Schroder ISF Greater China, FSSA Greater China Growth and Matthews China Small Companies are some of the Chinese equity funds that have consistently outperformed their peers on a wide spread of measures, Trustnet research suggests.

With Chinese New Year upon us – and after a recent show of strong performance from Chinese stocks – Trustnet is spending the week looking at the world’s second-largest economy and the funds that invest in it.

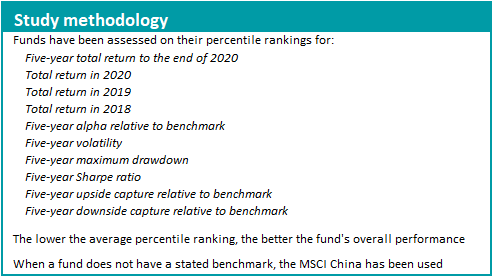

Kicking off this week of coverage is an analysis of the IA China/Greater China sector, which examines how its members have performed over the past five years when 10 different metrics are compared. The methodology of this study can be seen to the right.

According to FE Analytics, the average member of the IA China/Greater China sector made a total return of 125.37 per cent over the five years to the end of 2020, compared with 117.38 per cent from the MSCI China index (which is the most common benchmark in the sector).

In addition, the average Chinese equity fund was slightly less volatile, had a lower maximum drawdown and a better Sharpe ratio than the index.

But how have the sector’s individual members performed on these and other measures over the past five years?

Performance of fund vs sector and index over 5yrs to end-2020

Source: FE Analytics

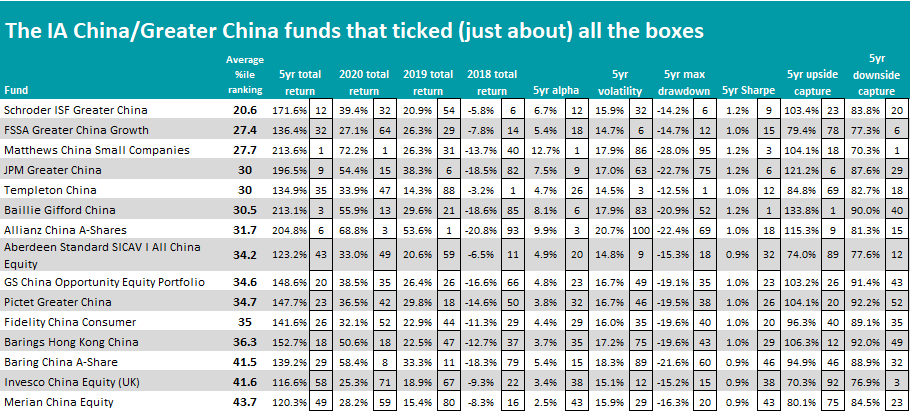

Sitting in top place with an average percentile ranking of 20.6 is Louisa Lo’s Schroder ISF Greater China fund. With assets under management of £2.8bn, this is the largest fund in the IA China/Greater China sector.

It has outperformed its average peer and MSCI Golden Dragon benchmark by a significant margin over the period under review, posting a 171.56 per cent total return. In addition, it has some of the peer group’s best numbers for metrics such alpha, maximum drawdown and Sharpe ratio.

The portfolio has a bias towards mainland Chinese equities (it currently has a 68.9 per cent weighting there), with another 16.9 per cent in Taiwan and 11.5 per cent in Hong Kong. Top holdings include Taiwan Semiconductor Manufacturing, Alibaba and Tencent.

In a recent note on Schroder ISF Greater China’s outlook and positioning, Lo said: “Economic growth in China is set to accelerate as the recovery continues and the impact of stimulus measures, launched last year, feed through.

“Sectors providing exposure to long-term growth themes in the region should continue to outperform. On the other hand, a broad global economic recovery on the back of the fading Covid-19 effects should support cyclical sectors. We continue to feel a balanced approach is warranted and we have both growth and value ideas in the portfolio.”

Source: FE Analytics

As the table above shows, FSSA Greater China Growth comes in second place in this research with an average percentile ranking of 27. Run by FE fundinfo Alpha Manager Martin Lau and Helen Chen, the £650m fund uses a quality-growth investment approach and focuses on companies that serve a social purpose.

While its five-year total return of 136.4 per cent puts it in the sector’s 32nd percentile and has been less successful than some in capturing the market’s upside, its overall score has been aided by strong performance when it comes to alpha, volatility, maximum drawdown, Sharpe ratio and downside capture.

Analysts at Square Mile Investment Consulting & Research, which gives FSSA Greater China Growth a ‘Responsible AA’ rating, said: “Given the emphasis on quality, this strategy might struggle in periods when investors are chasing certain themes or when riskier stocks are in demand. The upside to such an approach is that the team’s companies have tended to be more resilient in down markets and have, in aggregate, yielded solid risk-adjusted returns over the long term.

“We see this fund as a very strong and wholly viable option for long-term investors who wish to access the greater China region, but in a more conservative manner, where the emphasis is on identifying high-quality growth companies.”

Andrew Mattock and Winnie Chwang’s £232m Matthews China Small Companies fund came in third place thanks to an average percentile ranking of 27.7.

The fund’s 213.59 per cent total return over the five years under consideration is the highest of the IA China/Greater China sector and it also has some of the peer group’s best numbers for alpha, Sharpe ratio and downside capture. That said, its focus on smaller companies means it is one of the sector’s more volatile members and has been hit with its biggest maximum drawdown.

Given that less than 15 per cent of the portfolio is in large- and mega-cap names, many of the fund’s stocks – which include shipping services company SITC International Holdings, video sharing website Bilibili and glass product manufacturer Flat Glass Group – are some of the less-common holdings from the peer group.

Matthews China Small Companies was also the sector’s best performer in 2020 – a year when Chinese equities outpaced many of their international peers despite the coronavirus pandemic. In a recent note, the fund’s managers said: “From a global perspective, small companies generally faced greater challenges amid the pandemic than their larger peers, as larger companies tend to have more access to liquidity and resources during periods of economic strain.

“Nonetheless, small companies in China were strong performers in 2020, providing global investors with meaningful diversification and attractive equity price returns. One reason that China small companies stood out in the year was their focus on domestic demand and opportunities.”

Source: FE Analytics

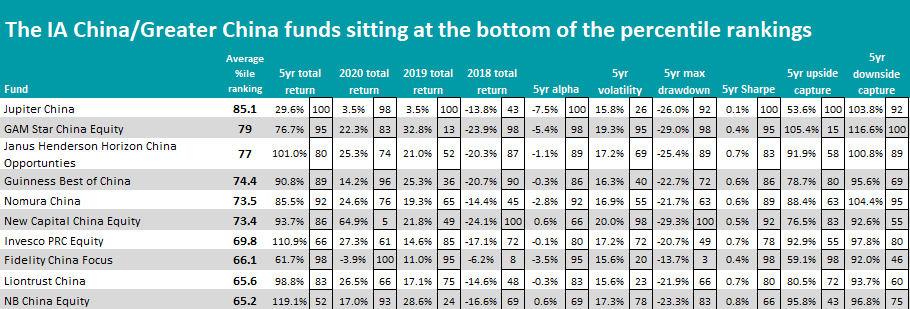

Turning this study on its head, the above table shows the 10 IA China/Greater China funds that have consistently underperformed across the metrics examined.

Jupiter China was the peer group’s worst performer with an average percentile ranking of 85.1, after it was at the bottom of the sector for its five-year returns, alpha, Sharpe ratio and upside capture.

Over the five years to the end of 2020, the fund made a total return of just 29.56 per cent – the lowest of the sector. This compares with 125.37 per cent from its average peer and is significantly behind the 61.66 per cent made by the next worst performer.