Fund performance was a bit of a mixed bag in the traditionally quiet month of August – with some risk-on strategies performing well while others lost money, and fixed income strategies lost out.

Equity markets were largely positive with the FTSE All Share up by 2.42 per cent and the US blue-chip S&P 500 index gaining an impressive 5.02 per cent (in sterling terms) during August.

Ben Yearsley (pictured), director at Fairview Investing, said: “Risk-on or risk-off? From a market perspective, it was a bit of both as the US and tech hit all-time highs and bonds fell.

“Latin America had a torrid time and the UK again treaded water for no apparent reason. Maybe it’s the lack of tech in the UK as that’s been the clear driver of US markets, or it could be Brexit worries coming to the fore again?”

He continued: “Despite a resurgence of Covid-19 cases in many European countries – and some Asian ones where it seemed under control – markets appear less worried.”

Nevertheless, some of the strongest performers could be found at the riskier end of the spectrum with smaller companies strategies performing strongly.

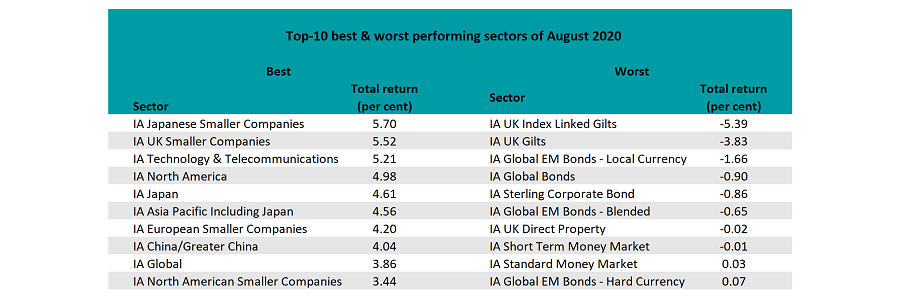

On a sector level, the best performer was IA Japanese Smaller Companies where the average fund rose by 5.7 per cent during August. It was also joined in the top 10 by its UK, European and North American peers.

It was a strong month for Japanese equity strategies broadly, however, with the IA Japan sector up by 4.6 per cent on average as the Japanese economy appeared more resilient in the face of a second wave of Covid-19 infections.

Source: FE Analytics

Another strongly performing part of the market in August was technology, as the sector continued to lead the market recovery and Apple saw its market cap hit $2trn.

As such, the average IA Technology & Telecommunications fund made a total return of 5.21 per cent. It was also beneficial for US equity strategies – where tech stocks represent a significant part of benchmarks such as the S&P 500 – with the average IA North America strategy up by 4.98 per cent.

Other strong performers included the IA Asia Pacific Including Japan, IA China/Greater China and IA Global sectors.

Fixed income sectors dominated the other end of the sector performance table, with UK government bond strategies rooted to the bottom.

The average IA UK Index Linked Gilts fund was down 5.39 per cent last month, while the IA UK Gilts sector posted a loss of 3.83 per cent.

Emerging market bond strategies also struggled with the IA Global EM Bonds – Local Currency, IA Global EM Bonds – Blended, and IA Global EM Bonds – Hard Currency sectors all featuring in the bottom 10.

Other fixed income sectors struggling in August included the IA Global Bonds and IA Sterling Corporate Bond sectors.

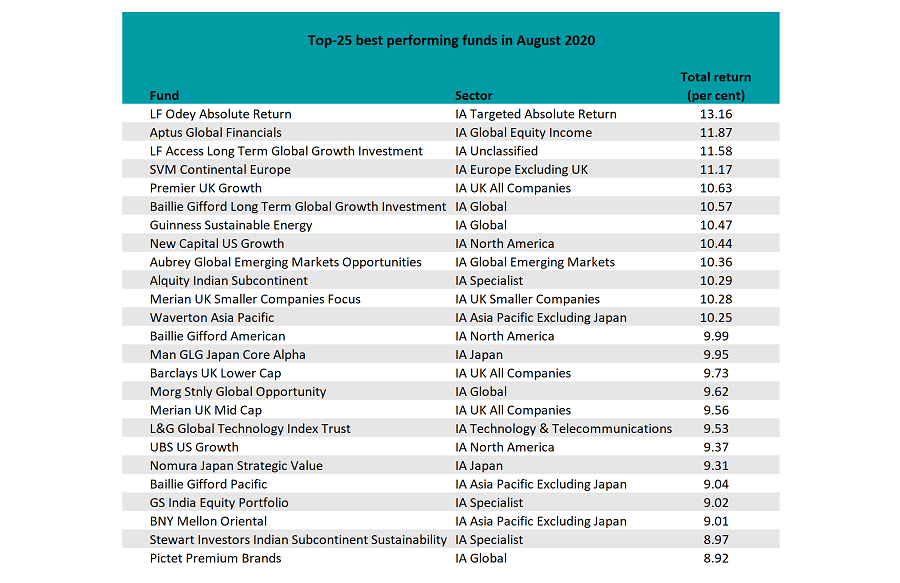

On a fund level, the best performer in August was hedge fund manager Odey Asset Management's £431.8m LF Odey Absolute Return strategy – overseen by FE fundinfo Alpha Manager James Hanbury and Jamie Grimston – which made a 13.16 per cent total return.

Also at the top was global equity strategy Aptus Global Financials – a strategy focusing on banks, asset managers and insurers and overseen by Toscafund Asset Management’s Johnny de la Hey. It made 11.87 per cent last month.

Source: FE Analytics

There were a number of growth-orientated strategies also recording double-digit gains during August spread over several different sectors, with very few trends to pick out.

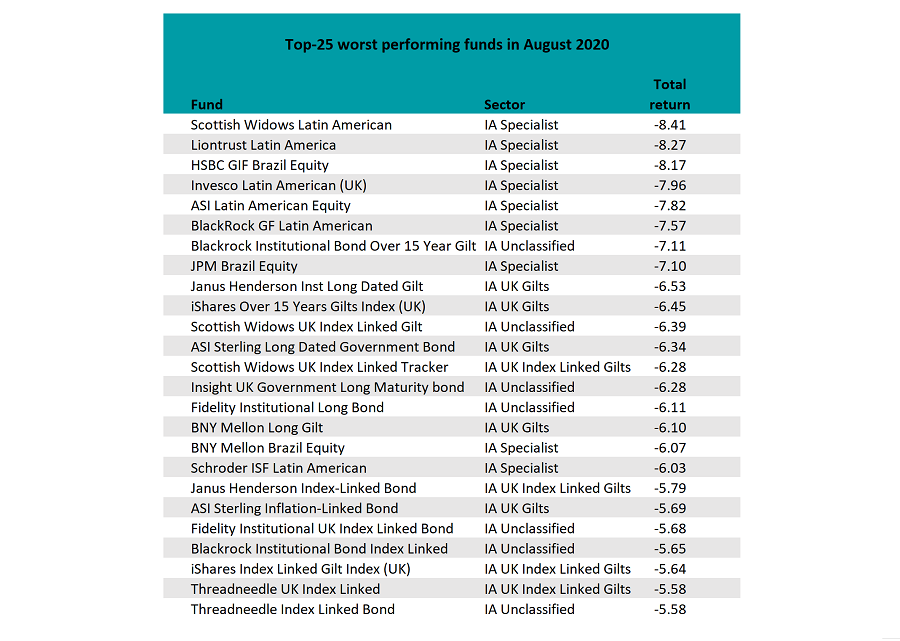

At the bottom of the table, there were more discernible trends with a number of Latin American equity strategies making losses in August.

The worst performer was the four FE fundinfo Crown-rated, £5.4m Scottish Widows Latin American fund, managed by Pablo Riveroll, which fell to a loss of 8.41 per cent, closely followed by Thomas Smith's £26.3m Liontrust Latin America fund, which was down by 8.27 per cent.

Source: FE Analytics

The presence of a number of Latin American strategies at the foot of the table can be explained by the make-up of the benchmark, which has a greater weighting to Brazil – the region’s largest market.

Concerns have continued to build in Brazil over its approach to the coronavirus pandemic and political risks in the country. As such, the Brazilian benchmark index – the Bovespa – was down by 10.18 per cent last month.

Other strategies sat at the bottom of the performance table were UK inflation-linked gilts strategies, as the UK government consulted on a switch from retail price index (RPI) rate of inflation to the lower CPIH rate, which could lose out from any switch.