While investors flocked to defensive assets when markets sold off at the beginning of the Covid-19 pandemic, riskier assets have performed strongly over the past six months as governments have unveiled various packages of support.

Indeed, the average IA UK Index Linked Gilts fund was down by 5.39 per cent in August, while the IA UK Gilts sector reported a loss of 3.83 per cent.

“August was a poor month for defensive assets as UK government bond yields rebounded having fallen to record low levels on the back of concerns of a US/Chinese trade war, which began to ease,” said Adrian Lowcock, head of personal investing at Willis Owen.

“This, combined with renewed optimism of a stronger recovery because of better than expected US consumer spending data, as well as higher inflation, led investors to shift away from defensive assets.”

Despite the disappointing performance of the sectors in August, the two gilt sectors are in positive territory year-to-date and there are some funds that have achieved strong returns in the months since the March sell-off.

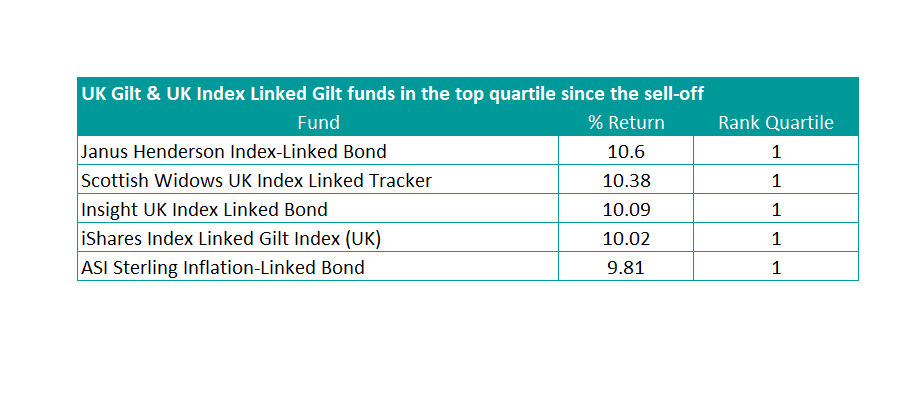

UK Gilt & UK Index Linked Gilt funds in the top quartile since the sell-off

Source: FE Analytics

But its inflation-linked gilt funds made up the top-five performing UK government bond strategies since 23 March, when markets bottomed to 4 September.

The strategies have performed better than their non-inflation linked counterparts as central banks maintain low interest rates and become more tolerant of inflation against a backdrop of higher government debt levels.

Interest rate cuts and quantitative easing measures this year have meant less demand for more conventional gilts, however.

At the very top is the £198.2m Janus Henderson Index-Linked Bond fund, managed by Andrew Mulliner and Bethany Payne, which has returned 10.60 per cent since the bottom of the market.

Over the same period, the £155.8m Insight UK Index Linked Bond fund, managed by David Hooker, had returns of 10.09 per cent. While the fund mainly invests in UK index-linked gilts, it does have some holdings in US Treasury Inflation Protected Securities (TIPs).

Meanwhile, the team-managed ASI Sterling Inflation-Linked Bond fund returned 9.91 per cent.

There were also strong returns for passive strategies, including the second-placed Scottish Widows UK Index Linked Tracker and iShares Index Linked Gilt Index.

Whilst inflation-linked gilt strategies have outperformed their peers since the sell-off, there are some consistent outperformers through longer time frames.

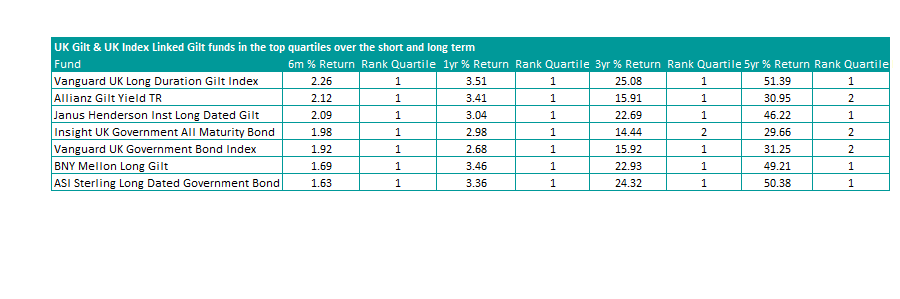

There are seven funds that stand out from both sectors, having been top- or second-quartile over several time frames: six months, one year, three years, and five years.

UK Gilt & UK Index Linked Gilt funds in the top quartiles over standardised periods

Source: FE Analytics

And while UK gilt strategies have been challenged over the past six months as yields fell following greater buying from the Bank of England, over the longer term it’s been a different story.

The best performer over five years is the £543.8m Vanguard UK Long Duration Gilt Index fund, a passive strategy tracking the performance of the Bloomberg Barclays UK Government 15+ Years Float Adjusted Bond Index, which has returned 51.39 per cent.

The fund is also one of just four from the two sectors that have been top quartile over all the periods, alongside the BNY Mellon Long Gilt, ASI Sterling Long Dated Government Bond and Janus Henderson Inst Long Dated Gilt funds.

The £53.9m BNY Mellon Long Gilt fund, managed by Howard Cunningham, has returned 49.21 per cent. Meanwhile, the £20.9m ASI Sterling Long Dated Government Bond fund is up by 50.38 per cent and the Janus Henderson Inst Long Dated Gilt fund – also managed by Mulliner and Payne and targeted at institutional investors – has made 46.22 per cent.

The three other funds – which have made second quartile returns over one or more time periods, as the above table shows – include Allianz Gilt Yield, Insight UK Government All Maturity Bond and Vanguard UK Government Bond Index.