News that veteran value investor Tom Dobell is to step down as manager of the £1.4bn M&G Recovery fund has got some investors wondering whether now might be the right time to start considering alternatives.

Dobell (pictured), who initially enjoyed a strong bout of performance when he took over the fund in the early 2000s has seen performance lag as the value style has fallen out of favour over the past decade.

Stiasny will take over management of the fund at the end of the year and bring a ‘refreshed investment approach’, focusing more on recovery opportunities in the mid-cap space.

However, as the fund transitions to a new focus, some investors may be considering other recovery-style funds as alternatives.

Below are six alternatives recommended by fund pickers.

Fidelity Special Situations

This £2.2bn Fidelity Special Situations fund is run by FE fundinfo Alpha Manager Alex Wright – who has been managing it since 2014 – and Jonathon Winton.

Wright took over the fund from Sanjeev Shah and it had previously been managed by veteran investor Anthony Bolton, during which time it had recorded strong returns.

Jason Hollands, managing director at Tilney Investment Management, praised the fund’s impressive returns in the past and is a fan of the Wright’s clear and disciplined approach.

“He is a contrarian investor, who likes to back out-of-favour companies on attractive valuations where he sees the potential for a significant uplift once the market re-rates the stock,” he said. “He doesn’t just target cheap shares and wait, but looks for a trigger.

“This can be where a turnaround plan is being put in place or where the business has growth options that have been unrecognised by the wider market.”

Performance of fund vs sector & benchmark under Wright

.png)

Source: FE Analytics

Since Wright took over management of Fidelity Special Situations it has returned 15.90 per cent versus a 20 per cent gain for the FTSE All Share’s 118.62 per cent and a 20.83 per cent return for the average IA UK All Companies peer. It has ongoing charges figure (OCF) of 0.91 per cent.

ES R&M UK Recovery

The£146m ES R&M UK Recovery fund launched in 2008 and has been run by Hugh Sergeant and is recommended by Teodor Dilov, fund analyst at interactive investor, who praised the manager’s impressive track record of over three decades of investing.

He said: “This fund has a very well-diversified portfolio of 290 stocks, with one-third of assets featuring in the largest constituents of the UK stock market.

“The fund invests in recovery stocks – good businesses that are currently experiencing below-normal profit levels – which are depressing their valuations.

To warrant inclusion in the portfolio, a company must have capabilities to help itself out of this predicament.”

He continued: “Sergeant adds holdings at fire-sale prices in volatile times. This increases the possibility of long-term capital gains, as well as a performance profile that deviates significantly from the benchmark FTSE All Share index.”

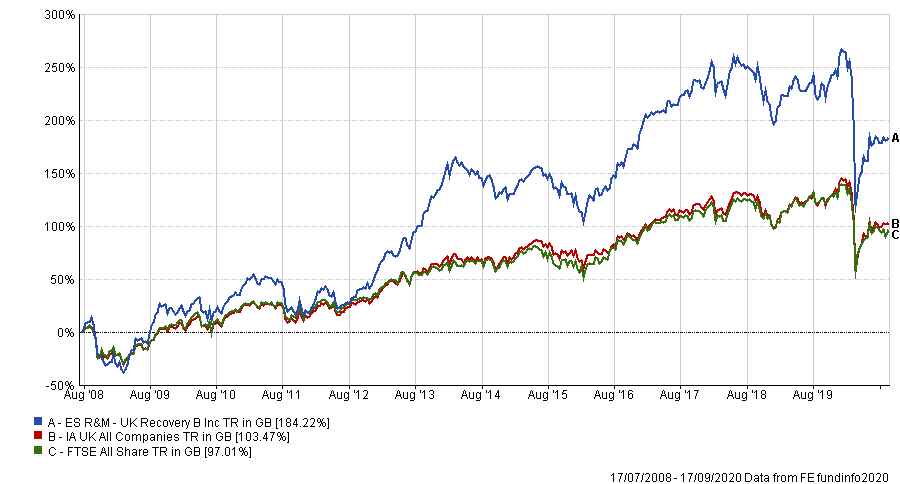

Performance of fund vs sector & benchmark since launch

Source: FE Analytics

ES R&M UK Recovery has returned 184.22 per cent over since inception versus the MSCI United Kingdom IMI benchmark’s 88.93 per cent and the IA UK All Companies sector average of 103.45 per cent. It has an OCF of 1.11 per cent.

Man GLG Undervalued Assets

Next up is the £1bn Man GLG Undervalued Assets fund launched in 2013 managed by Alpha Managers Henry Dixon and Jack Barrat. It is backed by AJ Bell’s head of active portfolios Ryan Hughes.

“Dixon would be the first to admit that 2020 has been a struggle as his focus on out of favour companies has not been rewarded,” said Hughes.

“However, Dixon has a calm and patient approach and full confidence in investing differently to the benchmark and this approach has allowed him to invest in areas such as Ryanair and the UK housebuilders during the correction in March.”

Hughes said: “While it may take a little while for these moves to pay off, that is the essence of value investing which is somewhat removed from the ‘get rich quick’ approach of much of today’s technology focused winners.”

Hughes said that whilst the fund could be volatile, as part of a diversified portfolio, it acts as a good complement to growth- and quality-focused funds.

Performance of fund vs sector & benchmark since launch

Source: FE Analytics

Man GLG Undervalued Assets has returned 23.10 per cent since launch in 2013 versus the FTSE All Share’s 21.91 per cent and the IA UK All Companies sector average of 24.25 per cent. The fund has an OCF of 0.9 per cent.

JOHCM UK Dynamic

Chelsea Financial Services’ Darius McDermott recommends the £1.4bn JOHCM UK Dynamic fund, a multi-cap strategy launched in 2008 and run by Alpha Manager Alex Savvides.

“After more than 10 years in charge, manager Saviddes has produced one of the most interesting multi-cap equity funds in the UK sector,” said McDermott. “He has a contrarian approach, looking for companies going through a period of change.

“He will use conviction when others are uncertain and, unusually for a fund focusing on capital growth, it produces a naturally good level of dividend yield.”

The fund has 47 holdings, with its largest positions in drugmaker GlaxoSmithKline, miner Anglo American and private equity group 3i.

Performance of fund vs sector & benchmark since launch

Source: FE Analytics

JOHCM UK Dynamic has returned 125.11 per cent since inception versus the FTSE All Share’s 79.61 per cent and the IA UK All Companies sector average of 84.08 per cent.

It has an OCF ongoing charges of 0.79 per cent.

Schroder Recovery

Another fund pick from Chelsea Financial Services managing director Darius McDermott is the £730.1m Schroders Recovery fund run by Kevin Murphy and Nick Kirrage.

McDermott said: “This quietly aggressive, value-driven fund has been run by the same lead managers since 2006, with a continuity of process and a very consistent track record.

“They invest in companies that have suffered a severe business or price setback, but where the managers believe long-term prospects are good.”

The fund has 40 holdings according to its latest factsheet, with its largest positions in Anglo American, Wm Morrison Supermarkets, and educational publisher Pearson.

Performance of fund vs sector & benchmark under Murphy and Kirrage

Source: FE Analytics

Schroder Recovery has returned 119.97 per cent under the pair versus the FTSE All Share’s 94.12 per cent and the IA UK All Companies sector average of 96.40 per cent. It has and OCF of 0.91 per cent.

Jupiter UK Special Situations

McDermott also likes the £1.6bn Jupiter UK Special Situations fund, contrarian strategy launched in 1996 and run by Ben Whitmore since 2006.

“Whitmore is hugely experienced and has had considerable success running this type of mandate throughout his career,” McDermott explained. “He follows a methodical and well-defined investment philosophy, looking to buy stocks that are out-of-fashion with the market.”

McDermott said the fund offers investors access to a well-diversified portfolio. It has 33 holdings according to its latest factsheet, with its largest positions in GlaxoSmithKline, DIY group Kingfisher and insurer Aviva.

Performance of fund vs sector & benchmark under Whitmore

Source: FE Analytics

Jupiter UK Special Situations has returned 116.18 per cent under Whitmore versus the IA UK All Companies sector average of 79.97 per cent. It has OCF of 0.76 per cent.