As US tech stocks continue to wobble, Trustnet looks at which funds have the most upside and downside exposure to the Nasdaq 100, an index that is home to some of the largest technology companies in the US.

Funds who have had large weightings to US tech have done extremely well over the last several years and indeed during the past six months as investors crowded into a few of the sector's biggest names during the recent rally.

While it has been an incredible decade for technology-led companies, with many industries disrupted by new entrants, the last three years – in particular – is where the performance has accelerated.

Performance of the Nasdaq 100, S&P 500, MSCI World over 3yrs

Source: FE Analytics

In sterling terms, the Nasdaq 100 index over the last three years has delivered a total return of 96.96 per cent, compared with 44.23 per cent from the blue-chip S&P 500 index, and 31.28 per cent from the broader global equity market represented by the MSCI World index.

However, it is worth noting that just five tech stocks – Apple, Microsoft, Amazon, Facebook and Alphabet, the so-called FAANGs – make up roughly 45 per cent of the market cap-weighted Nasdaq 100. If Tesla and Netflix are included, this figure goes up to more than half of the index.

This compares with the S&P 500 where the same five FAANG names make up around 21 per cent of the index.

Much of the market has been driven by the rally in a few tech names and many fund managers may have found themselves being dragged into them in order to not stray too far from their benchmarks.

If a manager avoided adding to these few tech companies as they became bigger constituents of the index, they would inadvertently be underweight relative to the index.

Holding anything other than tech would have then negatively affected returns on a relative basis when compared to the funds who continued to add as they rose.

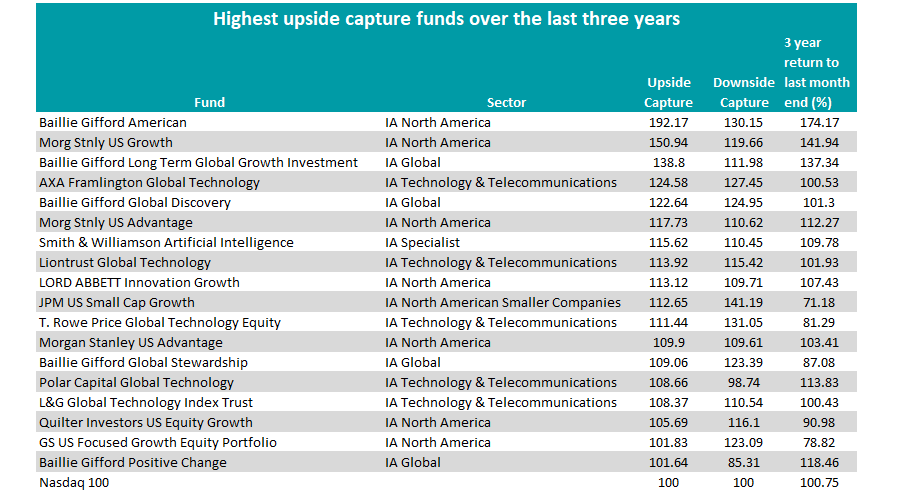

With this in mind, Trustnet looked at the funds with the highest upside capture over the past three years compared to the Nasdaq 100 to find out which participated most when the index rose.

The downside capture was also included to show the behaviour of the funds during downwards moves in the index.

Funds with the highest upside capture over the last 3yrs relative to the Nasdaq 100

Source: FE Analytics

As the above table shows, some 18 funds have exhibited higher upside capture to the Nasdaq 100 benchmark in the last three years.

It should come as no surprise that the majority of the funds that benefited the most from the performance of US tech stocks are North American or technology-focused.

There are five technology-focused funds with higher upside capture relative to the Nasdaq 100, and eight North American funds.

Of the top five highest upside capture funds, three were managed by growth-focused asset manager Baillie Gifford.

The £4.9bn Baillie Gifford American had the highest upside capture and the highest returns of those in the list. The fund is co-managed by Tom Slater – head of US equities and a manager of the popular Scottish Mortgage Investment Trust – as well as Gary Robinson, Kirsty Gibson and Dave Bujnowski. Its largest three holdings are in Tesla, Shopify and Amazon.

Interestingly, four of the funds with higher upside capture to the Nasdaq 100 were global funds, all of which were also Baillie Gifford-run. One of these funds also has the lowest downside capture in the list; the £1.19bn Baillie Gifford Positive Change fund.

Another fund that stands out is the only specialist fund that made the list: the £491m Smith & Williamson Artificial Intelligence fund run by Chris Ford and Tom Day. It has its largest three holdings in Alphabet, Tesla and Microsoft.

Commenting on the data, Adrian Lowcock (pictured), head of personal investing at Willis Owen, said: “The rebound in markets and particularly the US market has been led by a handful of US tech giants with many companies more closely linked to the economy lagging behind and not recovering as much.

“Investors should be wary of having too much in technology, the sector has been the main and almost only driver of the market rally and further profit-taking looks likely as investors will rotate into other, cheaper areas of the market.”

He added: “The issue at the moment is that many fund managers are all holding the same stocks from Amazon to Alphabet or Apple to Facebook, so there is a lot of concentration in this area of the market – many investors chasing the attractive returns and an increasing fear of missing out.”

James Clark, senior fund analyst at Hawksmoor Investment Management said: “For people who are underweight or have been resisting because of valuation multiples, it would have been tempting for them to loosen that discipline and get on board.

“At the same time, kudos to those who have kind of held their nerve and stuck with their valuation discipline or their preferences towards other regions – if it’s a global fund – and stuck to their course.”

While high upside capture to tech stocks and the Nasdaq 100 may be welcome, having a higher downside capture could be problematic for large cap-focused strategies when tech valuations come into question.

When tech begins to wobble and the Nasdaq 100 falls, a fund’s underperformance can also be proportionately higher.

Hawksmoor’s Clark continued: “I think if you are holding a successful growth fund, you need to know where the performance is coming from or where it might not be coming from in other sectors or areas.

“In this situation you have to be comfortable that a fair bit of the performance has come from tech and that may well continue.

“If I was completely in cash on the sidelines it would be a brave investor who piles in now, I would be looking for a bit more of a pullback to get involved.”

The analyst stressed the importance of knowing what kind of tech exposure is in a particular portfolio and understanding what degree of related exposure a manager has.