A record number of fund managers have been awarded an FE fundinfo Alpha Manager rating in the latest rebalance, after 2020’s ups-and-downs saw active funds outperform.

The FE fundinfo Alpha Manager rating aims to identify the top 10 per cent of UK retail-facing managers, based on their entire career performance. The rating is based on managers’ outperformance of a benchmark – or alpha – although the Sortino ratio (which is a measure of risk-adjusted alpha) is also considered.

In this year’s rebalance, 72 new managers were awarded FE fundinfo Alpha Manager status. This is the highest number of managers to ever be added to the Alpha Manager list in a single rebalance and takes the entire list to 199 managers.

Charles Younes, research manager at FE fundinfo, said: “One of the most important things the events of 2020 taught us in the investment world is the importance of good active management. Throughout the pandemic, the best performing fund managers were not only able to avoid the worst of the market collapse in March but were also quick to capture the upside.

“Many passive funds, meanwhile, which have grown in popularity in recent years, were left to the whims of the market, which faced unprecedented volatility. The Alpha Manager ratings illustrate how the most successful managers were able to navigate these challenges and have consistently added value for investors, in very different market conditions.”

Of the 72 managers who have just been added to the list, eight are with Baillie Gifford. The Edinburgh-based asset management house had an exceptional 2020, with many of its funds placing at the top of their respective sectors.

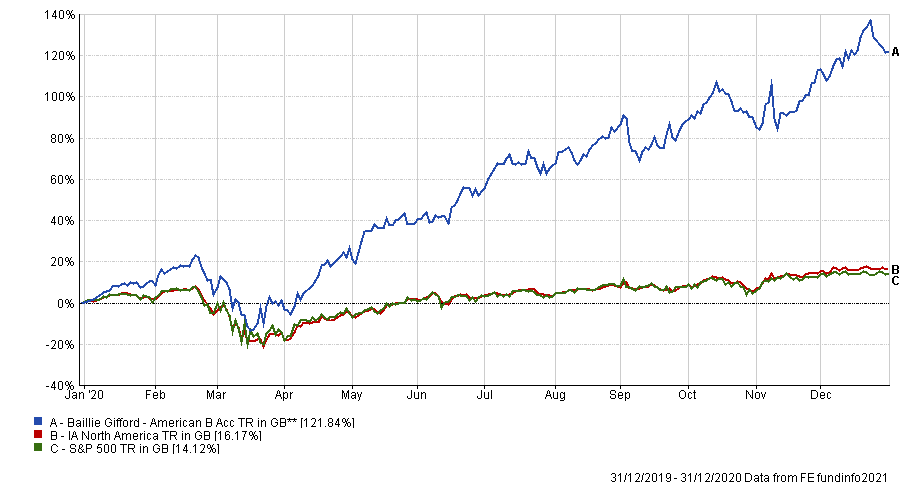

Among those being awarded an FE fundinfo Alpha Manager rating are Tom Slater, who works on the Baillie Gifford American fund - which generated the highest return in the whole Investment Association universe last year. Slater is also a co-manager on the well-known Scottish Mortgage investment trust.

Performance of fund vs sector and index in 2020

Source: FE Analytics

Other Bailie Gifford managers with newly minted Alpha Manager status include Charles Plowden, Roderick Snell, Mark Urquhart and James Dow.

Five of the new FE fundinfo Alpha Managers are with Nomura Asset Management: Ted Harlan, Vipin Kapoor, Keith Creveling, Brent Puff and Shintaro Harada.

Comgest Asset Management and JP Morgan Asset Management have four each. Chantana Ward, Richard Kaye, Makoto Egami and Caroline Maes are Comgest’s new Alpha Managers, while Miyako Urabe, Shrenick Shah, Amit Mehta and Anuj Arora hail from JP Morgan.

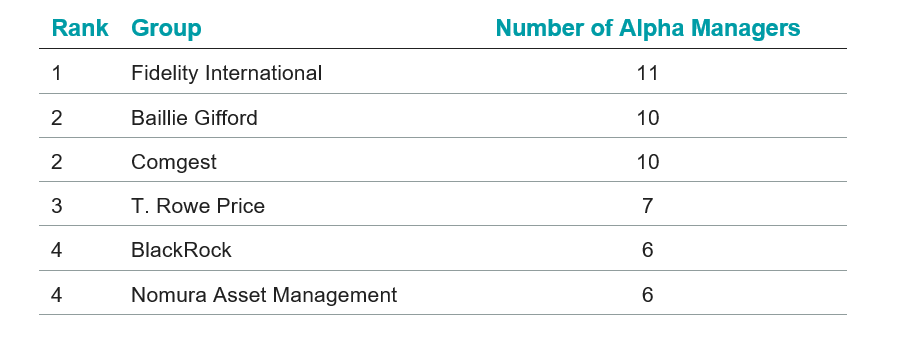

Looking at the entire list of 199 FE fundinfo Alpha Managers, however, it’s Fidelity that have the most making the grade with 11. In last year’s rebalance, the group was also at the top of the table.

Source: FE fundinfo

“Last year we noted that Fidelity had a number of Alpha Managers across a range of sectors, which was largely due to the collaborative environment they were able to create, where their support teams provided excellent feedback to the fund managers,” Younes said.

“This has once again proven to be the case with Fidelity seeing the highest number of its managers being conferred with Alpha Manager status. Once again, the success of Fidelity’s approach has been demonstrated, where their fund managers are provided with clear and accurate information allowing them to concentrate on managing money in line with their mandates, which has been especially important over the past year.”

The addition of new FE fundinfo Alpha Managers mentioned above has also seen Baillie Gifford and Comgest snap at Fidelity’s heels.

When it comes to Investment Association peer group, the most Alpha Managers are found in the IA Global sector. This popular sector is home to 43 Alpha Managers.

It’s followed by the IA UK All Companies sector with 18 Alpha Managers (although this is down sharply from 33 last year) while there are 16 in IA Europe ex UK.

For more information or for the full list of FE fundinfo Alpha Managers, please visit: www.fe-fundinfo.com