technology holdings and software as a service (SaaS) companies.

“Going into 2021, the portfolio had a relatively large technology tilt, with a focus on globally competitive companies with strong balance sheets, reasonable valuations and a secular growth story,” he said.

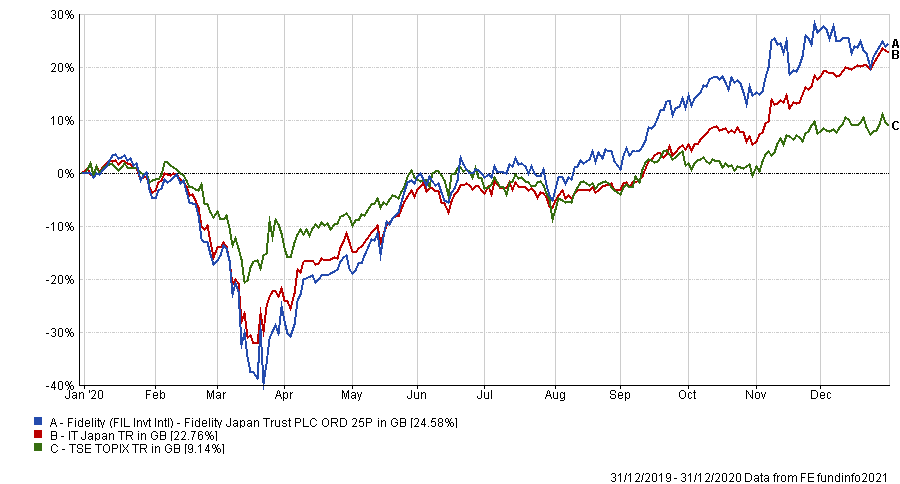

Performance of trust vs sector & benchmark in 2020

Source: FE Analytics

Over 2020, the £310.3m trust made a total return of 24.58 per cent, while the average fund in the IT Japan sector made 22.76 per cent and the TSE TOPIX index made 9.14 per cent.

With an eye on the next few years, the manager said that Suga’s commitment to reduce overall greenhouse gas emissions to zero by 2050 has the potential to throw up new investment opportunities in areas such as renewable energy and infrastructure spending.

“Clean energy and environmental efficiency are areas where Japan has some very competitive companies that can supply solutions to the regulatory and productivity needs of customers globally,” said Price.

“This is a core part of the portfolio and I expect related names to do well for the trust going forward.”

The IPO (initial public offering) environment in Japan picked up the second half of 2020, with more than 90 companies coming to market over the 12-month period.

Price said that this represented a modest uptick from 2019 as is in line with the average over the past five years.

“Being on the ground means that we see a lot of these new ideas and business models first-hand,” he added. “Continually meeting with pre-IPO companies enables us to identify the most attractive opportunities.”

Additionally, there was an uptake in M&A, or mergers & acquisitions activity, especially in terms of companies buying their listed subsidiaries.

Market reforms by the Tokyo Stock Exchange and enhancements to the Corporate Governance Code is expected to drive further consolidation in 2021.

“There are opportunities to invest in companies, particularly conglomerates and industrials, where business reorganisation could drive a rerating or at least act as a share price catalyst,” Price concluded.

Which other funds could enjoy in the recovery?

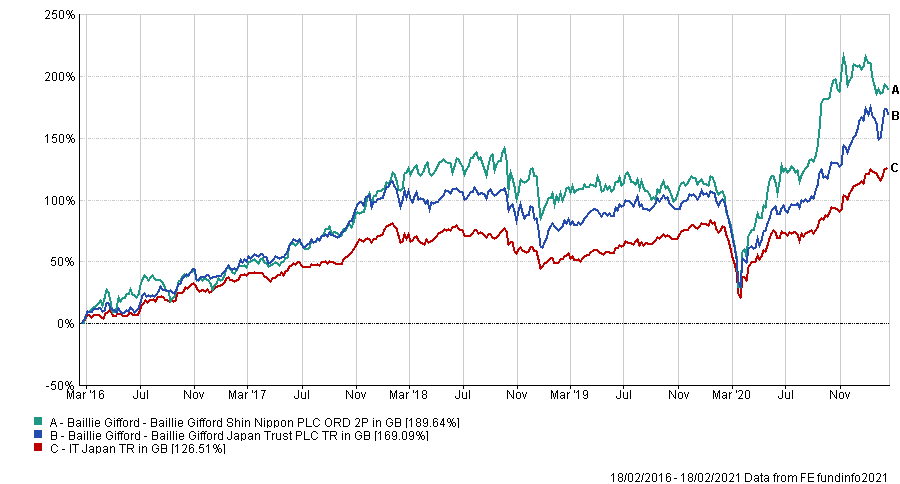

Rob Morgan, pensions and investment analyst at Charles Stanley Direct, said: “The Baillie Gifford Japan Trust captures many of the growth areas available among Japanese corporates.

“The managers believe the Japanese economy is undergoing structural transformation, with companies being run more efficiently and the service sector becoming larger and more dynamic.”

Morgan added that the focus on growth results in a higher risk collection of holdings, which is exacerbated by gearing of up to 20 per cent and an ability to invest in nascent unlisted companies, so investors need to be aware of this.

Similarly, the Baillie Gifford Shin Nippon portfolio contains 40-80 listed companies, often smaller and earlier stage, with up to 10 per cent allowed in unlisted investments.

“The fund has a more specific focus on innovative, disruptive business models representing the ‘New Japan’,” said Morgan.

Performance of trusts vs sector over 5 years

Source: FE Analytics

Over a five year period, the Baillie Gifford Shin Nippon trust made a total return of 189.64 per cent, while the Baillie Gifford Japan Trust returned 169.09 per cent. The average IT Japan sector peer posted a return of 126.51 per cent.

For a value-seeking approach, he suggested the Man GLG Japan Core Alpha fund.

“The fund applies a deep value approach to the Japanese market where some of the lowest valuations in developed markets can be found.”

Morgan added that it would be worthy of consideration to an investor looking for exposure to especially out-of-favour Japanese firms that could enjoy a rebound later this year.

“A cyclical upturn would favour the fund as the biggest sector overweight is banks, as well as iron & steel and autos,” he said. “If these areas really get going then it should be among the top performing funds in the sector.”

Performance of fund vs sector over 3yrs

Source: FE Analytics

Over three years, Man GLG Core Alpha made a loss of 6.17 per cent, while the average fund in the IA Japan sector made a total return of 25.20 per cent.