There is no reason that the transformative reforms put in place by departing Japanese prime minister Shinzo Abe should not continue to make the country an attractive investment destination, according to Matthews Asia managers Taizo Ishida and Shuntaro Takeuchi.

Under Abe, Japan enacted more flexible fiscal policy and structural reforms that included improving corporate governance and monetary easing from the Bank of Japan (BOJ).

Widely referred to as “Abenomics”, it aimed to boost the Japanese domestic economy following years of deflation since the asset price bubble burst in the early 1990s.

However, since Abe announced his decision to step down due to health problems there have been questions about whether a successor – now confirmed as Yoshihide Suga – would continue to back the reforms.

As such, Ishida and Takeuchi, managers of the Matthews Japan fund, discuss the transition of power and the three reasons why Japanese equity markets will not return to pre-Abenomics days.

“In our view, we assign a low probability that the [new] prime minister would radically change the current course of policies,” said the pair.

“While Japan’s domestic economy is still in a recessionary environment amid the outbreak of Covid-19, we expect fiscal policy will likely continue as it has been and remain more accommodative than other developed countries.”

From a central bank standpoint, Japanese monetary policy will remain under the guidance of current BOJ governor Haruhiko Kuroda until his current term ends in April 2023.

While the managers expect a short-term shock to equity markets in the near term, they do not foresee Abe’s resignation sending markets back to before 2012, which they described as being characterised by high volatility and uncertainty.

They outlined a strong yen, foreign investment and valuations as the three reasons Abenomics will sustain in the near term.

During Abe’s second term, the exchange rate between the US dollar and Japanese yen has risen from sub-¥80 level to $1 in 2012 to over ¥120 in 2015.

Performance of Japanese yen in US dollars since 2012

Source: XE.com

“We believe the move in part was led by Abe’s policies,” the managers said. “But it was also led by the more accommodative monetary policy overseen by the BOJ’s relative monetary policy stance among major central banks and US/Japan bond yield spread widening.

“Among these, all but the BOJ’s monetary policy has been already suggesting a stronger yen, as the Federal Reserve and the European Central Bank also have a more accommodative monetary policy and bond yields.

“We believe these have all contributed to the strengthening of the Japanese yen over the past few years.”

They added: “In our view a number of factors, including the BOJ solely stopping its accommodative stance and the US 10-year bond yields going well below its current levels will be required to continue to see improvement in the value of the Japanese yen in the long term.”

The Matthews Asia fund managers also identified foreign investor flows as an important legacy of Abe’s premiership.

“Foreign investors remain major buyers of Japanese equities. In 2013, foreign investors were net buyers of ¥15trn of Japanese equities,” said the pair.

However, foreign investors have also been net sellers of Japanese equities for the past few years since then, and year-to-date 2020 revealed a net selling of nearly ¥8trn.

“In terms of flows, the majority of Abenomics inflow has already gone out, leaving the Japan market as one of the more underweighted regions in the broader global equity context,” added Ishida and Takeuchi.

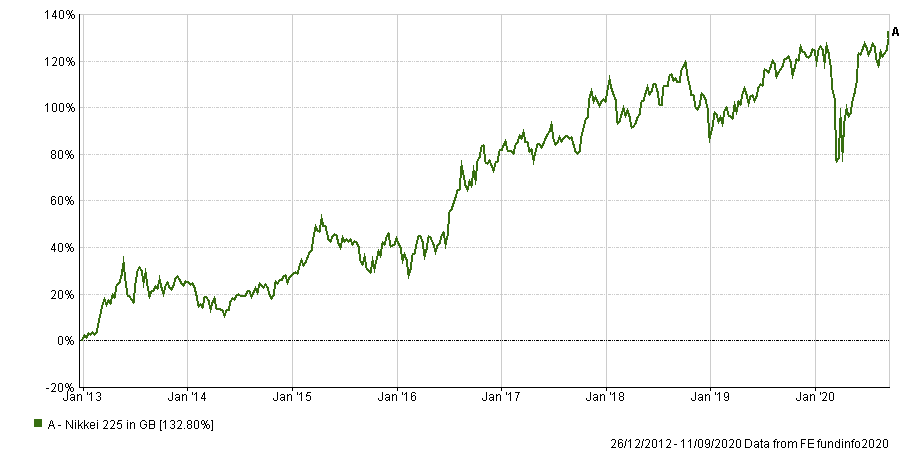

Performance of Nikkei 225 since 2012

Source: FE Analytics

Since December 2012, the Nikkei 225 – a valuation-weighted index of the 225 largest Japanese companies – has made a 132.8 per cent total return.

“Despite a strong decade of Japanese equity performance, valuation levels have stayed more or less the same, and in recent years, have come down more often than not,” said the managers.

“Japanese equity performance has been driven primarily by corporate earnings growth, and less so as a result of expansion directly attributed to policies under the Abenomics era.”

The managers explained that an active approach to stock selection is essential for capturing long-term growth in Japan.

“While many companies in Japan are innovating and growing, Japan’s broader market indexes have not yet caught up to this trend of innovation,” said the pair.

“Japan’s growth story remains about individual companies rather than its overall economy and we believe Japan’s future is grounded in innovation, automation and intellectual property.

They concluded: “In our opinion, continuity of economic policy should provide a strong foundation for continued growth opportunities among Japanese equities.”

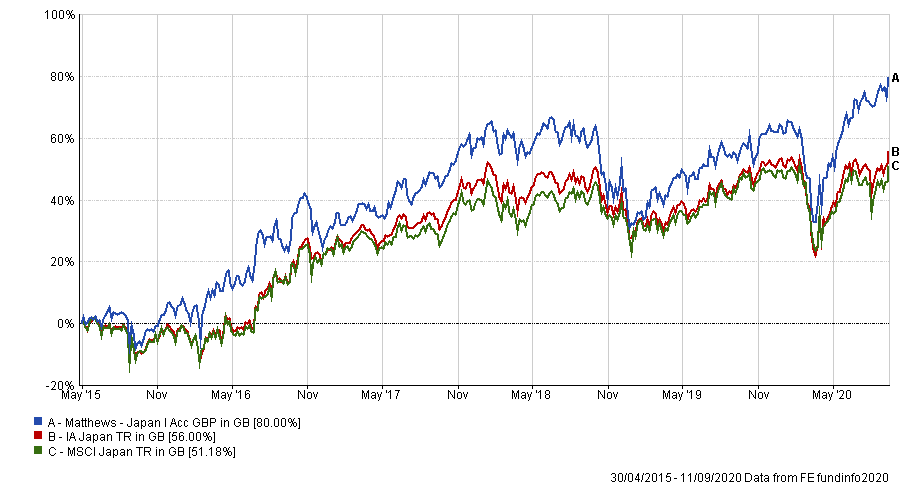

Ishida has overseen the $142m, four FE fundinfo Crown-rated fund since launch in April 2015 and was joined by deputy manager Takeuchi last year.

Performance of fund vs sector & benchmark since launch

Source: FE Analytics

Since launch the fund has made a total return of 80 per cent compared with 56 per cent for the average IA Japan peer and a 51.18 per cent gain for the MSCI Japan index. It has an ongoing charges figure (OCF) of 1.17 per cent.