Having bounced back strongly following the outbreak of the Covid-19 coronavirus, more investors are looking to China to take advantage of the stronger economic growth in the world’s second-largest economy.

And with the lunar year of the ox almost upon us (12 February), Trustnet has spoken with four industry experts to find out which Chinese funds an investor should consider for their portfolio.

FSSA Greater China Growth

“According to the Chinese zodiac, those born in the year of the Ox are patient – a characteristic which could apply to the team behind the FSSA Greater China Growth fund,” said Amaya Assan, head of fund origination at Square Mile Investment Consulting and Research.

The fund – run by FE fundinfo Alpha Manager Martin Lau and co-manager Helen Chen – invests primarily in large- and medium-sized companies based in, or with significant operations in China, Hong Kong or Taiwan.

“As well as being patient, Oxen are fair and conscientious which fits with this fund’s focus on companies with a social purpose,” she said. “They believe that businesses that ignore their impact on the environment, or that do not look after their customers, employees, suppliers and the larger community are unlikely to be rewarding long-term investments.”

However, Assan said the markets in which this fund invests are prone to strong gains as well as significant falls.

“Whilst we believe this fund's objectives are achievable, it may face headwinds at times,” she said. “Its emphasis on quality, means the strategy may struggle in periods when investors are chasing certain themes or when riskier stocks are in demand.

“Overall, we see this fund as a very strong and wholly viable option for long-term investors who wish to access the greater China region, but in a more conservative manner, where the emphasis is on identifying high quality growth companies.”

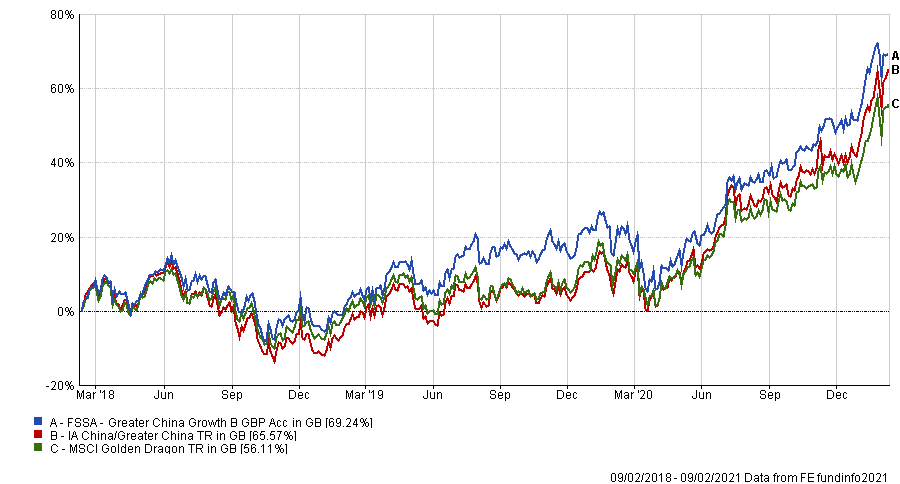

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

Over a three-year period, the £701.5m fund has made a total return of 69.24 per cent, compared to a 65.57 per cent gain for the average fund in the IA China/Greater China sector and 56.11 per cent for the MSCI Golden Dragon index. It has an ongoing charges figure (OCF) of 1.07 per cent.

Han Emerging Markets Internet & Ecommerce ETF / TM Cerno Pacific

Andy Merricks, manager of the EF 8am Focused fund, said investing in China funds has generally been a sensible thing to do over the past year, despite the misgivings that some investors may have.

He noted that the better performers, however, have little diversification, and all invest extensively in Alibaba, Tencent, Meituan, Pinduoduo and JD.com to varying degrees.

“The move by the Chinese authorities to clip the wings of Jack Ma and his Ant Group may sound a warning bell about becoming too reliant upon these to keep driving the performance,” he said.

As such, his first pick is the $349.1m Han Emerging Markets Internet & Ecommerce ETF.

“I’ve been a keen supporter of the opportunities that these types of company provide but have preferred to play them through this ETF which includes these companies, but which gives access to similar ones in other continents such as Latin America and Africa too,” he said.

“There is a strong Chinese dominance to the asset allocation within this ETF but spreads the risk a little, while not diluting returns particularly.”

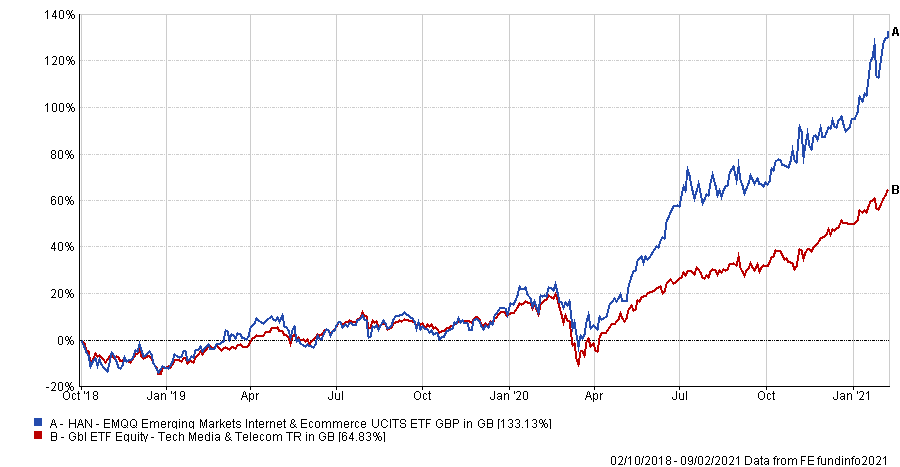

Performance of fund vs sector since launch

Source: FE Analytics

Since its launch in October 2018, the Han Emerging Markets Internet & Ecommerce ETF has made a total return of 133.13 per cent, while the average peer in the Gbl ETF Equity – Tech Media & Telecom sector has made 64.83 per cent. It has an OCF of 0.86 per cent.

For his second pick, Merricks recommended a fund that benefits from the effects of China, rather than just investing in China itself, and suggested the £75.1m, five FE fundinfo Crown-rated TM Cerno Pacific fund, overseen by Fay Ren and Michael Flitton.

“The Pacific region is dominated by China – there is no getting away from that – but this fund is different in that it gives access to the innovation that seems to thrive in Asia and, if you like, those companies that may do well because they are not Chinese,” he said.

“Opportunities are presented in the region which both piggyback off the growth of China yet exist because of their geographic proximity to China without the confrontation that can come from simply being China.

“The performance of the fund over 12 months is similar to, and in some cases better than, China-only funds,” he finished.

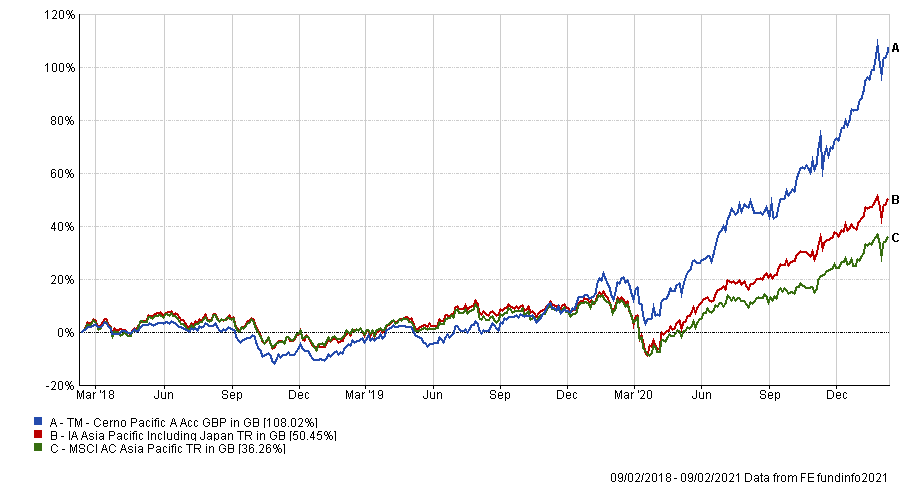

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

Over three years, the TM Cerno Pacific fund has made a total return of 108.02 per cent, while the average fund in the IA Asia Pacific Including Japan sector made 50.45 per cent and the MSCI AC Asia Pacific index made 36.26 per cent. It has an OCF of 1.28 per cent.

Fidelity China Special Situations

Rob Morgan, pensions and investment analyst at Charles Stanley Direct, chose the only investment trust in the list: the £3bn Fidelity China Special Situations fund run by Dale Nicholls.

“This represents a higher-risk option within the area,” said Morgan. “With significant concentration at the stock level and gearing of around 25 per cent, which exacerbates the gains and losses on the underlying portfolio.

“Nicholls makes full use of the investment trust flexibility. The manager will gear when deemed appropriate but also take short positions in single companies and indices.”

The trust has enjoyed recent strong performance, powered by large holdings in internet giants Tencent and Alibaba as well as several consumer stocks aligned with the growth of China’s middle classes. It also invests in private companies (to a maximum of 10 per cent of net asset value) with Bytedance (owner of TikTok) being a recent example.

“The trust is a differentiated and risker proposition than most of the other funds and trusts available but one that should fully harness the long-term growth potential of China,” Morgan said.

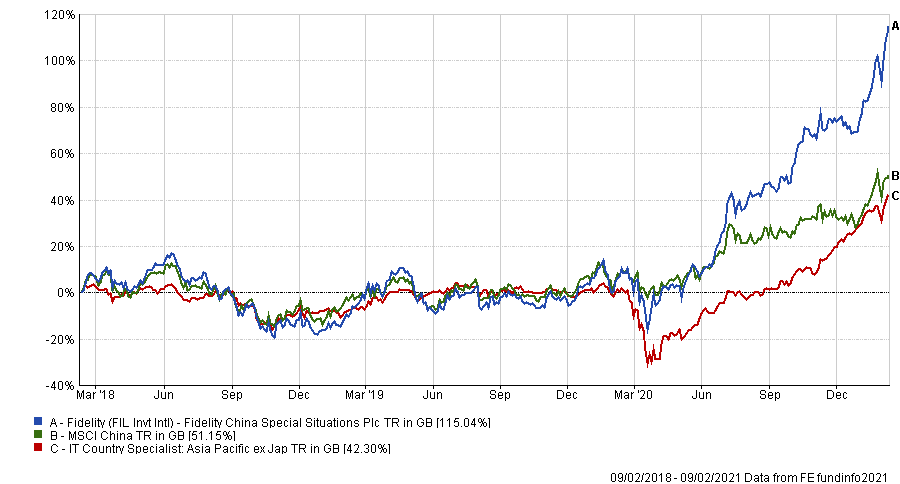

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

Over a three-year period, the trust has made a total return of 115.04 per cent, while its MSCI China benchmark made a gain of 51.15 per cent and the average fund in the IT Country Specialist: Asia Pacific ex Japan sector made 42.30 per cent.

The trust is 24 per cent geared, is trading at a 0.3 per cent discount to net asset value (NAV) and has an ongoing charges of 0.99 per cent.

Aubrey Emerging Market Opportunities

The final pick comes from Jason Hollands, managing director at Tilney Investment Management Services, whose choice is the $330.5m Aubrey Emerging Market Opportunities fund.

Veteran investor Andrew Dalrymple has been the lead manager since launch in 2015.

“The fund follows a ‘wealth cycle’ approach that seeks to identify each stage of development a country is going through and the sectors that will benefit accordingly,” said Hollands.

The four stages are rising prosperity (when countries are focused on developing their infrastructure), a behavioural change phase (when the middle class grows and new consumption habits develop); an innovation stage when there is more demand for technology and, finally, a maturity stage which drives interest in areas like financial services and healthcare.

He explained that the fund invests globally but is currently 53.6 per cent invested in China.

In particular, the fund has strong focus on the growth of the emerging market consumer with 39 per cent invested in consumer discretionary stocks and 29 per cent in consumer staples.

“After years focused on manufacturing exports and infrastructure, China’s long-term economic plan is now increasingly focused on consumption,” said Hollands.

He added: “China was first to be hit by coronavirus but locked down swiftly and is the first to re-emerge back into growth - this should gather pace during 2021.”

Performance of fund vs sector over 3yrs

Source: FE Analytics

Over the same period, the Aubrey Global Emerging Markets opportunity fund made a total return of 83.37 per cent compared to 30.34 per cent for the average peer in the IA Global Emerging Markets sector. It has an OCF of 1.19 per cent.