The coronavirus sell-off caused equities around the globe to plummet and while a recovery has been seen over recent months, many parts of the market are still sitting on a loss for 2020.

This is reflected in the performance of funds in the Investment Association universe, where 21 of its 39 sectors are in negative territory for 2020-to-date.

And it can be seen in the size of assets under management as well. When Trustnet added up the fund sizes of all the sectors at the end of July, a combination of negative returns and outflows means that many are now smaller than where they stood at the start of the year.

The biggest fall seems to be in the IA Japan sector, which dropped from £78.9bn to £29.4bn while IA UK All Companies peer group – which is the mainstay of many investors’ portfolios – is in second place after falling from £189.2bn to £142.2bn.

Other sectors that are smaller now than at the start of 2020 include IA Specialist, IA UK Equity Income, IA Targeted Absolute Return, IA Sterling Strategic Bond and IA UK Smaller Companies.

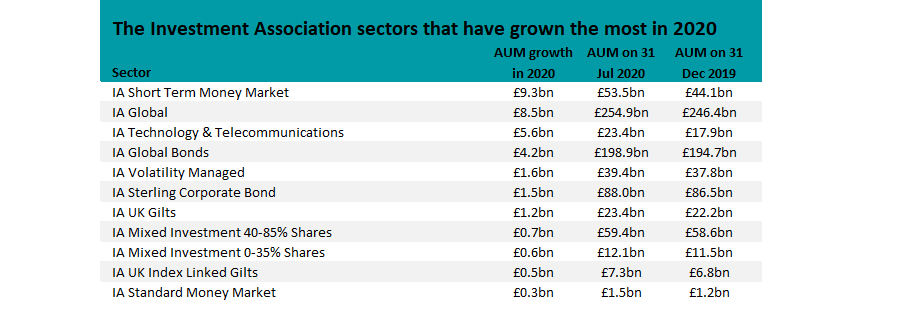

However, some sectors have grown over 2020 despite the year’s challenging conditions.

Source: FinXL

IA Short Term Money Market has seen the biggest growth in its total assets, which should not come as much of a shock given the high levels of investor nervousness that the coronavirus crisis has created.

This factor can also be seen in the larger size of most of the peer groups on the above list. Sectors such as IA Global Bonds, IA Volatility Managed, IA UK Gilts, IA Mixed Investment 0-35% Shares and IA UK Index Linked Gilts also tend to appeal to cautious investors.

Risk-on sentiment is completely absent, as the IA Global and IA Technology & Telecommunications sectors are among those that have been able to grow during 2020. The US – and especially its tech sector – is home to many of the ‘coronavirus winners’ and these areas have led the market rally that followed the initial crash.

All of these themes can when we look at the individual funds that grew the most over the first seven months of 2020 – the top-25 of which can be seen in the table below, ranked by the nominal amount they’ve grown by.

In all, around 40 per cent funds in the Investment Association universe now run more money than they did at the start of the year.

Source: FinXL

Reflecting we saw a sector level, FE fundinfo data suggests Insight ILF GBP Liquidity, which is a member of the IA Short Term Money Market sector, is the fund that has grown the most as it now £4.8bn bigger than it started the year.

Given that the £28.4bn fund has returned 0.2 per cent over the same period, it’s clear that 20.4 per cent jump in its size is down to inflows as investors sought out the safety of cash.

Strategies with a strong track record in the growth style of investing – which led the post-financial crisis bull market and has continued to dominate in 2020 – have also seen assets swell.

Fundsmith Equity, for example, can be seen on the list. It is one of the best-known funds in the UK market, thanks to the very high returns of manager Terry Smith and his quality-growth approach.

At £20.5bn in size, the fund is 9.1 per cent bigger than it was at the start of the year, but some 8.5 per cent of this is down to its performance rather than inflows.

Other growth strategies seem to have benefitted from stronger flows relative to their size and performance.

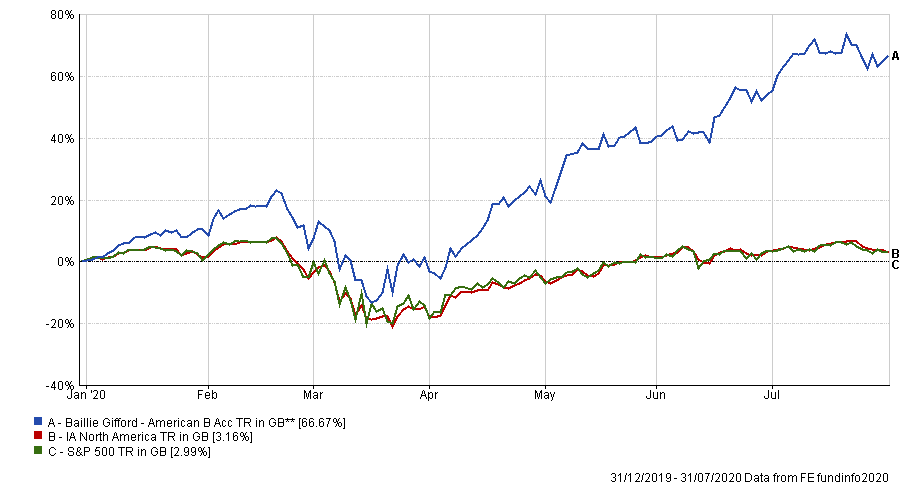

Baillie Gifford American, which has been one of the IA North America sector’s best performers in recent years and very strong again in 2020, is now 83.8 per cent larger than it started the year, growing from £2.5bn to £4.6bn. Its total return over the same period has been an impressive 66.7 per cent.

The FE Investments team said: “Overall the fund’s strong growth bias and focus on tech disrupters has worked in its favour, and led the fund to outperform the benchmark by a wide margin in 2017, 2018 and at in the first quarter of 2020.”

Performance of fund vs sector and index over 2020

Source: FE Analytics

Morgan Stanley’s growth-biased funds – including Morg Stnly US Advantage, Morg Stnly Global Brands and Morg Stnly US Growth – have also grown significantly in size over a volatile 2020 so far. All three of these funds have benefited from strong performance and inflows this year.

Another notable fund on the above list is Allianz Strategic Bond, which is headed by Mike Riddell and Kacper Brzezniak.

The fund caught investors’ eyes at the height of the coronavirus crisis when it posted double-digit returns in the first quarter, at a time the market was tanking while the coronavirus pandemic spread around the globe.

“The fund offers a process that should produce a low correlation to equities – lower than most strategic bond funds, including some on our shortlist,” the FE Investments team said.

Allianz Strategic Bond started the year with assets under management of £719m but was just over £2bn at the end of July – an increase of £1.4bn, or 189 per cent. Its total return over the same period was 29.1 per cent.