Global markets are going their third major crisis in 20 years, amid an unprecedented pandemic that could change society and the economy for ever.

The bursting of the dotcom bubble, 2008-9 global financial crisis and the ongoing coronavirus pandemic have all presented different challenges to investors.

With that in mind Trustnet asks long-serving fund managers which crisis out of the three was the worst to be in the middle of.

Coronavirus

One thing all market crises share is the potential for a ferocious economic and financial impact on individuals, investors and even entire global systems.

But the coronavirus crisis is unlike anything before, because it hasn’t been caused by poor policy makers or financial misconduct. Instead it has been catalysed by a health crisis, triggering major social, financial and economic disruption, which is still ongoing.

Indices performance start of 2020 to coronavirus crash

Source: FE Analytics

This is part of what makes coronavirus the most scary crisis that Franklin Templeton’s Colin Morton has seen across his lengthy career. He is worried by the fact that it came out of nowhere and doesn’t appear to be dissipating anytime soon.

Morton, who has managed the £810.9m Franklin UK Equity Income fund through all three financial crashes, said what made the current crisis different and more worrying is how out of the blue it was and how fast great companies started suffering.

“Where this one is different from the other two, in my opinion, is the other two were sort of predictable,” he said. “I’m not going to start saying that ‘I predicted coronavirus - this one came from absolutely nowhere and that was what made this really difficult, because this has come from completely left field.”

From a UK perspective, the virus’ impact on the market has been especially detrimental, according to Morton.

To date, the FTSE 100 has lagged other global markets, as the country has struggled to balance controlling the virus and reopening businesses and the economy.

Global indices performance YTD

Source: FE Analytics

Morton said 2020 initially looked like it would be a year of growth for the UK, as markets entered the year riding the ‘Boris Bounce’ after the Conservative’s landslide win. This helped to settle market’s uncertainties concerning Brexit.

“But things changed so quickly this time around,” Morton said. “It went from looking reasonably OK to awful within the space of a very short period of time and the types of companies you needed in your portfolios almost changed within a few weeks.”

The manager, who is Franklin Templeton’s head of UK equities, said market leaders and really good businesses “are being challenged [and] it’s not really their fault - they just happen to be impacted by this. And that’s what’s making this really difficult”.

Morton added that it’s not the case that he found the dotcom bubble and the 2008 banking crisis easy. In fact, in the run-up to the dotcom crisis “from a performance point of view felt terrible” for Morton, because he didn’t own popular, internet growth stocks.

He said: “If you weren’t invested in the ‘New Economy’ and you had your ‘Old Economy’ stocks like boring consumer stocks and boring tobacco, you were getting absolutely carried out.

“Even though those companies were doing nothing wrong nobody wanted them, they just wanted to buy the highly rated growth stocks and the next big thing.”

But this time, the solution to the crisis is not a financial bailout or implementing new economic theory. It’s a vaccine and that’s part of what makes it the scariest, Morton said.

“I’m sure that things will eventually get better this time as well, [but] it seems much more difficult because you don’t know whether this pandemic goes on for another couple of years or whether it’s three months or six months. It’s already started to get worse again in many parts of the world yet again now,” he said.

“The problem with this one is that we’re sort of in the lap of the gods to an extent because you just don’t really know when it’s going to end or how it’s going to end. I don’t know if you always feel more scared of the one you’re currently in or not.”

Global financial crisis

But not all of Morton’s peers agree with him.

Out of the three crises, the 2008-9 global financial crisis was, by far, the worst and most scary for several fund managers.

Aberdeen Standard’s Harry Nimmo, Liontrust’s Robin Geffen and Premier Miton Investor’s David Hambidge all said that the banking crisis was the hardest from an investment standpoint.

Nimmo (pictured), who managed his ASI UK Smaller Companies fund since 1997, said: “The banking crisis […] was so much scarier than this one.”

“There was a stage in say October-November 2008 when the entire world’s banking system was about to collapse.

“All these financial leaders hit the wall and that was pretty scary. And it had the feel of a long and serious depression afterwards.”

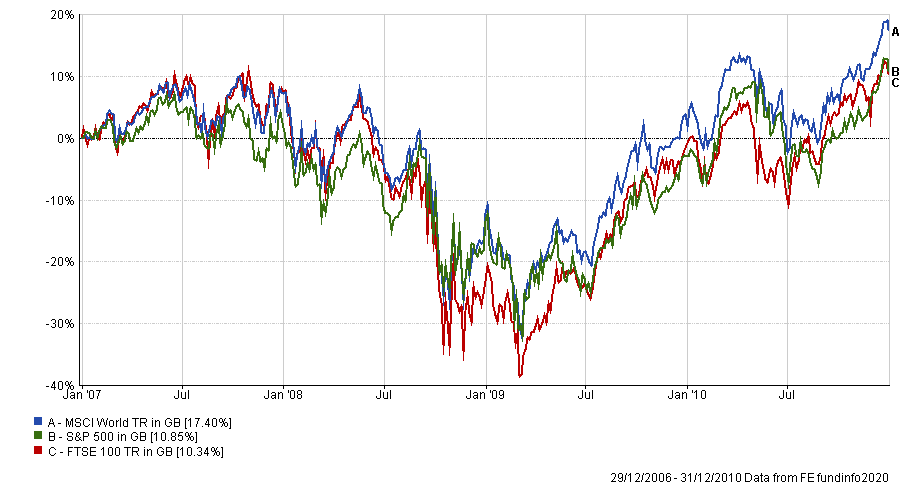

UK, US and global markets during the 2008-9 crisis

Source: FE Analytics

Nimmo added: “I just remember thinking ‘Oh my God the Bank of Scotland are going to go bust in the next few days’. You’d never seen anything like it, not in my lifetime or anybody’s lifetime. And that was the most serious no question about it.”

Geffen seconded Nimmo’s experience, adding: “The global financial crisis was the most worrying, for the reason that for a period of a couple of weeks it looked like there might be a complete meltdown of the financial system which could result in chaos and even anarchy.

“In contrast, during the bursting of the dotcom bubble, it was just that some companies which were not making money were hyped up.”

Every crisis is different and worrying for its own reasons, Hambidge said, although the banking crisis was the worst experience for him.

Having guided his £1.2bn Premier Multi-Asset Distribution fund through all three, Hambidge said: “Every crisis is different, although there are certainly similarities between the dotcom bubble in the late 90s and what is going on in some areas of the market today, especially in technology stocks.

“2020 has certainly been the most disruptive crisis due to lockdown/social distancing.”

But when looking at the crises from a fund management perspective, he said: “I think from an investment standpoint, the financial crisis was worse with the banks being the cause of the problem, while today they are much stronger and part of the solution.”