Global value funds such as Ninety One Global Special Situations and Schroder Global Recovery managed to make money when tech stocks were selling off last week but should this signal that now is the time to shift out of the mega-cap tech names that have led the past decade?

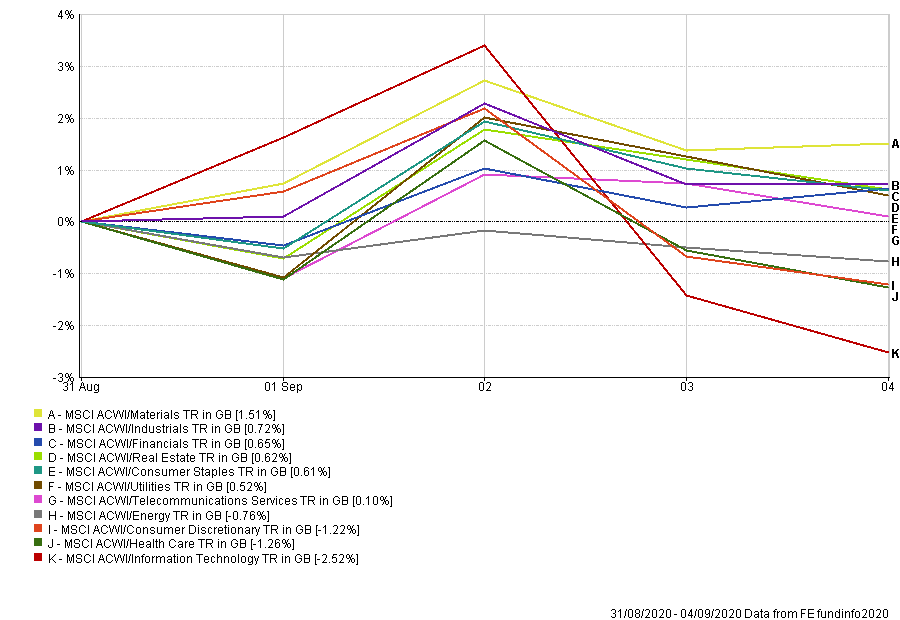

Tech stocks came under pressure last week and sold off aggressively, with the MSCI ACWI Information Technology index dropping 5.73 per cent (in sterling terms) over 3 and 4 September.

Some of those tech names that have grown to become some of the biggest companies in the world were among those hardest hit. Apple dropped by almost 8 per cent, while Microsoft fell more than 7.5 per cent and Amazon was down over 6.7 per cent.

In contrast, areas like financials, energy and telecommunications – which have lagged behind tech for much of the recent past – lost less than 1 per cent.

Performance of global industries last week

Source: FE Analytics

Helal Miah, investment research analyst at The Share Centre, said: “There seems to be no definitive trigger for this sell-off but analysts and economists would point to several factors including the slowdown of the economic recovery in many countries, hopes of an anti-virus in the not too distant future meaning that we could get back to work and resume travelling, a stalling of the next round of fiscal stimulus in the US and some profit-taking ahead of a long weekend in the US.

“Another theory is that there is finally a realisation by some investors that tech stocks are overvalued which is why they were dumped yesterday for some of the more ‘old economy’ stocks and those that have been beaten up during the crisis, especially the travel stocks.”

Given that tech stocks have performed so strongly for the past decade (the MSCI ACWI Information Technology index is up 582 per cent over 10 years) and some questioning when they will eventually start to underperform, Trustnet looked at where the impact of last week’s sell-off was felt most keenly.

Of course, it has to be kept in mind that past performance is no guide to future returns and two days is a very short period over which to judge performance.

On a sector level, it should be little surprise that IA Technology & Telecommunications was the worst performer in the sell-off, with an average loss of 4.36 per cent. This does mean that the average tech fund held up better than the index.

Other tech-heavy sectors were also hit hard, with IA North American Smaller Companies (down 2.71 per cent), IA North America (down 2.71 per cent) and IA China/Greater China (down 2.56 per cent).

The only sectors that made money over the two days in question were fixed income and cautious multi-asset peer groups, headed by IA Global EM Bonds – Local Currency and its 0.55 per cent total return.

Turning to individual funds, the highest return came from LF Purisima PCG, which was up 3.48 per cent during the tech dip. The fund resides in the IA Unclassified sector and is not available to most investors, however.

Eight funds made total returns in excess of 2 per cent on 3 and 4 September, including Omnis Managed Adventurous and Quilter Investors Cirilium Dynamic Passive Portfolio while LF Odey Absolute Return was close behind with a 1.94 per cent gain.

The highest performers from across the Investment Association universe are a very mixed bag, so we focused on the IA Global sector – which is a mainstay of investor portfolios and an area where they have been tilting towards in recent years.

Source: FE Analytics

The table above shows the 25 global equity funds that had the strongest returns over the two days that tech stocks were selling off.

It’s topped by VT Greystone Global Growth, which is a multi-manager fund. The £89.2m fund has made decent returns over longer time frames, sitting in the IA Global sector’s top quartile over one, three, five and 10 years.

However, even a quick look at the table will show a clear theme – that global value funds came out best when tech stocks were hit. These funds have tended to make some of the sector’s lowest returns in recent years as the growth style (which favours holdings in tech) outpaced value by a wide margin.

Jupiter Global Value Equity, Ninety One Global Special Situations, M&G Global Strategic Value, JOHCM Global Opportunities and Schroder Global Recovery are some of the funds that held up best last week.

At the same time, the global funds at the bottom of the table for last week’s dip include many of those that have ridden high thanks to the growth and tech rally.

Baillie Gifford Long Term Global Growth Investment, Baillie Gifford Global Discovery, Morg Stnly Global Opportunity, Wellington Global Quality Growth and Seilern World Growth are some of those that fell to the bottom of the sector for the two-day period.

A similar picture can be seen in other sectors, with value funds gaining as tech sold off and growth strategies bearing the brunt of the hit.

But does this mean investors should be moving away from tech stocks and towards cheaper parts of the stock market?

Andy Merricks, manager of the 8AM Focussed fund, agreed that the market can often undergo significant shifts, noting that value outperformed for more than three decades between 1975 and 2008 before handing market leadership over to growth investing.

However, he concluded: “For those who think (and hope) that the recent surge in growth stocks is over, remember that the period of outperformance for value stocks lasted 33 years. This current trend has lasted 12 years so far.

“When you look at the reasons behind this outperformance, and the roles that modern technology have played in challenging the very constituents of old world order, it is very hard to make a case for this recent momentum to be over just yet. In fact, in any time soon.

“There will almost certainly be a snapback by value over growth, albeit most likely relatively short-lived, and we don’t want to miss out on it. Like our growth themes though, we aim to be selective in what we’re investing in. Are sectors such as banks and oil & gas where you really want to be investing for the future as opposed to cybersecurity and artificial intelligence? We’d argue not.”