Investing in the IA Targeted Absolute Return sector over the last 10 years has been anything but straightforward amidst large outflows and weak returns that have damaged the reputation of the sector.

An absolute return strategy in its simplest form aims for positive returns regardless of market volatility. But investors have felt let down by this style of investing as for a few years now they haven’t enjoyed any upside of the decade-long bull market and haven’t protected on the downside following the coronavirus sell-off.

With that in mind, Trustnet has taken a closer look at absolute return funds to discover which have had the most positive months over the past decade.

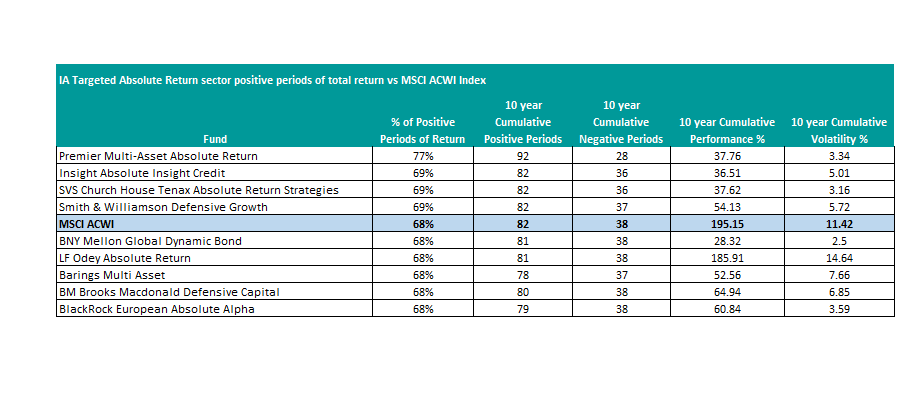

We’ve used the MSCI AC World index for comparison, as it has been on a (largely) upward trend for much of the past 10 years and it seems reasonable to assume that absolute return funds should be able to keep pace with a rising market. We’re not trying to find absolute return funds that have made more money than global equities (which are up 195.15 per cent), just those that have been able to make money in more months.

FE fundinfo data shows the MSCI AC World has achieved positive returns in 82 of the 120 months of the past decade. The average IA Targeted Absolute Return fund, on the other hand, was in positive territory in 80 months; eight other sectors have a better track record, including IA Sterling Strategic Bond, IA Technology & Telecommunications and IA UK Smaller Companies.

Sectors positive months vs global equities over 10yrs

Source: FE Analytics

With global equities making a positive return in 68 per cent of the months we examined, just four absolute return funds – out of 41 – have managed to beat this. In the last 10 years, the fund has made a return of 37.76 per cent with annualised volatility of 3.34 per cent (compared with volatility of 11.42 per cent from global equities).

The winner by a clear margin is the £150.3m Premier Multi-Asset Absolute Return fund, run by David Hambidge, Ian Rees, David Thornton and Simon Evan-Cook. Over the past 10 years, it has had 92 positive months – or 77 per cent of the periods looked at here.

IA Targeted Absolute Return sector positive periods of total return vs MSCI ACWI Index

Source: FE Analytics

It is managed with a funds of funds approach, although it holds more than use ‘pure’ absolute return strategies and has property and bond funds among its holdings. But alternative investment strategies make up over 60 per cent of its portfolio, with Man GLG UK Absolute Value, Polar Capital Global Absolute Return and Twelve Insurance Best Ideas being some of its biggest holdings.

Premier Multi-Asset Absolute Return fell 11 per cent in the coronavirus sell-off but has made 10 per cent since then to post a 1.53 per cent loss for 2020 so far. In April, its managers said: “We expect volatility will continue, and we will look to take advantage of the dislocation in asset prices, while keeping cash available for opportunities which will inevitably present themselves in the coming months.”

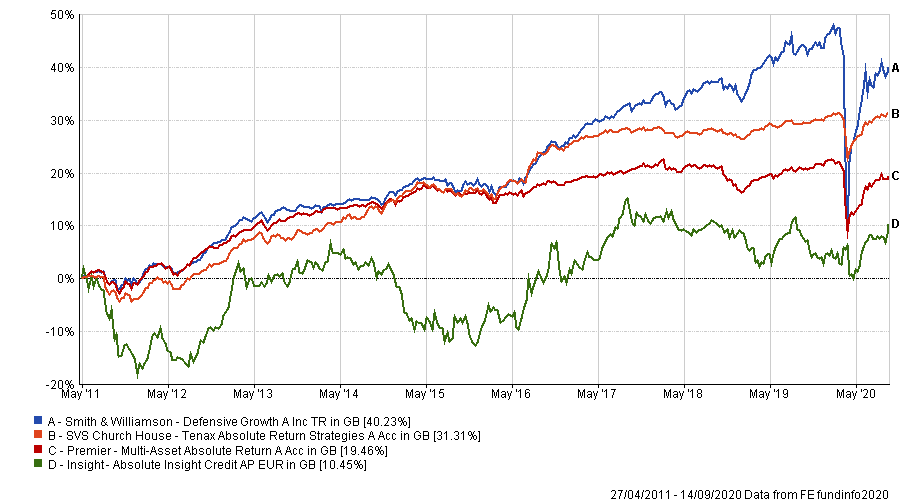

Second on our list is the £164.8m Absolute Insight Credit fund, which has been managed by Lucy Speake since 2017. It has enjoyed positive returns in 69 per cent of the months we examined and has returned 36.51 per cent over that time.

However, it has the highest level of volatility amongst the funds in the top five, at 5.01 per cent.

The SVS Church House Tenax Absolute Return Strategies fund also had positive returns in 69 per cent of months in the last decade, with 82 positive periods out of a possible 120.

Managed by James Mahon and Jeremy Wharton, the fund has returned 37.62 per cent in that period. With an emphasis on capital perseveration, the fund has high proportions in cash with only 8.6 per cent in equities.

With the highest returns amongst the four funds, the Smith & Williamson Defensive Growth fund has made 54.13 per cent, albeit with a volatility of 5.72 per cent. Similarly, to its peers, it has made positive returns in 82 months out of a possible 120, equalling 69 per cent.

Performance of funds over 10yrs

Source: FE Analytics

Managed by James Burns and Genevra Banszky von Ambroz, the defensive fund has 32.80 per cent in global equities and 23.90 per cent in UK equities.

Commenting recently on the coronavirus crisis, the managers said: “In the real economy the damage will be significant, and the long-term impacts are not yet known. We continue to use the decades of experience and considerable insight of our investment team to help negotiate difficult markets.”

As would be expected, no absolute return fund has beaten the MSCI AC World for total returns over the past decade, although some have come close.

LF Odey Absolute Return fund, run by James Hanbury and Jamie Grimston, is up 185.91 per cent over the past decade. However, it comes with a high volatility percentage of 14.64 with 81 positive months out of 120.

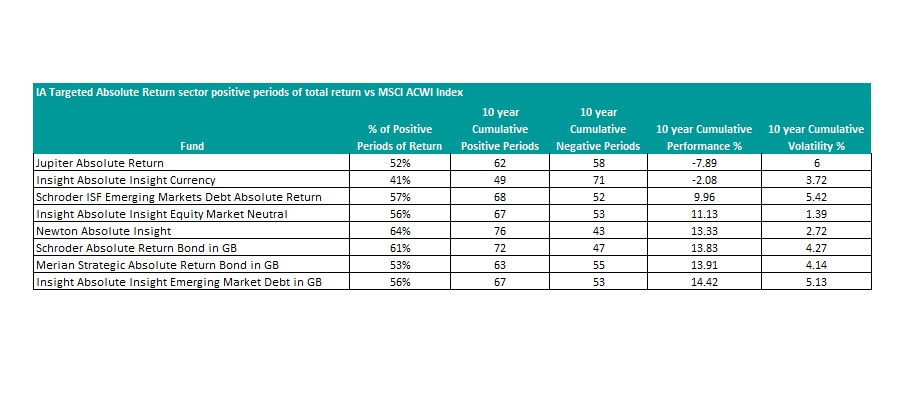

While Premier Multi-Asset Absolute Return and others have given their investors more positive months than global equities, some have trailed far behind.

Funds with the lowest performance over 10yrs

Source: FE Analytics

The £47.6m Absolute Insight Currency fund has made positive returns in 41 per cent of months in the last decade, making a loss of 2.08 per cent over the full period. The fund invests in global currencies through futures and options and the Polish zloty, Chinese renminbi and Korean won make up the largest holdings.

But the Jupiter Absolute Return fund, managed by James Clunie, is more recognisable and sits second from the bottom. It has made positive returns in 52 per cent of months sampled, compared with 77 per cent for the Premier Multi-Asset Absolute Return fund.

The fund has some strong periods of performance but has struggled over recent years, owing Clunie’s bets that the underperforming value style would come into its own and short positions in surging tech stocks like Tesla.

The fund was £1.5bn in size at the end of 2018 has seen significant outflows since then and waned in popularity, with assets falling to just £293.5m today.

“To us the current environment feels most similar to 2000, which saw a growth stock/technology, media and telecoms (‘TMT’) bubble and the elimination of several well-reputed investors just before the turn,” Clunie said earlier this year.

“Even though the market finally started to fall in March 2000, large-cap growth stocks kept climbing until Intel’s profit warning in August 2000, and then the rotation from growth to value really got underway.”