China has become a growing market of interest for international investors in recent years, with its equity market creeping up performance tables and its economy growing into one of the global leaders.

Last year, Chinese equity funds were among the best performers globally as China quickly got a hold of the Covid-19 outbreak allowing it to reopen its economy months ahead of other countries.

Indeed, IA China/Greater China strategies were among the best performers last year with the sector emerging as the second best-performing sector overall.

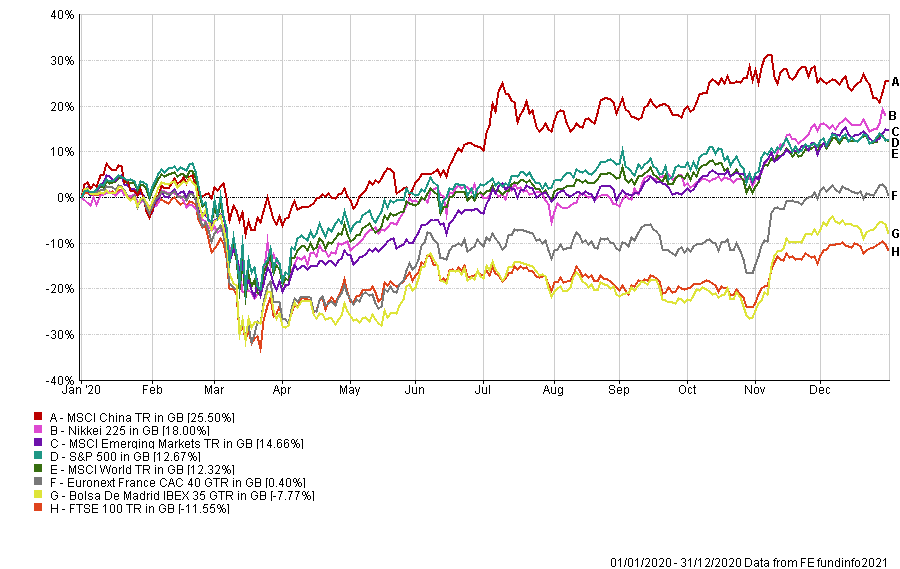

Performance of global indices in 2020

Source: FE Analytics

And the economy is primed for strong growth this year too, with the International Monetary Fund (IMF) forecasting 8.1 per cent growth, significantly stronger than developed markets and the overall global forecast (5.5 per cent).

It’s little surprise then that interest amongst investors in has been growing in tandem with funds returns.

According to data from the Investment Association, there was £646m in inflows to funds in the IA China/Greater China sectorin 2020 compared with a £129m outflow in 2019.

With investors interest in the Chinese market growing Trustnet asks whether a dedicated Chinese equities portfolio is the best way to access this market versus a broader emerging market or global portfolio.

“China remains woefully underweight in global investors’ portfolios by nearly any measure”

One advocate of a dedicated Chinese equities portfolio is Andrew Mattock, manager of several funds at asset manager Matthews Asia, including last year’s best performing IA China/Greater China fund, Matthews China Small Companies fund.

Matthews Asia has long advocated that investment in China requires an active approach, conducting thorough on-the-ground research into potential holdings.

Mattock (pictured) said: “As China looks to celebrate the Year of the Ox, the second animal of the Chinese zodiac which denotes hard work, determination and positivity, these characteristics have undoubtedly been important to China becoming the second-largest economy in the world.

“Today, China’s Shenzhen and Shanghai stock exchanges are now the third and fifth most liquid, respectively, in the world. Their universe includes over 5,300 Chinese and Hong Kong stocks with a market capitalisation greater than $50m.”

“And while China has been the key driver in global growth over the past decade – making up 15.8 per cent of global GDP and contributing 42 per cent of global GDP growth over the past decade – it remains woefully underweight in global investors’ portfolios by nearly any measure.

“We believe this slow reaction to the rise of China as a global economic power creates an opportunity for investors who are willing to lead the pack.”

He continued: “A dedicated China allocation can help narrow the gap between an investor’s existing allocation and China’s position in the world, today and in the future. Furthermore, it can provide exposures to China’s growth by looking beyond tech giants like Alibaba and Tencent.

“The breadth, depth and quality of companies accessible to investors have expanded dramatically in recent years. Global businesses that are recognised from insurers, sportswear brands, to fast-food chains, car manufacturers, coffee shops and even pharmaceutical companies have peers among listed Chinese equities.

“Meanwhile, domestic brands are emerging and demands for intellectual property protection are increasing. Technology companies provide solutions for consumer entertainment, health care, business efficiency and the distribution of financial products. Innovation is prevalent in the biotechnology and transport industries.

“China has made huge strides in developing an innovative consumer-led economy and deepening its capital markets. We believe this is a good time to see this reflected more fully in portfolios.”

Three reasons to bearish

However not all investors agree with the idea that to invest in China you need to hold a pure China equities strategy, as opposed to a global or broader emerging markets option.

Jason Hollands, managing director at Tilney Investment Management Services, acknowledged that the investment opportunity in China has grown significantly, but said a dedicated Chinese equity fund could actually be more limiting.

Hollands (pictured) said: “As the world’s most populated county and second largest economy, there is a no doubt that from an investment perspective China is too big to ignore. But tapping into exciting opportunities such as the growth of the Chinese consumer does not necessitate having to select from a fairly narrow selection of a dedicated Chinese equity funds.

“Firstly, many developed market listed companies like Burberry and Standard Chartered, earn a significant chunk of their revenues in China and so even a global, UK, European or US equity fund will likely be participating in the China growth story to varying degrees.

“Secondly, it is also the case that while China has both an enormous population and large GDP figure, you can’t invest in directly in these, you can only invest in what is actually available i.e. stocks and shares.

“In this respect, the Chinese equity market is a bit of a minefield which is littered with many state-owned enterprises that are ultimately beholden to the objectives of the Chinese Communist Party rather than shareholders.”

He added: “While growing, Chinese equities are also just 5.5 per cent of global equity markets as measured by the MSCI AC World index so exposure to Chinese stocks should be proportionate to the risks involved and only form a relatively modest part of a portfolio.

“In most cases, private investors can adequately achieve their exposure to China within the framework of a broader Asian or emerging market fund.

“China does, after all, represent around 40 per cent of the MSCI Emerging Markets index and is therefore the biggest component of most emerging market funds.

“Achieving exposure to Chinese equities through a global emerging market fund also means that your allocation will adjust depending on the relative outlook and risks compared to other high growth developing nations, such as India. In my view this adds an additional filter from a risk management perspective compared to committing to a high-risk single country fund.

“In my experience fund managers have tendency to become advocates for the market they specialise in.

“I think you’ll get a much more rounded perspective on China investing with a manager who can look across the whole emerging market complex when weighing up how much to invest in Chinese companies at a particular point in time.”