The lockdown enforced to tackle the coronavirus pandemic has challenged many companies’ business models but Quilter Investors’ Paul Craig believes that a number of sectors will emerge from the crisis stronger than before.

Economies around the world are in the process of opening up and, although a second wave of the pandemic remains a real threat, many sectors are figuring out how to adapt to the ‘new normal’.

Craig (pictured), portfolio manager at Quilter Investors, said: “Coronavirus has had a profound impact on the way we live and work. We very much expect these changes to become permanent and businesses are going to have to keep up. As economies reopen around the world, it is going to be a case of survival of the fittest in the business-as-unusual environment.

“The fight for consumer spending is going to be intense and unfortunately not every business is going to survive. Some of this will be as a result of sectoral changes, while some will be as a result of the renewed competition. Long-term opportunities will present themselves to investors and they can take advantage of the new environment.”

Below, Craig identifies three of the sectors he believes stand to benefit from the shift in consumer behaviour along with funds exposed to therm.

Sustainability

Investing by environmental, social and governance (ESG) principles has been in ascendancy for some time, but the coronavirus pandemic has seen both consumers and investors pay a lot more attention to the companies’ sustainability performance.

“The crisis has put a renewed emphasis on the actions and impact of corporates. While attention used to be primarily devoted to environmental considerations, many investors are now focusing on the behaviour of corporates during the crisis, and in turn their societal impact,” Craig said.

“This drive to ESG investment will result in those companies already committing themselves to progressive policies doing well out of the pandemic and will cause the others to sit up and take notice. Going forward, management teams will be challenged more frequently, and decisions taken during the pandemic won’t necessarily be forgotten in a hurry.”

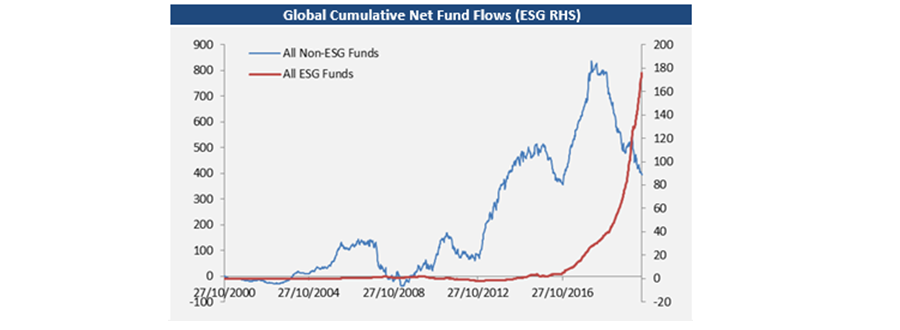

Source: Goldman Sachs Global Markets Division, Aug 2020

The chart above shows how ESG funds have benefited from strong inflows over recent years, while investors have been pulling money out of those active strategies that take a more conventional approach.

In addition, FE fundinfo data shows that funds with an ESG approach have tended to outperform their conventional peers by a wide margin over 2020 so far. In the IA Global sector, for example, the average ESG fund has made a 10.7 per cent total return while the average non-ESG fund is up just 4.4 per cent. Trustnet will take a closer look at this next week.

Craig added that an ESG fund he likes Drew Edwards’ Usonian Japan Value, which looks for Japanese companies that appear undervalued but are profitable with high-quality balance sheets. Also, value investing has struggled over recent years, Edwards focuses on protecting capital in down markets and aims to be less volatile than the Topix.

Automation

The second sector that Craig expects to emerge from the coronavirus pandemic stronger than before is automation. The world had already been moving towards a future where more and more processes were automated through technology, but this is a trend that has been super-charged by coronavirus.

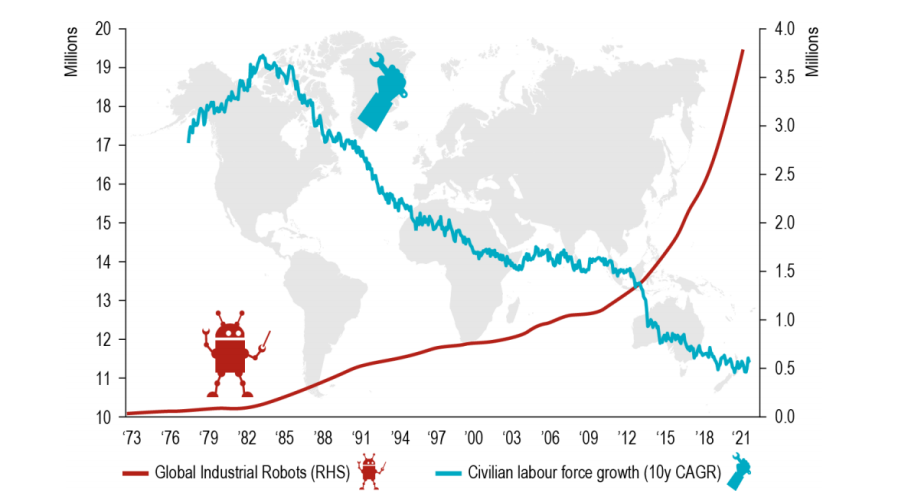

At the end of 2019, research by Bank of America highlighted automation & robotics as one of the megatrends to watch over the coming decade. The bank thinks the size of the artificial intelligence analytics and technology market could exceed $110bn by 2024, while the number of industrial robots in use worldwide is set to grow from 2.25 million today to 20 million by 2030.

Growth in human and robot workforces

Source: BofAML Global Research, IFR, US BLS

Craig said: “This theme is not necessarily a new one given its importance over the last few years, but it is not simply just a 'big technology' company play. Instead, we expect to see an acceleration and evolution of the theme as a result of standards being brought in to help combat the virus.

“While many would associate automation with the likes of Tesla or Apple, we believe the bigger opportunity is within factories and manufacturing. Businesses are being forced to introduce social distancing on the production line, which means less staff, while many have had to make staff redundant to keep costs under control. This means further automation of tasks will be required to pick up the slack and none of it is likely to be reversed once normality is restored. As such this is a theme that will play an even greater role in the global economy for years to come.”

The Quilter Investors manager said one way to gain exposure to this theme is through Ben Rogoff, Nick Evans and Xuesong Zhao’s $578m Polar Capital Automation & Artificial Intelligence fund. The fund focuses on stocks involved in industrial and process automation, robotics, artificial intelligence and materials science, as well those that can be “fundamentally transformed” by the adoption of these technologies.

Chinese consumer

The coronavirus pandemic may have originated in China and the country was the first to undergo a lockdown, but it was also the first to restart its economy – which has picked back up on the pent-up demand from its consumers. Craig thinks this is another theme to watch post-coronavirus.

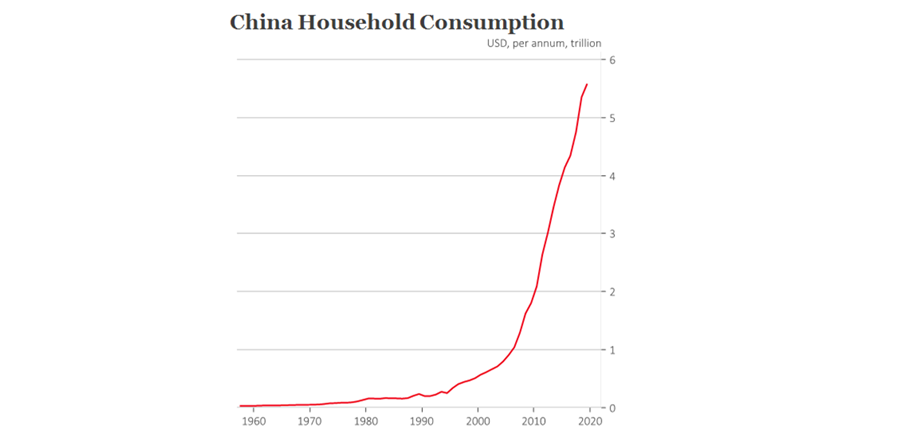

Source: Quilter Investors, China National Bureau of Statistics, 24 Aug 2020

“While coronavirus may have started in China and impacted the country to a large extent, it has also been the first to emerge from the crisis and take advantage of the pent-up consumer demand. The growth of the middle class in China continues and shows no sign of abating as its economy continues to dwarf those of many former powerhouses,” he said.

“The return of increasing tensions with the US threatens to throw a spanner in the works, but this is likely to be a short-term issue, as the resilience of the middle classes has been shown to be strong during the crisis. With wealth increasing and China’s urban centres continuing to grow, we are likely to see increased consumer spending. Global businesses aimed at taking advantage of this cohort stand to be the big winners out of coronavirus as people return to the shops.”

One fund offering exposure to this trend is Fidelity China Consumer. Managed by Hyomi Jie, the £222m fund holds stocks that are very much linked to the growth of the affluent Chinese middle class, such as Alibaba, Tencent and Ping An Insurance.