News that Shinzo Abe will step down as Japanese prime minister for health reasons should not deter investors who are bullish on his long-running stimulus programme, fund managers have reassured.

Abe announced last week that he would stand down following several hospital visits for ulcerative colitis. His resignation came just four days after he recorded the longest continuous term of any Japanese prime minister.

He will remain in place as caretaker prime minister until a successor is chosen by his Liberal Democratic Party (LDP) but investors will be wondering if the bold ‘Abenomics’ reforms spearheaded by Abe will remain in place.

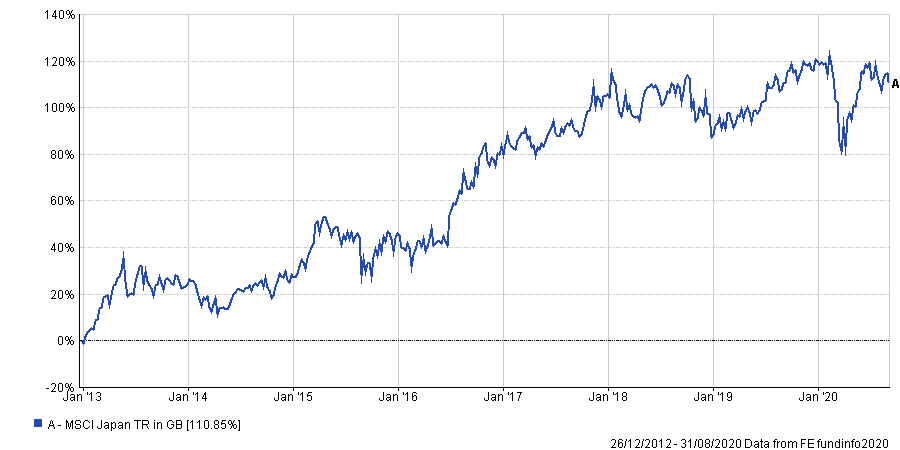

Abenomics – which revolves around ‘three arrows’ of aggressive monetary easing, boosting government spending and enacting reforms to make the Japanese economy more competitive – has been one of the drivers of Japanese equities since Abe assumed office in December 2012.

Performance of Japanese equities under Abe

Source: FE Analytics

Masaki Taketsume, manager of the Schroder Tokyo fund, said investors should not allow the change in leadership to distract them from the other positive reasons for investing in Japan.

“The change in political leadership may cause some nervousness in financial markets, especially among foreign investors,” he said. “In reality, since the LDP will remain the dominant party, we would expect little to change.

“In fact, this may be a good opportunity for a new leader to refresh the cabinet and refocus the pandemic response. The next prime minister may bring some differences in the emphasis on various structural reforms but overall we would expect continuity of fiscal policy. Monetary policy under the Bank of Japan governor Haruhiko Kuroda will also be unchanged.”

Archibald Ciganer, manager of the T. Rowe Price Japanese Equity fund, is another who believes the investment case for Japan remains intact after Abe leaves office.

Ciganer has been positive on Abe’s reform programme and noted that he established political stability, enhanced Japan’s international presence over his eight years as prime minister. However, investors should not expect these positives to disappear.

“Despite his resignation, Abe will remain influential within Japanese politics and within the LDP party. This is important from a continuity perspective. We do not expect many of the positive and popular market reform aspects of Abe and the LDP’s policies will be impacted or rolled back. His successor will most likely come from his closer allies within the party and will continue to move forward with the broad principles of constructive politics,” the manager said.

“The case for Japanese equities is positive, especially as we continue down a path of improvement from a structural and global economic dimension. With corporate Japan evidencing little to no net debt, and with corporate governance continuing to improve – even as profits have been pressured – Japan provides a very different set of characteristics to US equities, which have led the strong equity market rally in recent months.”

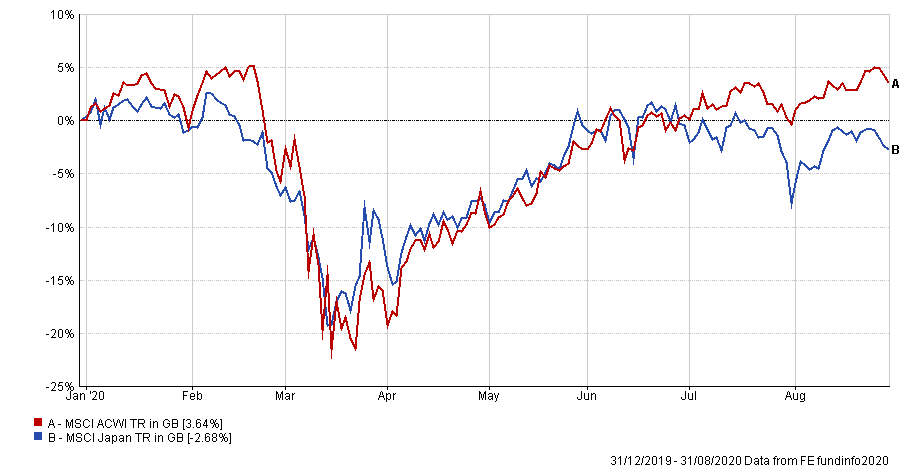

On a more short-term view, Schroders’ Taketsume also argued that investors can take some comfort in how effectively Japan has responded to the coronavirus crisis. He said it has outperformed many other countries in dealing with the pandemic so far, although this has not been reflected in share prices.

Performance of Japanese and global equities in 2020

Source: FE Analytics

In April, the Japanese government unveiled an economic stimulus package with a headline figure of ¥117trn (£823bn), which is equivalent to 22 per cent of GDP, while another package was announced in May.

This means the effective size of Japan’s stimulus easily exceeds the country’s past fiscal measures and could also outstrip the stimulus of other major economies, as a percentage of GDP.

Furthermore, the Bank of Japan temporarily increased the pace of its ETF purchases from March and has since announced additional monetary initiatives.

“As a result of all these factors, we think Japan is likely to see a smoother progression through the downturn and recovery without the huge dislocations seen elsewhere,” Taketsume said.

“This contrast is particularly stark in the labour market where the jump in unemployment has still left Japan’s jobless rate below 3 per cent. Companies’ experience of serious labour shortages in recent years may be making them particularly reluctant to lay off workers in response to short-term pressures.”

There are a number of potential successors in the running, with the most notable being chief cabinet secretary Yoshihide Suga, LDP policy chief Fumio Kishida, defence minister Taro Kono and former LDP secretary-general Shigeru Ishiba.

According to media reports, Suga is leading the race to replace Abe and John Vail, chief global strategist at Nikko Asset Management, thinks this would lead to a reassuring continuation of Abenomics.

“It is important to note that [Suga] is not just a safe pair of hands; rather, he has the same long-held vision as Abe and led his rise into his second stint as prime minister in 2012,” Vail said.

“He has stood by him as his chief cabinet secretary since then, which was a historical record along with Abe’s record as prime minister, and pushed through all Abe’s successful efforts, including many reforms that were deeply resisted.

“It is highly likely that Suga will retain all of Abe’s major policies, including regarding corporate governance.”

When it comes to how to invest in Japan, Willis Owen head of personal investing Adrian Lowcock suggested looking for managers that have extensive experience of investing in Japan and have done so throughout successive governments.

Performance of fund vs sector and index over 20yrs

Source: FE Analytics

He highlighted Man GLG Japan Core Alpha, as manager Stephen Harker is “amongst the most experienced Japanese equity managers” after a 35-year stint investing in the country.

“He is a contrarian investor and believes that company valuations revert to a long-term average in price, so he looks for businesses unloved by the market compared with their competitors,” Lowcock said.

“He uses price to book, dividend yield and P/E [price-to-earnings] ratios to assess a company's value and then considers its fundamentals and management team skill, to identify turnaround opportunities.”

Lowcock also likes Baillie Gifford Japanese Income Growth, pointing out that Matthew Brett – who has invested in Japanese equities for more than 12 years – and Karen See are supported by a team of nine Japanese specialists.

The fund’s process focuses on stock selection, with an emphasis on growing dividends and strong balance sheets, while paying close attention to industry trends and themes such as technology and demographics.